Kentucky Form 720 2012

What is the Kentucky Form 720

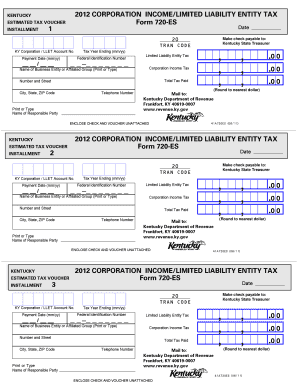

The Kentucky Form 720 is a tax form used by businesses operating in Kentucky to report and remit various taxes owed to the state. This form is primarily utilized for the Kentucky Corporation Income Tax and is essential for ensuring compliance with state tax regulations. Businesses must accurately complete this form to determine their tax liability based on their income and other relevant factors.

How to use the Kentucky Form 720

To effectively use the Kentucky Form 720, businesses should first gather all necessary financial information, including revenue, deductions, and any applicable credits. The form requires detailed reporting of income and expenses, which will ultimately influence the tax amount owed. Once completed, the form must be submitted to the Kentucky Department of Revenue by the specified deadline to avoid penalties.

Steps to complete the Kentucky Form 720

Completing the Kentucky Form 720 involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form accurately, ensuring all sections are completed.

- Calculate the total tax liability based on the provided income and deductions.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Kentucky Department of Revenue by the due date.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the Kentucky Form 720. Generally, the form must be filed by the 15th day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the deadline is April 15. Late submissions may incur penalties and interest, making timely filing essential.

Required Documents

When preparing to complete the Kentucky Form 720, businesses should have the following documents on hand:

- Income statements and profit and loss statements.

- Records of any deductions or credits claimed.

- Previous tax returns for reference.

- Documentation of any estimated tax payments made during the year.

Who Issues the Form

The Kentucky Form 720 is issued by the Kentucky Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Kentucky. For any inquiries or clarifications regarding the form, businesses can contact the department directly for assistance.

Quick guide on how to complete kentucky form 720

Prepare Kentucky Form 720 effortlessly on any device

Digital document management has gained traction with organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Kentucky Form 720 on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Kentucky Form 720 with ease

- Find Kentucky Form 720 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for such purposes.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign Kentucky Form 720 to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky form 720

Create this form in 5 minutes!

How to create an eSignature for the kentucky form 720

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky Form 720?

The Kentucky Form 720 is a tax form used by businesses to report and pay various taxes in the state of Kentucky. It is essential for ensuring compliance with state tax regulations. Using airSlate SignNow, you can easily eSign and submit your Kentucky Form 720 online, streamlining the process.

-

How can airSlate SignNow help with the Kentucky Form 720?

airSlate SignNow simplifies the process of completing and submitting the Kentucky Form 720 by providing an intuitive platform for eSigning documents. You can fill out the form, add necessary signatures, and send it directly to the appropriate authorities. This saves time and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that can help with the Kentucky Form 720 and other document management tasks. You can choose a plan that fits your budget and requirements.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow. You can connect it with tools like Google Drive, Dropbox, and CRM systems to manage your documents, including the Kentucky Form 720, more efficiently. This integration helps streamline your document processes.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including eSigning, templates, and real-time tracking. These features make it easy to handle the Kentucky Form 720 and other important documents. You can also customize workflows to suit your business needs.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the Kentucky Form 720. With encryption and secure cloud storage, you can trust that your sensitive information is safe while using our platform for eSigning and document management.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage and eSign documents like the Kentucky Form 720 on the go. The mobile app provides a user-friendly interface, ensuring you can complete your tasks anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for Kentucky Form 720

Find out other Kentucky Form 720

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now