Form 3832 Limited Liability Company Nonresident Members Consent 2024-2026

What is the Form 3832 Limited Liability Company Nonresident Members’ Consent

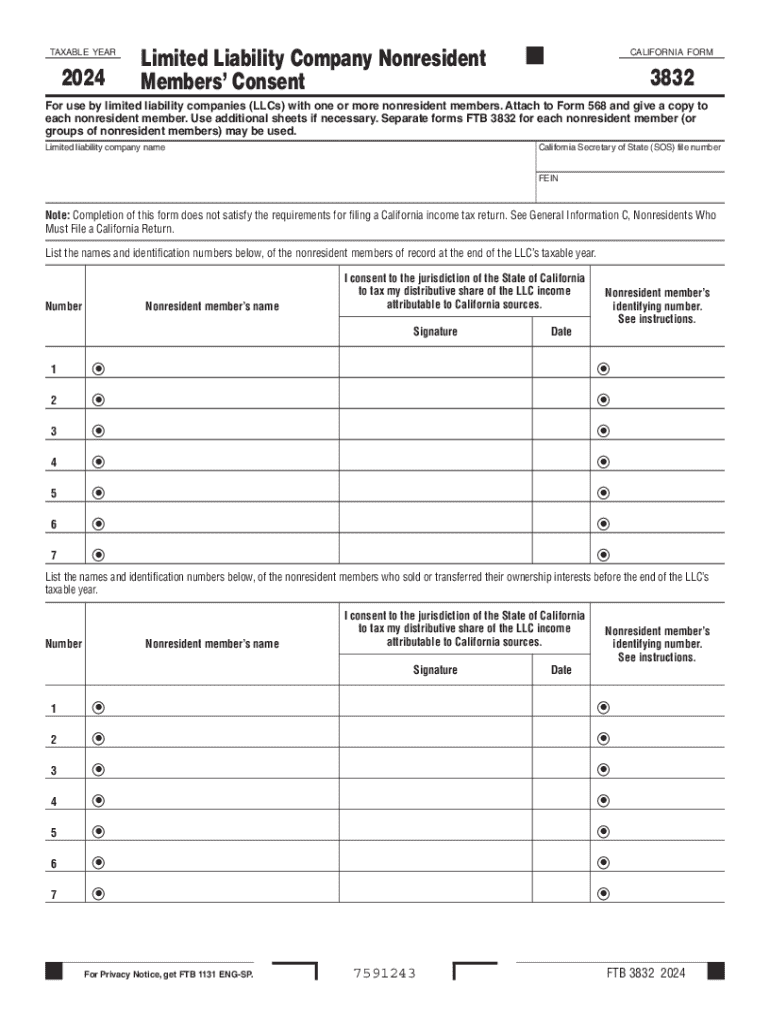

The Form 3832, known as the Limited Liability Company Nonresident Members’ Consent, is a crucial document for limited liability companies (LLCs) in the United States that have nonresident members. This form is used to obtain consent from nonresident members to be subject to California income tax on their share of the LLC's income. It ensures compliance with state tax regulations and helps streamline the tax process for both the LLC and its members.

How to use the Form 3832 Limited Liability Company Nonresident Members’ Consent

Utilizing the Form 3832 involves several steps that ensure proper compliance with California tax laws. First, the LLC must complete the form by providing necessary information about the company and its nonresident members. Each nonresident member must then review and sign the form, indicating their consent to the tax obligations. Once completed, the form is submitted to the California Franchise Tax Board (FTB) as part of the LLC's tax filings.

Steps to complete the Form 3832 Limited Liability Company Nonresident Members’ Consent

Completing Form 3832 requires attention to detail. Here are the essential steps:

- Gather information about the LLC, including its name, address, and federal employer identification number (EIN).

- List all nonresident members along with their respective ownership percentages.

- Each nonresident member must review the form and provide their signature, acknowledging their consent.

- Submit the completed form to the California Franchise Tax Board by the specified deadline.

Key elements of the Form 3832 Limited Liability Company Nonresident Members’ Consent

The Form 3832 includes several key elements that are vital for its validity. These elements consist of:

- The name and address of the LLC.

- The federal employer identification number (EIN) of the LLC.

- A list of all nonresident members and their ownership percentages.

- Signature lines for each nonresident member to provide their consent.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting Form 3832. The form must be filed with the California Franchise Tax Board by the due date of the LLC's tax return. Typically, this aligns with the annual tax filing deadline for the LLC, which is usually the 15th day of the fourth month after the end of the taxable year. It is important to stay informed about any changes in deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 3832 or obtain the necessary consents from nonresident members can lead to significant penalties. The California Franchise Tax Board may impose fines for late submissions, and the LLC may be held responsible for any unpaid taxes owed by its nonresident members. Ensuring compliance with the form's requirements is essential to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct form 3832 limited liability company nonresident members consent

Create this form in 5 minutes!

How to create an eSignature for the form 3832 limited liability company nonresident members consent

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 3832 form and how does it relate to airSlate SignNow?

The ftb 3832 form is used for California tax purposes, specifically for reporting certain income. With airSlate SignNow, you can easily eSign and send the ftb 3832 form securely, ensuring compliance and efficiency in your tax filing process.

-

How can airSlate SignNow help me manage my ftb 3832 documents?

airSlate SignNow provides a user-friendly platform to manage your ftb 3832 documents. You can create, edit, and eSign your forms seamlessly, making it easier to keep track of your tax documents and ensuring they are always up to date.

-

What are the pricing options for using airSlate SignNow for ftb 3832?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large enterprise, you can find a plan that allows you to manage your ftb 3832 forms efficiently without breaking the bank.

-

Are there any integrations available for ftb 3832 with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications to streamline your workflow. You can connect your accounting software or CRM to easily manage your ftb 3832 forms alongside other business documents.

-

What features does airSlate SignNow offer for eSigning ftb 3832 forms?

airSlate SignNow offers robust features for eSigning ftb 3832 forms, including customizable templates, secure storage, and real-time tracking. These features ensure that your signing process is efficient and compliant with legal standards.

-

Can I use airSlate SignNow on mobile devices for ftb 3832?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage and eSign your ftb 3832 forms on the go. This flexibility ensures that you can handle your documents anytime, anywhere, without any hassle.

-

What are the benefits of using airSlate SignNow for my ftb 3832 needs?

Using airSlate SignNow for your ftb 3832 needs offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the signing process, allowing you to focus on your business while ensuring compliance.

Get more for Form 3832 Limited Liability Company Nonresident Members Consent

- I break stuff for a living readworks answer key form

- Acquittance roll pdf 232410499 form

- Grand river hospital childbirth registration form

- Sentara self test form

- Application form for ielts academic course aibe edu

- Kaufvertrag jagdwaffe form

- The drivers model leadstrat com form

- Physician employment agreement template form

Find out other Form 3832 Limited Liability Company Nonresident Members Consent

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple