Reset Form MI W4PMichigan Department of Treasury 4 2021

Understanding the MI W4P Form

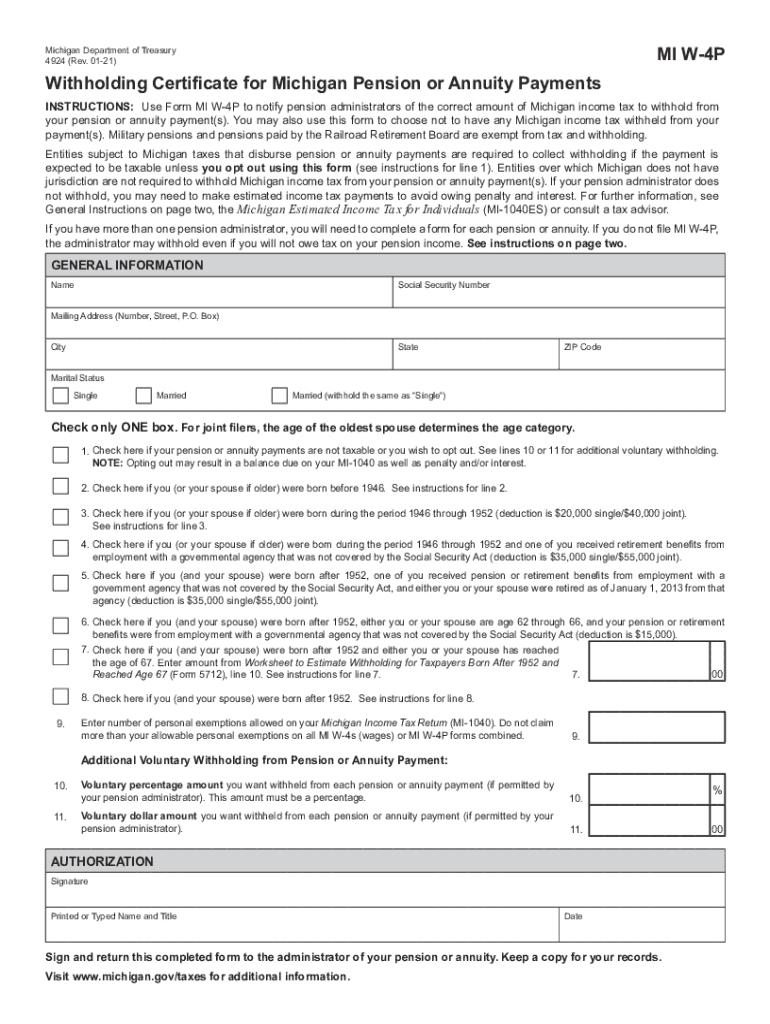

The MI W4P form, officially known as the Michigan Department of Treasury 4, is used by employees in Michigan to determine their state income tax withholding. This form is essential for ensuring that the correct amount of state taxes is deducted from an employee's paycheck. It is particularly relevant for those claiming exemptions or adjustments based on their financial situation. Understanding the purpose and implications of this form can help employees manage their tax liabilities effectively.

Steps to Complete the MI W4P Form

Completing the MI W4P form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which may include options such as single, married, or head of household.

- Specify the number of allowances you wish to claim. This affects the amount of tax withheld from your paycheck.

- If applicable, provide any additional amount you want withheld from each paycheck.

- Sign and date the form to validate your submission.

Once completed, the form should be submitted to your employer's payroll department for processing.

Legal Use of the MI W4P Form

The MI W4P form is legally recognized for determining state income tax withholding in Michigan. It complies with state regulations, ensuring that employers withhold the appropriate amount of taxes based on the information provided by employees. Accurate completion of the form is crucial, as incorrect information can lead to under-withholding or over-withholding, impacting an employee's tax obligations at the end of the year.

Filing Deadlines and Important Dates

It is important to be aware of key deadlines associated with the MI W4P form. Typically, employees should submit this form to their employer at the start of employment or whenever there is a change in their tax situation, such as a change in marital status or the number of dependents. Additionally, employers must ensure that they process the form promptly to reflect any changes in withholding on upcoming paychecks.

State-Specific Rules for the MI W4P Form

Michigan has specific rules regarding the MI W4P form that employees must follow. For instance, the number of allowances claimed can significantly affect tax withholding. Employees should consult the Michigan Department of Treasury guidelines to understand how their individual circumstances may influence their withholding amounts. Furthermore, employees should keep abreast of any changes in state tax laws that may affect their obligations.

Examples of Using the MI W4P Form

Consider a scenario where an employee recently got married. They may choose to adjust their MI W4P form to reflect their new marital status, which could allow them to claim additional allowances. This adjustment can lead to a decrease in the amount of state tax withheld from their paycheck, providing them with more take-home pay. Another example is a parent claiming dependents, which can also influence the number of allowances and subsequently the withholding amount.

Quick guide on how to complete reset form mi w4pmichigan department of treasury 4

Manage Reset Form MI W4PMichigan Department Of Treasury 4 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Handle Reset Form MI W4PMichigan Department Of Treasury 4 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Reset Form MI W4PMichigan Department Of Treasury 4 with ease

- Locate Reset Form MI W4PMichigan Department Of Treasury 4 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Reset Form MI W4PMichigan Department Of Treasury 4 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct reset form mi w4pmichigan department of treasury 4

Create this form in 5 minutes!

How to create an eSignature for the reset form mi w4pmichigan department of treasury 4

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is miw4p and how does it relate to airSlate SignNow?

miw4p is a keyword associated with airSlate SignNow, a platform that enables businesses to send and electronically sign documents seamlessly. By integrating miw4p into your workflow, you can enhance document management efficiency and streamline the signing process.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow features a user-friendly interface that allows users to prepare, send, and sign documents quickly. With miw4p, you gain access to powerful tools like customizable templates, advanced security options, and real-time tracking of document statuses.

-

How does miw4p benefit businesses using airSlate SignNow?

Using miw4p with airSlate SignNow offers businesses a cost-effective solution for managing contracts and agreements. This approach increases productivity by reducing the time spent on document processing and enhances the overall signing experience for all parties involved.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to varying business needs. Each plan includes access to miw4p features, ensuring that businesses can choose the solution that best suits their document management requirements.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows seamless integration with various applications and platforms to enhance your workflow. By utilizing miw4p, you can connect with CRM systems, cloud storage solutions, and other tools to streamline document handling across your business operations.

-

Is airSlate SignNow compliant with legal standards?

Absolutely! airSlate SignNow ensures that all electronic signatures comply with legal standards, making it a trustworthy choice for businesses. Leveraging miw4p, you can confidently manage your legal documents, knowing that they maintain compliance with relevant regulations.

-

What industries can benefit from using airSlate SignNow?

airSlate SignNow is versatile and can benefit a wide range of industries, including real estate, healthcare, and finance. By implementing miw4p, businesses from various sectors can optimize their document workflows and improve their signing processes.

Get more for Reset Form MI W4PMichigan Department Of Treasury 4

- Ups claim form 247375330

- Como llenar el formato sf 001 323502390

- Non resident alien nra certification statement 206699518 form

- Renunciation form has to fill on line

- Enrollment form for group dhmo benefits a metlife

- Ice cream shop employee handbook form

- Amerigroup physical therapy authorization form

- Laptop agreement template form

Find out other Reset Form MI W4PMichigan Department Of Treasury 4

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy