If the Taxpayer Qualifies for and Chooses Option 1 2022

Eligibility criteria for Ohio Form 2210

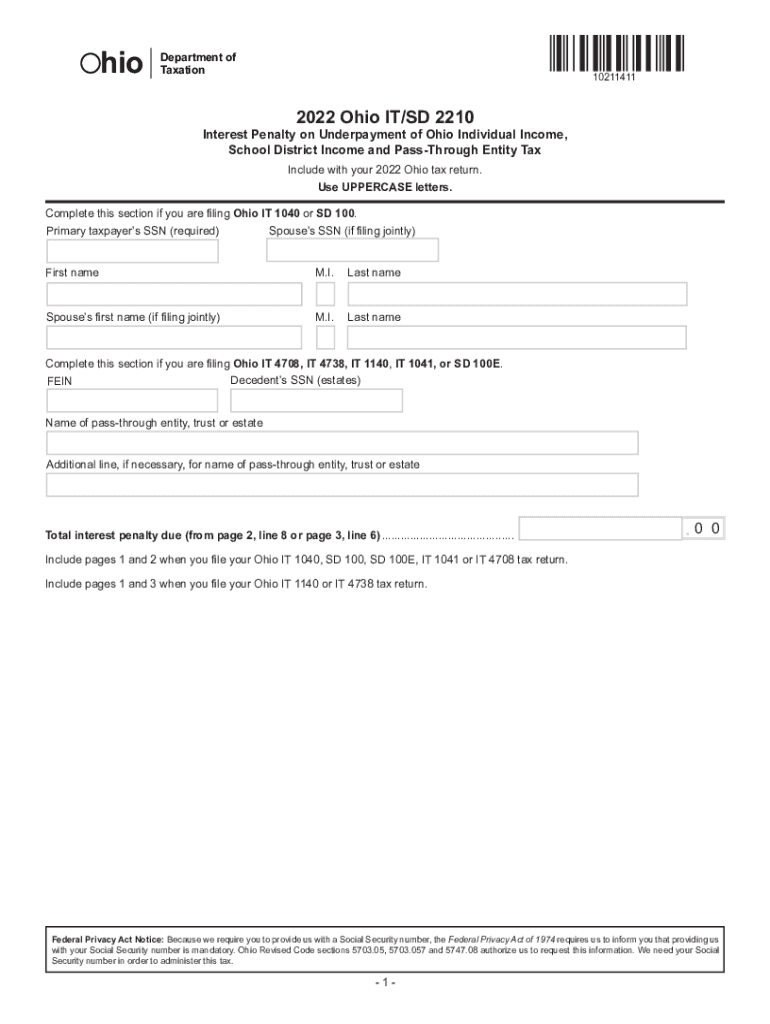

To determine eligibility for Ohio Form 2210, taxpayers must assess their income and tax liability. This form is primarily used by individuals who have underpaid their estimated taxes throughout the year. Taxpayers may qualify if they expect their total tax liability to exceed a certain threshold based on their income level. Additionally, those who have experienced significant changes in income or deductions may also find this form applicable. It is essential to review the specific income brackets and tax rates that apply to your situation to ensure compliance with state regulations.

Steps to complete Ohio Form 2210

Completing Ohio Form 2210 involves several key steps. First, gather all necessary documents, including income statements and previous tax returns. Next, calculate your total tax liability for the year, considering any credits or deductions you may qualify for. After determining your total liability, compare it to the amount of tax you have already paid through withholding or estimated payments. If there is a discrepancy, proceed to fill out the form accurately, ensuring all calculations are correct. Finally, review the completed form for accuracy before submission.

Filing deadlines for Ohio Form 2210

Filing deadlines for Ohio Form 2210 align with the overall tax filing deadlines set by the state. Generally, taxpayers must submit their forms by the due date of their annual income tax return, typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these dates and ensure timely submission to avoid penalties.

Required documents for Ohio Form 2210

When preparing to file Ohio Form 2210, several documents are essential. Taxpayers should collect their W-2 forms, 1099 forms, and any other income documentation. Additionally, previous tax returns may be necessary to provide context for income changes. It is also helpful to have records of estimated tax payments made throughout the year. Having these documents organized will facilitate a smoother filing process and help ensure accuracy.

Penalties for non-compliance with Ohio Form 2210

Failure to comply with the requirements of Ohio Form 2210 can result in significant penalties. Taxpayers who underpay their estimated taxes may face a penalty based on the amount owed. Additionally, late filing can incur further penalties, which can accumulate over time. It is important to understand these consequences and take proactive measures to avoid them, such as making timely payments and submitting the form by the required deadlines.

Form submission methods for Ohio Form 2210

Ohio Form 2210 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed online through the Ohio Department of Taxation's website, which offers a streamlined process for electronic submission. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address specified by the state. In-person submissions are also an option at designated tax offices. Each method has its own processing times, so it is advisable to consider these factors when deciding how to submit the form.

Quick guide on how to complete if the taxpayer qualifies for and chooses option 1

Accomplish If The Taxpayer Qualifies For And Chooses Option 1 effortlessly on any gadget

Digital document management has gained increased popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, alter, and electronically sign your documents quickly without interruptions. Manage If The Taxpayer Qualifies For And Chooses Option 1 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign If The Taxpayer Qualifies For And Chooses Option 1 with ease

- Obtain If The Taxpayer Qualifies For And Chooses Option 1 and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements with just a few clicks from any device you choose. Alter and eSign If The Taxpayer Qualifies For And Chooses Option 1 and maintain excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct if the taxpayer qualifies for and chooses option 1

Create this form in 5 minutes!

How to create an eSignature for the if the taxpayer qualifies for and chooses option 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Form 2210 and why is it important?

The Ohio Form 2210 is a crucial tax form used by residents of Ohio to calculate their penalties for underpayment of estimated taxes. Understanding this form can help taxpayers avoid unnecessary fines and meet their tax obligations effectively.

-

How can airSlate SignNow help with the Ohio Form 2210?

airSlate SignNow simplifies the process of electronically signing and sending the Ohio Form 2210, making it easy to manage tax documents. With our platform, you can ensure your form is filled out correctly and sent securely without the hassle of paperwork.

-

What features does airSlate SignNow offer for handling the Ohio Form 2210?

airSlate SignNow provides features such as templates, reminders, and eSigning capabilities to streamline the handling of the Ohio Form 2210. These tools help ensure that your tax forms are completed accurately and on time.

-

What is the pricing structure for using airSlate SignNow for the Ohio Form 2210?

airSlate SignNow offers flexible pricing plans based on your needs, making it cost-effective for businesses looking to manage the Ohio Form 2210. Depending on your plan, you can access various features that enhance the document signing process.

-

Is airSlate SignNow compliant with Ohio state regulations for the Form 2210?

Yes, airSlate SignNow is fully compliant with Ohio state regulations for submitting the Ohio Form 2210. We prioritize security and compliance to ensure that your documents are handled according to state requirements.

-

Can airSlate SignNow integrate with other tools for managing the Ohio Form 2210?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting and financial software, making it easier to manage your Ohio Form 2210 across different platforms. This integration helps streamline workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for the Ohio Form 2210?

Using airSlate SignNow for the Ohio Form 2210 offers benefits such as faster document turnaround times, reduced paperwork, and enhanced security. Our platform helps you stay organized while ensuring that all your tax forms are properly documented.

Get more for If The Taxpayer Qualifies For And Chooses Option 1

- Event planner form

- Texas southern university affidavit of support form

- Application form sandford park school sandfordparkschool

- 2010 scholarship application form

- Dcf fiu form

- Pathway scholarship acceptance form clovis community college clovis

- Radioactive decay worksheet answers form

- Estelle dippenaar universiteit van stellenbosch web apps sun ac form

Find out other If The Taxpayer Qualifies For And Chooses Option 1

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now