What's a California Franchise Tax Board Form 3832? 2023

Understanding California Franchise Tax Board Form 3832

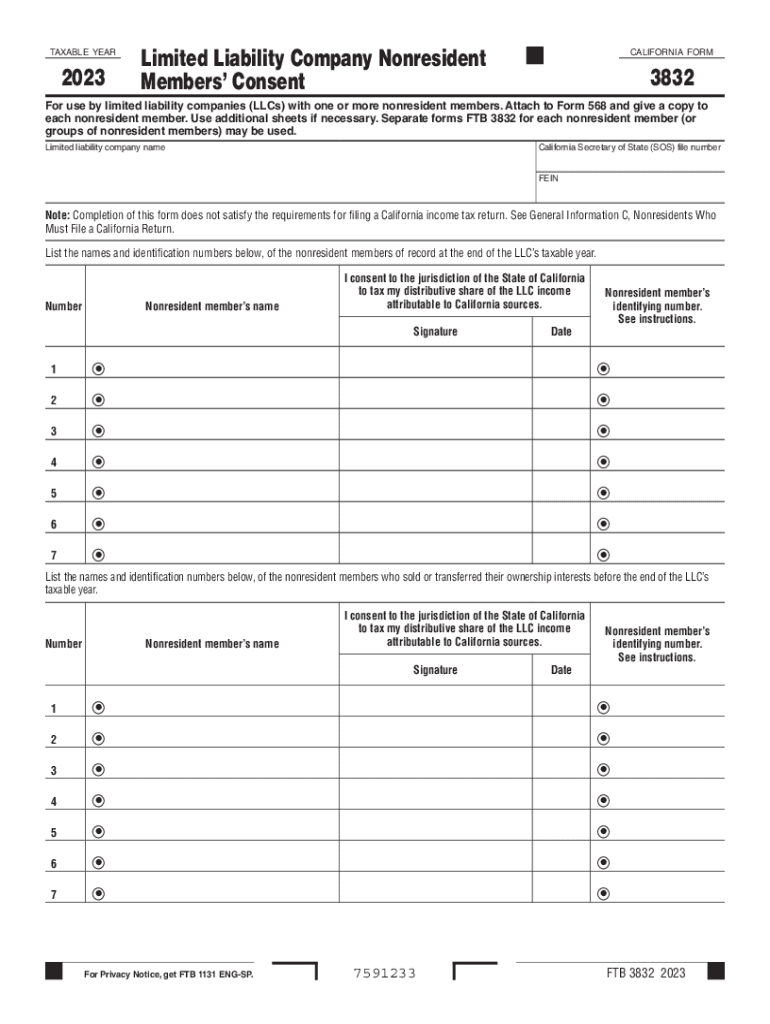

The California Franchise Tax Board Form 3832 is an essential document used for reporting certain tax-related information for partnerships and limited liability companies (LLCs) in California. This form is primarily utilized to provide consent for the California FTB to disclose specific information related to the entity's tax matters. It is crucial for ensuring compliance with state tax regulations and facilitating communication between the FTB and the entity.

Steps to Complete California Franchise Tax Board Form 3832

Completing the California Form 3832 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your entity, including its legal name, address, and tax identification number.

- Provide details about the partners or members of the LLC, including their names and addresses.

- Indicate the specific consent being granted to the FTB regarding the disclosure of tax information.

- Review the form for accuracy, ensuring that all required fields are filled out correctly.

- Sign and date the form to validate the consent provided.

Legal Use of California Franchise Tax Board Form 3832

The legal use of Form 3832 is primarily to authorize the California Franchise Tax Board to share tax information about the entity with designated individuals or entities. This consent is vital for ensuring that partners or members can access necessary tax information for compliance and reporting purposes. It is important to understand that this form must be completed accurately to avoid any legal implications or penalties associated with improper disclosure.

Filing Deadlines for California Franchise Tax Board Form 3832

Timeliness is crucial when filing Form 3832. Generally, the form should be submitted along with the annual tax return of the partnership or LLC. It is advisable to check the specific deadlines for your entity type, as these can vary based on the fiscal year and any extensions that may apply. Missing the deadline can result in penalties or delays in processing.

Obtaining California Franchise Tax Board Form 3832

California Form 3832 can be easily obtained from the California Franchise Tax Board's official website. The form is available in a downloadable PDF format, allowing for easy access and printing. Additionally, it may be available through tax professionals or accounting software that supports California tax forms.

Key Elements of California Franchise Tax Board Form 3832

Form 3832 includes several key elements that must be accurately completed:

- Entity information, including name and tax identification number.

- Details of the partners or members granting consent.

- Specific consent language outlining the scope of information to be disclosed.

- Signature of an authorized representative of the entity.

Quick guide on how to complete whats a california franchise tax board form 3832

Effortlessly prepare What's A California Franchise Tax Board Form 3832? on any device

Managing documents online has gained popularity among both businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your documents swiftly without delays. Handle What's A California Franchise Tax Board Form 3832? on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest method to modify and eSign What's A California Franchise Tax Board Form 3832? with ease

- Find What's A California Franchise Tax Board Form 3832? and click on Get Form to initiate the process.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign What's A California Franchise Tax Board Form 3832? and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct whats a california franchise tax board form 3832

Create this form in 5 minutes!

How to create an eSignature for the whats a california franchise tax board form 3832

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 3832, and why is it important?

The CA Form 3832 is an essential document used for reporting specific income and tax information to the state of California. It is crucial for businesses to complete this form accurately to ensure compliance with state regulations and avoid penalties. airSlate SignNow simplifies the process of signing and managing CA Form 3832, making it easy for businesses to stay organized.

-

How does airSlate SignNow help with the CA Form 3832?

airSlate SignNow streamlines the process of signing CA Form 3832 through its user-friendly electronic signature features. Users can easily send the form for signature, track its status, and store it securely in the cloud. This solution saves time and reduces the hassle of managing paperwork.

-

Is airSlate SignNow cost-effective for handling CA Form 3832?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to handle CA Form 3832. Our competitive pricing plans cater to organizations of all sizes, allowing you to choose a package that fits your budget. By reducing operational costs through digital document management, businesses can save signNow resources.

-

What features does airSlate SignNow provide for CA Form 3832?

airSlate SignNow provides robust features for CA Form 3832, including customizable templates, electronic signatures, and secure document storage. You can easily track who has signed, set reminders for pending signatures, and integrate with other business tools. These features enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other software for CA Form 3832?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow around CA Form 3832. Whether you use CRM systems, project management tools, or accounting software, you can easily connect SignNow to streamline your processes. This ensures that your documents are accessible where you need them.

-

What are the benefits of using airSlate SignNow for CA Form 3832?

Using airSlate SignNow for CA Form 3832 offers numerous benefits, including faster turnaround times and enhanced compliance. The electronic signature process eliminates the delays associated with traditional methods, allowing businesses to expedite documentation. Additionally, the secure storage features ensure that your sensitive information is protected.

-

Is there customer support available for questions about CA Form 3832?

Yes, airSlate SignNow offers dedicated customer support for any questions related to CA Form 3832. Our support team is knowledgeable and ready to assist you with any technical issues or inquiries you may have. Whether through email, chat, or phone, we strive to provide timely assistance.

Get more for What's A California Franchise Tax Board Form 3832?

Find out other What's A California Franchise Tax Board Form 3832?

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF