Group Policy Number Policyholder Form

Understanding the Group Policy Number Policyholder

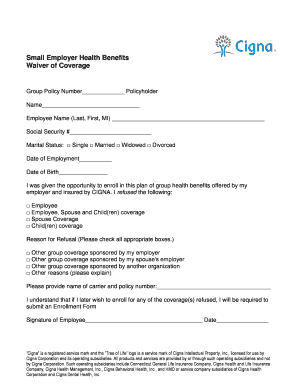

The group policy number policyholder is a crucial identifier for insurance policies, particularly in group health insurance plans. This number uniquely associates the policyholder with the insurance provider and the specific policy under which they are covered. It is essential for managing claims, verifying coverage, and ensuring that benefits are administered correctly. The policyholder's name is typically linked to this number, making it vital for accurate documentation and communication with the insurance company.

Steps to Complete the Group Policy Number Policyholder

Completing the group policy number policyholder section of any insurance form requires careful attention to detail. Here are the steps to follow:

- Locate your group policy number on your insurance documents or member card.

- Clearly write the policyholder's name as it appears on the insurance documents.

- Double-check for any spelling errors to avoid issues with claims or benefits.

- Ensure that the group policy number is entered in the correct format, as specified by the insurance provider.

Legal Use of the Group Policy Number Policyholder

The group policy number policyholder is not just a formality; it has legal implications. This number is used to validate claims and ensure that benefits are distributed according to the terms of the insurance policy. Misrepresentation of the policyholder's name or number can lead to denied claims or legal repercussions. Therefore, it is crucial to use the correct group policy number and policyholder name when filling out any related forms.

How to Obtain the Group Policy Number Policyholder

If you do not have your group policy number readily available, there are several ways to obtain it:

- Contact your insurance provider's customer service for assistance.

- Check your insurance policy documents or welcome kit, where the group policy number is often listed.

- Access your online account on your insurance provider's website, where you can find your policy details.

Examples of Using the Group Policy Number Policyholder

Understanding how to use the group policy number policyholder can clarify its importance. For instance, when submitting a benefits waiver form, you will need to include the group policy number to ensure that your request is processed correctly. Additionally, when filing a claim for medical expenses, the group policy number helps the insurance company verify your coverage and expedite the claims process.

Required Documents for Group Policy Number Policyholder

When filling out forms that require the group policy number policyholder, certain documents may be needed to support your submission:

- Your insurance card, which typically displays the group policy number.

- Any official correspondence from your insurance provider that includes your policy details.

- Identification documents that may be required to verify your identity as the policyholder.

Quick guide on how to complete group policy number policyholder

Effortlessly Prepare Group Policy Number Policyholder on Any Device

Digital document organization has gained popularity among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without obstacles. Manage Group Policy Number Policyholder on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign Group Policy Number Policyholder Without Stress

- Find Group Policy Number Policyholder and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Mark important parts of the documents or cover sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a standard ink signature.

- Confirm all the details and click on the Done button to save your changes.

- Choose how you wish to send your document, via email, text message (SMS), or a shareable link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Group Policy Number Policyholder and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the group policy number policyholder

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is waiver insurance?

Waiver insurance is a type of coverage that protects individuals from liability for claims arising from specific activities or events. It is often utilized in scenarios such as rental agreements, events, or sports activities where risks are present. Understanding waiver insurance can help individuals make informed decisions about protection against potential claims.

-

How does airSlate SignNow support waiver insurance management?

airSlate SignNow simplifies the process of managing waiver insurance by allowing businesses to easily draft, send, and eSign waiver documents. This efficiency ensures that all necessary parties can sign off quickly, making it easier to maintain compliance and insurance documentation. By using SignNow, you can streamline your waiver insurance processes signNowly.

-

What are the benefits of using airSlate SignNow for waiver insurance agreements?

Using airSlate SignNow for waiver insurance agreements provides numerous benefits, including ease of use, speed, and cost-effectiveness. Digital signatures enhance the security of your documents, ensuring that all agreements are legally binding. Additionally, you can manage and store all your documents in one centralized platform, improving organization and access.

-

Is there a cost associated with using airSlate SignNow for waiver insurance?

Yes, there are costs associated with airSlate SignNow, but the pricing is designed to be budget-friendly for businesses of all sizes. With various plans available, you can choose one that meets your specific needs, especially if you regularly deal with waiver insurance documents. Investing in SignNow can ultimately save time and reduce administrative overhead.

-

Can I customize my waiver insurance templates in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize waiver insurance templates according to their specific requirements. You can easily modify text, fields, and branding to align with your business's needs. This flexibility ensures that your waiver insurance documents reflect your company's standards and comply with regulations.

-

What kinds of businesses benefit from waiver insurance?

Businesses in various sectors benefit from waiver insurance, particularly those involved in recreational activities, events, and rentals. Examples include gyms, sports facilities, event planners, and rental companies that need to mitigate their liability. Utilizing airSlate SignNow for managing waiver documents can enhance efficiency and compliance in these industries.

-

Does airSlate SignNow integrate with other software for waiver insurance?

Yes, airSlate SignNow offers integrations with a wide range of software applications, enabling seamless management of waiver insurance processes. Whether you use CRM systems, project management tools, or even payment processors, SignNow can connect to increase workflow efficiency. This capability ensures that your waiver insurance documents fit smoothly into your existing systems.

Get more for Group Policy Number Policyholder

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure alabama form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497295646 form

- Alabama failure form

- Alabama codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497295655 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497295657 form

- Al letter landlord 497295659 form

- Alabama landlord tenant form

Find out other Group Policy Number Policyholder

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed