KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 2025-2026

What is the Kentucky Estimated Tax Voucher Installment 1

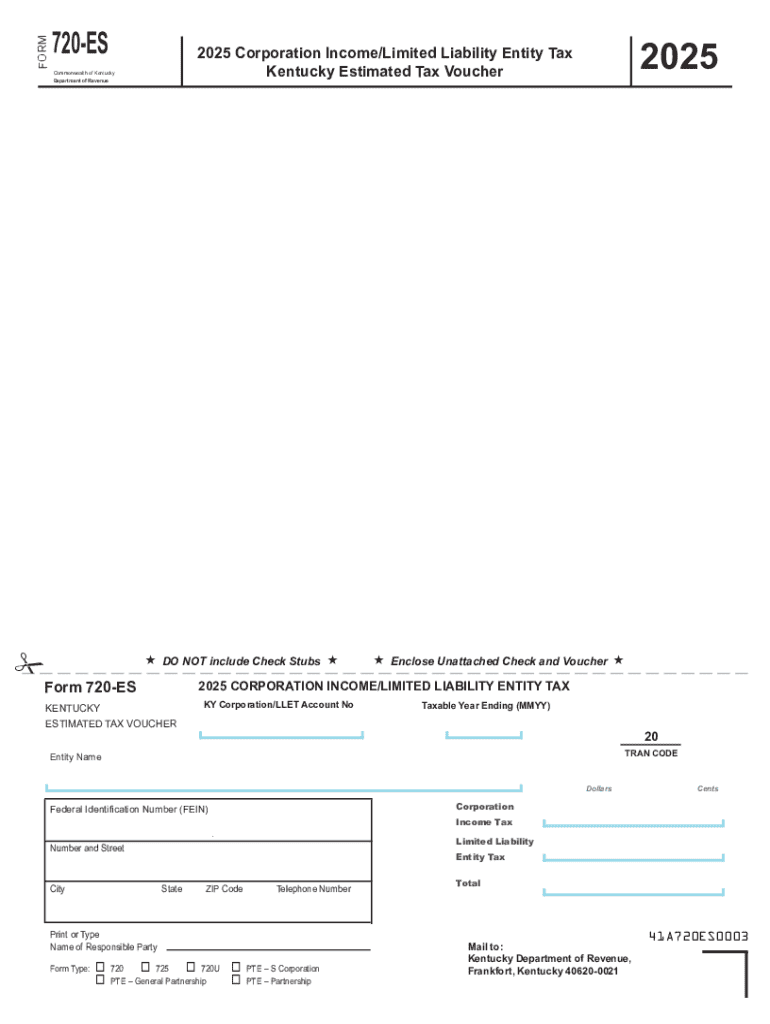

The Kentucky Estimated Tax Voucher Installment 1 is a form used by individuals and businesses in Kentucky to report and pay estimated income taxes. This voucher is part of the state's tax system, allowing taxpayers to make quarterly payments based on their expected tax liability for the year. It is essential for those who do not have sufficient tax withheld from their income, such as self-employed individuals or those with significant investment income.

How to use the Kentucky Estimated Tax Voucher Installment 1

To use the Kentucky Estimated Tax Voucher Installment 1, taxpayers must first calculate their estimated tax liability for the year. This involves considering income, deductions, and credits. Once the estimated amount is determined, the taxpayer fills out the voucher with the appropriate details, including their name, address, Social Security number, and the payment amount. The completed voucher is then submitted along with the payment to the Kentucky Department of Revenue.

Steps to complete the Kentucky Estimated Tax Voucher Installment 1

Completing the Kentucky Estimated Tax Voucher Installment 1 involves several steps:

- Gather necessary financial information, including income and deductions.

- Calculate the estimated tax liability for the year.

- Fill out the voucher with personal and payment details.

- Review the completed voucher for accuracy.

- Submit the voucher along with the payment to the appropriate state agency.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when submitting the Kentucky Estimated Tax Voucher Installment 1. Typically, the first installment is due on April fifteenth, with subsequent payments due on June fifteenth, September fifteenth, and January fifteenth of the following year. Staying aware of these dates is crucial to avoid penalties and interest on late payments.

Required Documents

When completing the Kentucky Estimated Tax Voucher Installment 1, taxpayers should have the following documents ready:

- Previous year's tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits.

- Bank information for payment processing, if applicable.

Penalties for Non-Compliance

Failing to submit the Kentucky Estimated Tax Voucher Installment 1 on time can result in penalties and interest. The state may impose a late payment penalty, which can accumulate over time, increasing the total amount owed. Additionally, taxpayers may face interest charges on any unpaid tax amounts, making timely submission essential to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct kentucky estimated tax voucher installment 1 771977158

Create this form in 5 minutes!

How to create an eSignature for the kentucky estimated tax voucher installment 1 771977158

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

The KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 is a form used by taxpayers in Kentucky to report and pay their estimated income taxes. This voucher is essential for individuals and businesses to ensure compliance with state tax regulations. By using this voucher, taxpayers can avoid penalties and interest on underpayment.

-

How can airSlate SignNow help with the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

airSlate SignNow provides a seamless platform for eSigning and sending the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1. Our user-friendly interface allows you to complete and submit your tax documents quickly and securely. This ensures that you meet your tax obligations without hassle.

-

What are the pricing options for using airSlate SignNow for the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

airSlate SignNow offers various pricing plans to accommodate different needs when handling the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can access our services. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

With airSlate SignNow, you can enjoy features like customizable templates, secure eSigning, and document tracking for the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1. These features streamline the process, making it easier to manage your tax documents efficiently. Additionally, our platform ensures that your data is protected.

-

Are there any benefits to using airSlate SignNow for the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

Using airSlate SignNow for the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1 offers numerous benefits, including time savings and enhanced accuracy. Our platform minimizes the risk of errors in your tax documents, ensuring compliance with state regulations. Furthermore, you can access your documents anytime, anywhere.

-

Can I integrate airSlate SignNow with other software for the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

Yes, airSlate SignNow can be integrated with various software applications to facilitate the management of the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1. This integration allows for a more streamlined workflow, enabling you to connect your tax documents with accounting software and other tools. This enhances efficiency and reduces manual data entry.

-

Is airSlate SignNow secure for handling the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1?

Absolutely! airSlate SignNow prioritizes security when handling the KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can trust that your tax documents are safe and secure with us.

Get more for KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children washington form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497429235 form

- Change residence form

- Washington business incorporation package to incorporate corporation washington form

- Washington corporation template form

- Washington pre incorporation agreement shareholders agreement and confidentiality agreement washington form

- Washington bylaws form

- Corporate records maintenance package for existing corporations washington form

Find out other KENTUCKY ESTIMATED TAX VOUCHER INSTALLMENT 1

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online