Limited Liability Company Nonresident Ftb Ca 2017

What is the Limited Liability Company Nonresident Ftb Ca

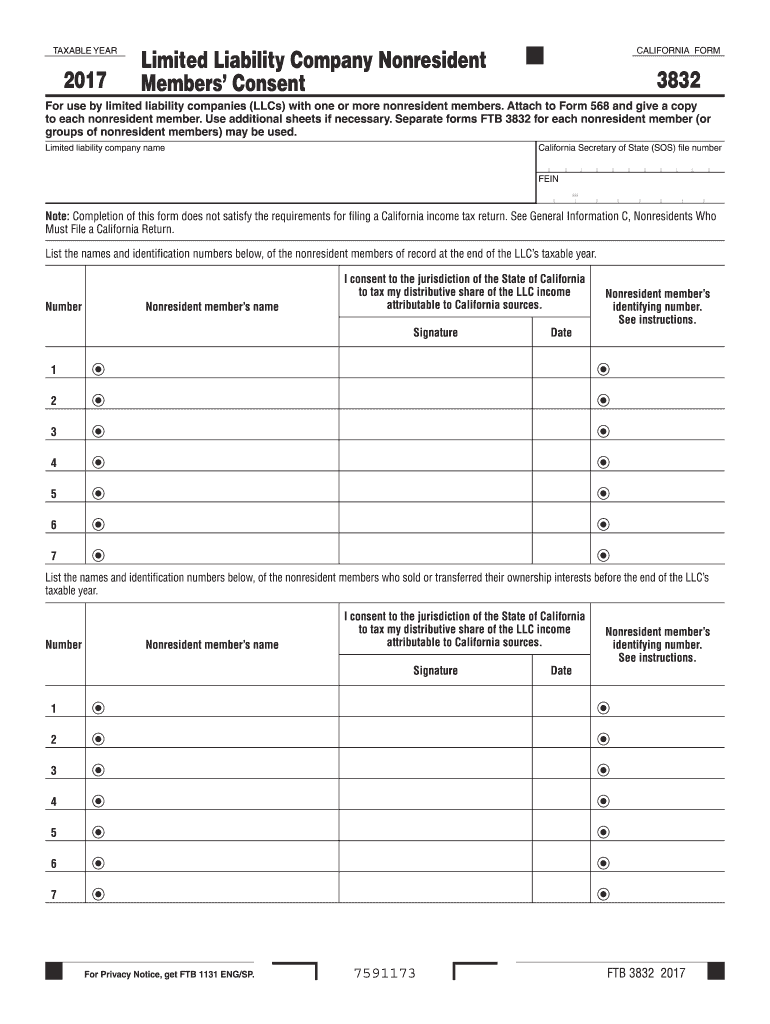

The Limited Liability Company Nonresident FTB CA form is a tax document specifically designed for nonresident limited liability companies (LLCs) operating in California. This form allows these entities to report their income and fulfill their tax obligations to the California Franchise Tax Board (FTB). Nonresident LLCs must complete this form to ensure compliance with California tax laws, as they may be subject to specific tax rates and regulations that differ from those applicable to resident LLCs.

Steps to complete the Limited Liability Company Nonresident Ftb Ca

Completing the Limited Liability Company Nonresident FTB CA form involves several key steps:

- Gather necessary information about the LLC, including its legal name, address, and federal Employer Identification Number (EIN).

- Determine the income earned in California and any applicable deductions or credits.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the form for accuracy and completeness before submission.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form by the specified deadline, either online, by mail, or in person.

How to use the Limited Liability Company Nonresident Ftb Ca

Using the Limited Liability Company Nonresident FTB CA form is essential for nonresident LLCs to report their income to the state of California. This form can be filled out online using secure platforms that comply with eSignature regulations. After completing the form, it can be submitted electronically, which streamlines the filing process and ensures timely compliance with state tax requirements. It is important to follow the guidelines provided by the California FTB to avoid any penalties or issues with your submission.

Required Documents

To complete the Limited Liability Company Nonresident FTB CA form, you will need the following documents:

- Federal Employer Identification Number (EIN).

- Financial statements detailing income earned in California.

- Records of any deductions or credits that may apply.

- Previous tax returns, if applicable, to provide context for your current filing.

Legal use of the Limited Liability Company Nonresident Ftb Ca

The legal use of the Limited Liability Company Nonresident FTB CA form is crucial for compliance with California tax laws. Nonresident LLCs must file this form to report income generated within the state and pay any taxes owed. Failure to submit this form can result in penalties, including fines and interest on unpaid taxes. It is advisable to consult with a tax professional to ensure that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the Limited Liability Company Nonresident FTB CA form are typically aligned with the California tax calendar. Nonresident LLCs should be aware of the following important dates:

- The due date for the form is usually the 15th day of the fourth month after the close of the taxable year.

- If filing an extension, ensure that the extended deadline is adhered to for submission.

- Keep track of any changes to deadlines announced by the California FTB, especially during tax season.

Quick guide on how to complete limited liability company nonresident ftb ca

Your support manual on how to prepare your Limited Liability Company Nonresident Ftb Ca

If you're curious about how to generate and dispatch your Limited Liability Company Nonresident Ftb Ca, here are a few brief guidelines on how to simplify tax processing.

To get started, you just need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that allows you to modify, draft, and finalize your tax documents with ease. With its editor, you can alternate between text, check boxes, and eSignatures and return to modify responses as necessary. Optimize your tax management with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the following steps to complete your Limited Liability Company Nonresident Ftb Ca in no time:

- Create your account and begin working on PDFs swiftly.

- Utilize our directory to locate any IRS tax document; navigate through versions and schedules.

- Press Obtain form to bring up your Limited Liability Company Nonresident Ftb Ca in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding eSignature (if needed).

- Examine your document and rectify any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that paper filing can lead to return errors and delays in refunds. Naturally, before electronically filing your taxes, review the IRS website for declaration rules applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct limited liability company nonresident ftb ca

FAQs

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

I am forming a Limited Liability Company. Do I need to file taxes separate for my company and how frequent should I file?

If you are the only owner of the LLC, the default tax classification as "sole proprietor," which means that the LLC itself is disregarded for tax purposes (i.e. it does not exist for tax purposes). In that case, you would include all of the company's business income and loss on your personal income tax return (Form 1040, filed annually), in a Schedule C attachment.If the LLC has more than one owner, the default tax classification is partnership, which means you would have to file a partnership tax return annually (Form 1065). The LLC would report any profit or loss to you via a Schedule K-1, and then you would include that income on your personal income tax return.

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

Create this form in 5 minutes!

How to create an eSignature for the limited liability company nonresident ftb ca

How to generate an eSignature for your Limited Liability Company Nonresident Ftb Ca in the online mode

How to generate an eSignature for your Limited Liability Company Nonresident Ftb Ca in Google Chrome

How to generate an eSignature for putting it on the Limited Liability Company Nonresident Ftb Ca in Gmail

How to create an electronic signature for the Limited Liability Company Nonresident Ftb Ca right from your smart phone

How to create an electronic signature for the Limited Liability Company Nonresident Ftb Ca on iOS

How to make an electronic signature for the Limited Liability Company Nonresident Ftb Ca on Android OS

People also ask

-

What is a Limited Liability Company Nonresident Ftb Ca?

A Limited Liability Company Nonresident Ftb Ca is a business structure that allows nonresidents to operate in California while limiting their personal liability. This type of LLC provides flexibility and protection, making it an ideal choice for entrepreneurs looking to establish a presence in the state without facing excessive risks.

-

How can airSlate SignNow help with the formation of a Limited Liability Company Nonresident Ftb Ca?

airSlate SignNow facilitates the document signing process required for forming a Limited Liability Company Nonresident Ftb Ca. With our user-friendly platform, you can easily prepare, send, and eSign necessary documents, streamlining the setup of your LLC in California.

-

What are the costs involved in setting up a Limited Liability Company Nonresident Ftb Ca?

Setting up a Limited Liability Company Nonresident Ftb Ca involves various costs such as registration fees, annual taxes, and possible legal expenses. While fees can vary, using airSlate SignNow can help reduce costs by simplifying the documentation process and minimizing the need for extensive legal services.

-

What features does airSlate SignNow offer for managing a Limited Liability Company Nonresident Ftb Ca?

airSlate SignNow offers features such as customizable templates, secure document storage, and real-time collaboration, which are essential for managing a Limited Liability Company Nonresident Ftb Ca. These tools not only enhance efficiency but also ensure compliance with California regulations.

-

Can I integrate airSlate SignNow with other tools for my Limited Liability Company Nonresident Ftb Ca?

Yes, airSlate SignNow integrates seamlessly with various business applications, making it easy to manage your Limited Liability Company Nonresident Ftb Ca. Whether you use CRM systems, cloud storage, or accounting software, our platform can enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for a Limited Liability Company Nonresident Ftb Ca?

Using airSlate SignNow for your Limited Liability Company Nonresident Ftb Ca provides numerous benefits, including time savings, enhanced security, and ease of use. Our cost-effective solution allows you to focus on growing your business while we handle the complexities of document management.

-

Is airSlate SignNow secure for handling my Limited Liability Company Nonresident Ftb Ca documents?

Absolutely! airSlate SignNow employs advanced security measures to ensure that your Limited Liability Company Nonresident Ftb Ca documents are protected. Our platform uses encryption and compliance with industry standards to safeguard sensitive information during the signing process.

Get more for Limited Liability Company Nonresident Ftb Ca

Find out other Limited Liability Company Nonresident Ftb Ca

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy