Form it 2663 Nonresident Real Property Estimated Income Tax Payment Form Tax Year

What is the Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form?

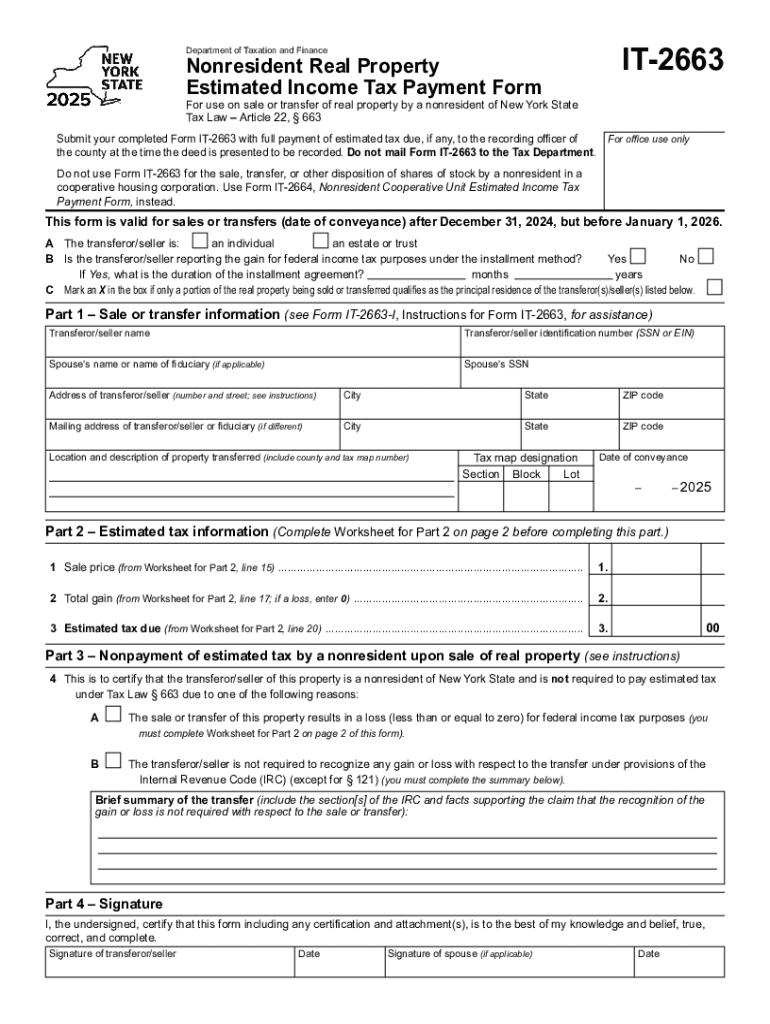

The Form IT 2663 is a tax form used by nonresidents of New York State to make estimated income tax payments on income derived from real property located in New York. This form is specifically designed for individuals who do not reside in New York but earn income from property investments, such as rental income or capital gains from the sale of real estate. By using this form, nonresidents can ensure compliance with New York tax laws and avoid potential penalties associated with underpayment of taxes.

How to Obtain the Form IT 2663

The Form IT 2663 can be obtained directly from the New York State Department of Taxation and Finance website. It is available in PDF format, allowing users to download, print, and complete the form easily. Additionally, physical copies may be available at various tax offices and public libraries throughout New York State. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Steps to Complete the Form IT 2663

Completing the Form IT 2663 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number or taxpayer identification number.

- Provide details about the real property from which you are earning income, including the address and type of property.

- Calculate your estimated income from the property and determine the appropriate tax amount based on New York State tax rates.

- Sign and date the form to certify that the information provided is accurate and complete.

Key Elements of the Form IT 2663

The Form IT 2663 contains several essential components:

- Personal Information: This section collects the taxpayer's identifying details.

- Property Information: This includes specifics about the real estate generating income.

- Income Calculation: A section dedicated to calculating the estimated income and corresponding tax liability.

- Signature Line: A requirement for the taxpayer to sign, confirming the accuracy of the information.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form IT 2663. Typically, estimated tax payments are due quarterly. Specific due dates may vary, so it is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines. Missing these deadlines can result in penalties and interest on unpaid taxes.

Penalties for Non-Compliance

Failure to file the Form IT 2663 or to make timely estimated payments can lead to significant penalties. Nonresidents may face interest charges on any unpaid tax amounts, as well as additional penalties for underpayment. It is essential to adhere to all filing requirements to avoid these financial repercussions and ensure compliance with New York tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 2663 nonresident real property estimated income tax payment form tax year 772017788

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2663 pdf and how does it relate to airSlate SignNow?

The it 2663 pdf is a document format that can be easily integrated with airSlate SignNow. This allows users to send, sign, and manage their documents efficiently. By utilizing airSlate SignNow, businesses can streamline their workflows and enhance document management.

-

How much does airSlate SignNow cost for accessing the it 2663 pdf features?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost for accessing features related to the it 2663 pdf is competitive and designed to provide value for businesses of all sizes. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing it 2663 pdf documents?

airSlate SignNow provides a range of features for managing it 2663 pdf documents, including eSigning, document templates, and real-time tracking. These features ensure that your documents are handled securely and efficiently. Additionally, users can collaborate on documents seamlessly.

-

Can I integrate airSlate SignNow with other applications for it 2663 pdf management?

Yes, airSlate SignNow offers integrations with various applications to enhance your it 2663 pdf management. This includes popular tools like Google Drive, Dropbox, and CRM systems. These integrations help streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for it 2663 pdf documents?

Using airSlate SignNow for it 2663 pdf documents provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform simplifies the signing process, allowing users to focus on their core business activities. Additionally, it helps in maintaining compliance with legal standards.

-

Is airSlate SignNow user-friendly for handling it 2663 pdf files?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy to handle it 2663 pdf files. The intuitive interface allows users to navigate through the signing process effortlessly, even if they are not tech-savvy. Training resources are also available to assist users.

-

How secure is airSlate SignNow when dealing with it 2663 pdf documents?

airSlate SignNow prioritizes security, ensuring that all it 2663 pdf documents are protected. The platform employs advanced encryption and complies with industry standards to safeguard your data. Users can trust that their sensitive information remains confidential and secure.

Get more for Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form Tax Year

- Determining speed velocity worksheet answers form

- Careers are everywhere form

- School bus seating chart form

- Foundational literacy progress monitoring connected lexercise form

- Eur 1 certificate example form

- Sale representative employment contract template form

- Seamstress employment contract template form

- Salon employment contract template form

Find out other Form IT 2663 Nonresident Real Property Estimated Income Tax Payment Form Tax Year

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy