5081, Sales, Use and Withholding Taxes Annual Return Form

What is the 5081, Sales, Use And Withholding Taxes Annual Return

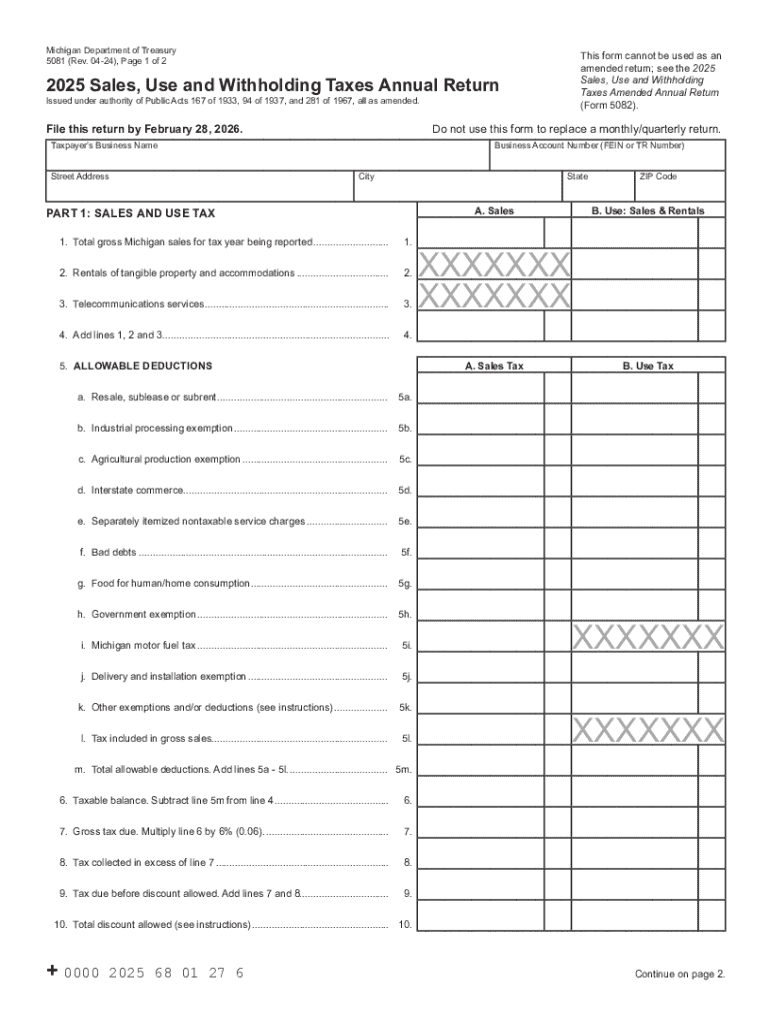

The 5081 form, officially known as the Sales, Use And Withholding Taxes Annual Return, is a critical document for businesses operating in Michigan. This form is used to report and remit sales and use taxes, as well as withholding taxes collected throughout the tax year. It provides the Michigan Department of Treasury with essential information regarding the tax liabilities of businesses, ensuring compliance with state tax laws.

Filing the 5081 form is mandatory for all businesses that are registered to collect sales tax in Michigan. This includes various business entities such as corporations, partnerships, and sole proprietorships. The form serves as an annual summary of the taxes collected, allowing the state to assess the overall tax contributions made by each business.

How to use the 5081, Sales, Use And Withholding Taxes Annual Return

Using the 5081 form involves several important steps to ensure accurate reporting of sales and use taxes. First, businesses must gather all relevant financial records, including sales invoices, receipts, and any documentation related to purchases subject to use tax. This information is crucial for accurately calculating the total tax liability for the year.

Next, businesses need to complete the form by entering the required information, such as total sales, taxable sales, and any exemptions claimed. It is essential to double-check all figures for accuracy to avoid potential penalties. Once the form is completed, it can be submitted electronically or via mail, depending on the preferred filing method.

Steps to complete the 5081, Sales, Use And Withholding Taxes Annual Return

Completing the 5081 form involves a systematic approach to ensure all necessary information is accurately reported. Here are the key steps:

- Gather all sales and purchase records for the tax year.

- Calculate total sales and determine the amount of taxable sales.

- Identify any exemptions or deductions applicable to your business.

- Fill out the 5081 form with the calculated figures.

- Review the form for accuracy and completeness.

- Submit the form by the designated filing deadline.

By following these steps, businesses can ensure a smooth filing process and maintain compliance with Michigan tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 5081 form are crucial for businesses to avoid penalties. The due date for submitting the form is typically the last day of February following the end of the tax year. For example, for the tax year ending December 31, the form must be filed by February 28 of the following year.

It is important for businesses to mark their calendars and prepare the necessary documentation well in advance of the deadline. Late submissions may incur penalties, which can add to the overall tax liability.

Required Documents

To complete the 5081 form accurately, several documents are required. These include:

- Sales invoices and receipts for the reporting period.

- Purchase records for items subject to use tax.

- Documentation of any exemptions claimed.

- Prior year tax returns, if applicable.

Having these documents readily available will streamline the process of filling out the form and help ensure compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the 5081 form on time or inaccuracies in reporting can lead to significant penalties. The Michigan Department of Treasury may impose fines based on the amount of tax owed or the length of time the form is overdue. Additionally, interest may accrue on unpaid taxes, further increasing the financial burden on the business.

To avoid these penalties, it is essential for businesses to understand their obligations and ensure timely and accurate filing of the 5081 form.

Handy tips for filling out 5081, Sales, Use And Withholding Taxes Annual Return online

Quick steps to complete and e-sign 5081, Sales, Use And Withholding Taxes Annual Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant service for optimum straightforwardness. Use signNow to e-sign and send 5081, Sales, Use And Withholding Taxes Annual Return for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5081 sales use and withholding taxes annual return 771975678

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan sales use form?

The Michigan sales use form is a document used by businesses to report and pay sales tax on taxable purchases made in Michigan. It is essential for compliance with state tax regulations and helps businesses accurately track their sales tax obligations.

-

How can airSlate SignNow help with the Michigan sales use form?

airSlate SignNow simplifies the process of completing and submitting the Michigan sales use form by providing an intuitive eSignature platform. Users can easily fill out the form electronically, ensuring accuracy and saving time on paperwork.

-

Is there a cost associated with using airSlate SignNow for the Michigan sales use form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that streamline the completion of the Michigan sales use form, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the Michigan sales use form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which enhance the management of the Michigan sales use form. These tools help ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the Michigan sales use form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Michigan sales use form. This integration capability enhances productivity and ensures seamless document management.

-

What are the benefits of using airSlate SignNow for the Michigan sales use form?

Using airSlate SignNow for the Michigan sales use form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly interface makes it easy for businesses to manage their sales tax documentation.

-

Is airSlate SignNow secure for handling the Michigan sales use form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Michigan sales use form and other documents are protected. The platform employs advanced encryption and security measures to safeguard sensitive information.

Get more for 5081, Sales, Use And Withholding Taxes Annual Return

- Pennsylvania married form

- Legal last will and testament form for a married person with no children pennsylvania

- Legal last will and testament form for married person with minor children pennsylvania

- Codicil form sample

- Legal last will and testament form for married person with adult and minor children from prior marriage pennsylvania

- Legal last will and testament form for married person with adult and minor children pennsylvania

- Mutual wills package with last wills and testaments for married couple with adult and minor children pennsylvania form

- Pennsylvania widow 497324932 form

Find out other 5081, Sales, Use And Withholding Taxes Annual Return

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple