Affidavit to Claim Small Business Tax Exemption under Form

Understanding the Affidavit to Claim Small Business Tax Exemption

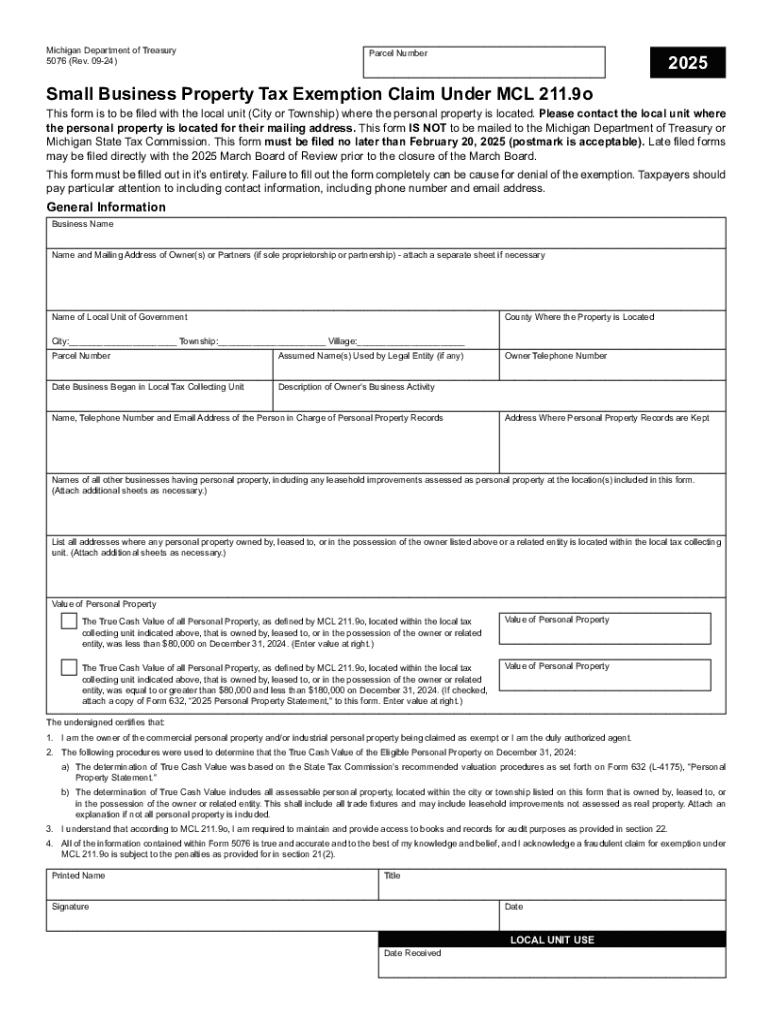

The Affidavit to Claim Small Business Tax Exemption, commonly referred to as form 5076, is a crucial document for small businesses in Michigan seeking tax relief. This form allows eligible businesses to claim an exemption from certain property taxes, thereby reducing their financial burden. The exemption is designed to support small businesses, which are vital to the state's economy.

Steps to Complete the Affidavit to Claim Small Business Tax Exemption

Filling out form 5076 requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather necessary information about your business, including its legal structure, ownership details, and property information.

- Fill out the form completely, ensuring all sections are addressed. This includes providing your business's name, address, and tax identification number.

- Indicate the specific property for which you are claiming the exemption, including its location and description.

- Sign and date the affidavit to validate your claim.

- Submit the completed form to the appropriate local tax authority by the specified deadline.

Eligibility Criteria for the Small Business Tax Exemption

To qualify for the small business tax exemption using form 5076, businesses must meet specific criteria. Generally, the business must:

- Be classified as a small business according to Michigan's definitions.

- Operate from a physical location within Michigan.

- Meet the income and asset thresholds established by the Michigan Department of Treasury.

- Not exceed the maximum property value limits set for the exemption.

Required Documents for Filing the Affidavit

When submitting form 5076, certain documents may be required to support your claim. These typically include:

- Proof of business registration and legal structure, such as articles of incorporation or an operating agreement.

- Financial statements demonstrating eligibility based on income and assets.

- Documentation of the property for which the exemption is being claimed, including tax statements or property deeds.

Filing Deadlines for the Affidavit

Timeliness is critical when submitting form 5076. The filing deadlines are typically aligned with local tax assessment schedules. Businesses should be aware of the following:

- Forms must generally be submitted by the last day of February for the upcoming tax year.

- Extensions may not be available, so it is essential to adhere to the deadlines to avoid penalties.

Form Submission Methods

Form 5076 can be submitted through various methods, providing flexibility for businesses. The available submission options include:

- Online submission through the Michigan Department of Treasury's website, if available.

- Mailing the completed form to the local tax authority.

- In-person delivery to the appropriate office, ensuring a receipt is obtained for your records.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the affidavit to claim small business tax exemption under

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5076 and how can airSlate SignNow help?

Form 5076 is a document used for specific business processes, and airSlate SignNow provides an efficient platform to manage and eSign this form. With our user-friendly interface, you can easily fill out, send, and track form 5076, ensuring a seamless workflow for your business.

-

Is there a cost associated with using airSlate SignNow for form 5076?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage form 5076 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing form 5076?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning capabilities for form 5076. These features streamline the document management process, making it easier for businesses to handle their paperwork efficiently.

-

Can I integrate airSlate SignNow with other applications for form 5076?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily manage form 5076 alongside other tools your business uses, enhancing productivity.

-

How does airSlate SignNow ensure the security of form 5076?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your data, including form 5076, ensuring that your sensitive information remains safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for form 5076?

Using airSlate SignNow for form 5076 offers numerous benefits, including increased efficiency, reduced turnaround time, and improved accuracy. Our platform simplifies the signing process, allowing you to focus on what matters most—growing your business.

-

Is there customer support available for issues related to form 5076?

Yes, airSlate SignNow provides dedicated customer support to assist you with any issues related to form 5076. Our team is available to help you navigate the platform and resolve any questions you may have.

Get more for Affidavit To Claim Small Business Tax Exemption Under

Find out other Affidavit To Claim Small Business Tax Exemption Under

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer