PITIT22102018082118 Indd 2024-2026

Understanding the Ohio IT SD 2210 Form

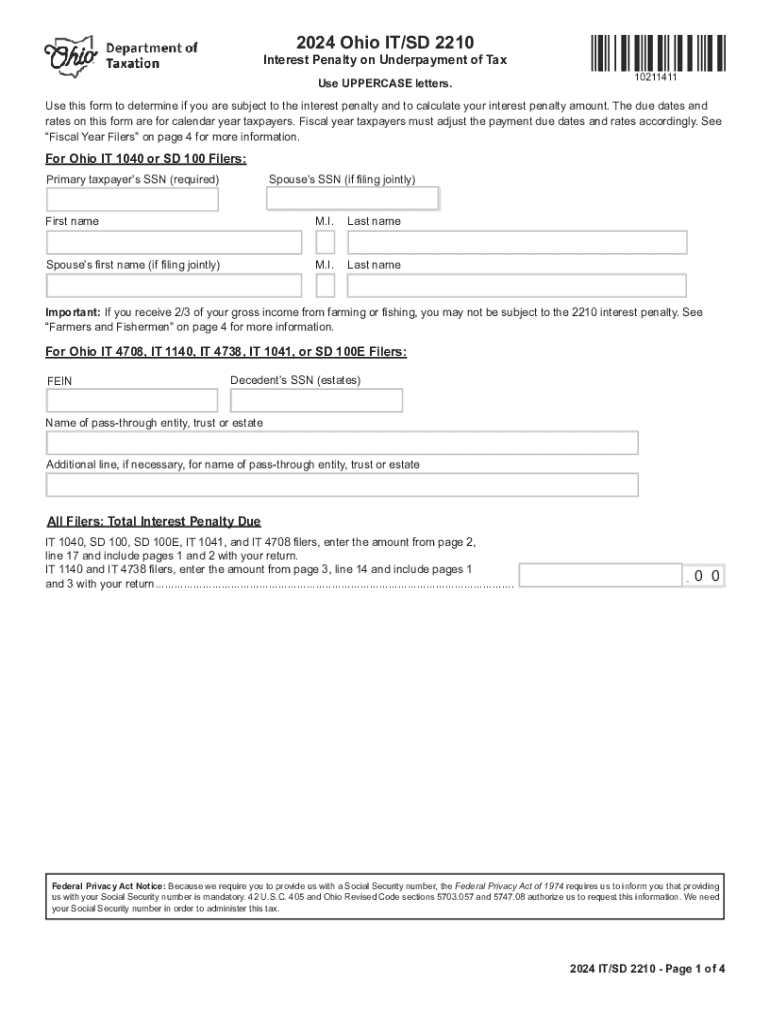

The Ohio IT SD 2210 form, also known as the Ohio form 2210, is a crucial document for taxpayers who need to report their income and calculate any penalties for underpayment of estimated taxes. This form is specifically designed for individuals who may not have paid enough tax throughout the year, either through withholding or estimated payments. Understanding its structure and purpose is essential for compliance and accurate tax reporting.

Steps to Complete the Ohio IT SD 2210 Form

Completing the Ohio IT SD 2210 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total income for the year to determine your tax liability.

- Assess your estimated tax payments and any withholding amounts already submitted.

- Use the form's worksheet to determine if you owe any penalties for underpayment.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

Filing Deadlines and Important Dates

Timely filing of the Ohio IT SD 2210 is essential to avoid penalties. The form must typically be submitted along with your annual tax return. Key dates to remember include:

- April 15: Deadline for filing individual income tax returns.

- Estimated tax payment due dates: April 15, June 15, September 15, and January 15 of the following year.

Required Documents for the Ohio IT SD 2210 Form

To complete the Ohio IT SD 2210 form accurately, you will need several documents:

- W-2 forms from employers.

- 1099 forms for any additional income sources.

- Records of estimated tax payments made throughout the year.

- Previous year’s tax return for reference.

Penalties for Non-Compliance with the Ohio IT SD 2210

Failure to file the Ohio IT SD 2210 form or underpayment of estimated taxes can result in penalties. These may include:

- Interest on unpaid taxes.

- Additional penalties for late filing or underpayment.

Who Issues the Ohio IT SD 2210 Form

The Ohio IT SD 2210 form is issued by the Ohio Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. It provides resources and guidance for individuals completing their tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct pitit22102018082118 indd

Create this form in 5 minutes!

How to create an eSignature for the pitit22102018082118 indd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ohio it sd 2210 and how does it work?

The ohio it sd 2210 is a comprehensive solution designed to streamline document signing and management. It allows users to send, sign, and store documents securely, ensuring a smooth workflow. With its user-friendly interface, businesses can easily adopt this tool to enhance their operations.

-

How much does the ohio it sd 2210 cost?

Pricing for the ohio it sd 2210 varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes. You can select a plan that best fits your needs and budget, ensuring you get the most value for your investment.

-

What features are included in the ohio it sd 2210?

The ohio it sd 2210 includes a variety of features such as document templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and offers advanced security measures to protect your documents. These features make it an ideal choice for businesses looking to enhance their document management processes.

-

What are the benefits of using the ohio it sd 2210?

Using the ohio it sd 2210 can signNowly improve your business efficiency by reducing the time spent on document handling. It allows for faster turnaround times on contracts and agreements, which can lead to increased productivity. Moreover, the cost-effective nature of this solution helps businesses save money while improving their operations.

-

Can the ohio it sd 2210 integrate with other software?

Yes, the ohio it sd 2210 is designed to integrate seamlessly with various software applications. This includes popular tools like CRM systems, project management software, and cloud storage services. Such integrations enhance the functionality of your existing systems and streamline your workflow.

-

Is the ohio it sd 2210 secure for sensitive documents?

Absolutely, the ohio it sd 2210 prioritizes security with advanced encryption and compliance with industry standards. This ensures that your sensitive documents are protected from unauthorized access. You can confidently use this solution knowing that your data is secure.

-

How can I get started with the ohio it sd 2210?

Getting started with the ohio it sd 2210 is simple. You can sign up for a free trial on the airSlate SignNow website to explore its features. Once you're ready, you can choose a subscription plan that suits your business needs and start optimizing your document processes.

Get more for PITIT22102018082118 indd

- Angle puzzle worksheet answers pdf form

- Minutes writing format pdf

- Verification of working life residence in australia form

- Certificado de empadronamiento form

- Ndis continence assessment template form

- Hiv test form pdf 10735885

- Practice worksheet graphing quadratic functions in intercept form answer key

- Domiciliary letters 50223486 form

Find out other PITIT22102018082118 indd

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer