Limited Liability Company Nonresident Ftb Ca 2017

What is the Limited Liability Company Nonresident Ftb Ca

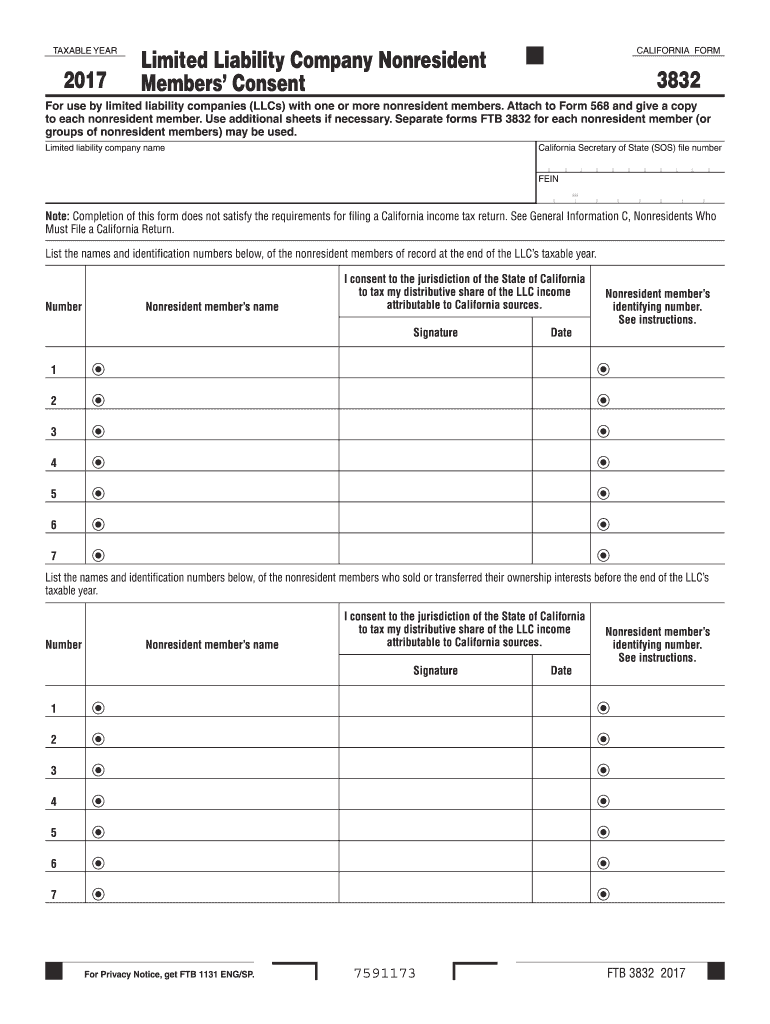

The Limited Liability Company Nonresident FTB CA form is a tax document specifically designed for nonresident limited liability companies (LLCs) operating in California. This form allows these entities to report their income and fulfill their tax obligations to the California Franchise Tax Board (FTB). Nonresident LLCs must complete this form to ensure compliance with California tax laws, as they may be subject to specific tax rates and regulations that differ from those applicable to resident LLCs.

Steps to complete the Limited Liability Company Nonresident Ftb Ca

Completing the Limited Liability Company Nonresident FTB CA form involves several key steps:

- Gather necessary information about the LLC, including its legal name, address, and federal Employer Identification Number (EIN).

- Determine the income earned in California and any applicable deductions or credits.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

How to use the Limited Liability Company Nonresident Ftb Ca

Using the Limited Liability Company Nonresident FTB CA form is essential for nonresident LLCs to report their income to the state of California. This form can be filled out online using secure platforms that comply with eSignature regulations. After completing the form, it can be submitted electronically, which streamlines the filing process and ensures timely compliance with state tax requirements. It is important to follow the guidelines provided by the California FTB to avoid any penalties or issues with your submission.

Required Documents

To complete the Limited Liability Company Nonresident FTB CA form, you will need the following documents:

- Federal Employer Identification Number (EIN).

- Financial statements detailing income earned in California.

- Records of any deductions or credits that may apply.

- Previous tax returns, if applicable, to provide context for your current filing.

Legal use of the Limited Liability Company Nonresident Ftb Ca

The legal use of the Limited Liability Company Nonresident FTB CA form is crucial for compliance with California tax laws. Nonresident LLCs must file this form to report income generated within the state and pay any taxes owed. Failure to submit this form can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Limited Liability Company Nonresident FTB CA form are typically aligned with the California tax calendar. Nonresident LLCs should be aware of the following important dates:

- The due date for the form is usually the 15th day of the fourth month after the close of the taxable year.

- If filing an extension, ensure that the extended deadline is adhered to for submission.

- Keep track of any changes to deadlines announced by the California FTB, especially during tax season.

Quick guide on how to complete limited liability company nonresident ftb ca

Your support manual on how to prepare your Limited Liability Company Nonresident Ftb Ca

If you're curious about how to generate and dispatch your Limited Liability Company Nonresident Ftb Ca, here are a few brief guidelines on how to simplify tax processing.

To get started, you just need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify responses as necessary. Optimize your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the following steps to complete your Limited Liability Company Nonresident Ftb Ca in no time:

- Create your account and begin working on PDFs swiftly.

- Utilize our directory to locate any IRS tax document; navigate through versions and schedules.

- Press Obtain form to bring up your Limited Liability Company Nonresident Ftb Ca in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that paper filing can lead to return errors and delays in refunds. Naturally, before electronically filing your taxes, review the IRS website for declaration rules applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct limited liability company nonresident ftb ca

FAQs

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

I am forming a Limited Liability Company. Do I need to file taxes separate for my company and how frequent should I file?

If you are the only owner of the LLC, the default tax classification as "sole proprietor," which means that the LLC itself is disregarded for tax purposes (i.e. it does not exist for tax purposes). In that case, you would include all of the company's business income and loss on your personal income tax return (Form 1040, filed annually), in a Schedule C attachment.If the LLC has more than one owner, the default tax classification is partnership, which means you would have to file a partnership tax return annually (Form 1065). The LLC would report any profit or loss to you via a Schedule K-1, and then you would include that income on your personal income tax return.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the limited liability company nonresident ftb ca

How to generate an eSignature for your Limited Liability Company Nonresident Ftb Ca in the online mode

How to generate an eSignature for your Limited Liability Company Nonresident Ftb Ca in Google Chrome

How to generate an eSignature for putting it on the Limited Liability Company Nonresident Ftb Ca in Gmail

How to create an electronic signature for the Limited Liability Company Nonresident Ftb Ca right from your smart phone

How to create an electronic signature for the Limited Liability Company Nonresident Ftb Ca on iOS

How to make an electronic signature for the Limited Liability Company Nonresident Ftb Ca on Android OS

People also ask

-

What is a Limited Liability Company Nonresident Ftb Ca?

A Limited Liability Company Nonresident Ftb Ca is a specific type of LLC that is formed in California but is owned by individuals who do not reside in the state. This structure provides the benefits of liability protection and potential tax advantages while allowing nonresidents to engage in business activities in California. Utilizing airSlate SignNow simplifies the document signing process for your LLC.

-

How does airSlate SignNow assist with Limited Liability Company Nonresident Ftb Ca formations?

airSlate SignNow offers a streamlined eSigning platform that allows you to manage all necessary documents for forming a Limited Liability Company Nonresident Ftb Ca effectively. With its user-friendly features, you can easily prepare, send, and receive signed documents, ensuring compliance and proper filing. This efficiency helps expedite the formation process for your LLC.

-

What are the benefits of forming a Limited Liability Company Nonresident Ftb Ca?

Forming a Limited Liability Company Nonresident Ftb Ca provides numerous benefits, including protecting your personal assets from business liabilities and potential tax savings. Additionally, it offers flexibility in management structures and fewer compliance requirements compared to corporations. airSlate SignNow can help you secure required documents for your LLC formation quickly.

-

Is there a cost associated with using airSlate SignNow for a Limited Liability Company Nonresident Ftb Ca?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs when managing a Limited Liability Company Nonresident Ftb Ca. The pricing is competitive, providing access to powerful features for document management and eSigning. Consider the value of time saved and ease of use when evaluating the cost.

-

What features does airSlate SignNow provide for Limited Liability Company Nonresident Ftb Ca?

airSlate SignNow provides comprehensive features such as secure eSigning, document templates, real-time tracking, and reminders to help you manage your Limited Liability Company Nonresident Ftb Ca documents efficiently. Additionally, the platform allows you to store and organize your files securely, ensuring you have easy access to essential documents at all times.

-

Can I integrate airSlate SignNow with other tools for my Limited Liability Company Nonresident Ftb Ca?

Absolutely! airSlate SignNow offers integrations with various business tools that you might already be using for your Limited Liability Company Nonresident Ftb Ca. This seamless integration allows for improved workflow efficiency, keeping your documents and processes interconnected and organized.

-

How does airSlate SignNow ensure the security of my Limited Liability Company Nonresident Ftb Ca documents?

Security is a top priority for airSlate SignNow, which implements advanced encryption and secure access controls to protect your Limited Liability Company Nonresident Ftb Ca documents. In addition, the platform complies with industry standards, ensuring that your sensitive information remains confidential and safe during electronic transactions.

Get more for Limited Liability Company Nonresident Ftb Ca

Find out other Limited Liability Company Nonresident Ftb Ca

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors