Pennsylvania E File Signature Authorization PA 8879 Form

What is the Pennsylvania E file Signature Authorization PA 8879

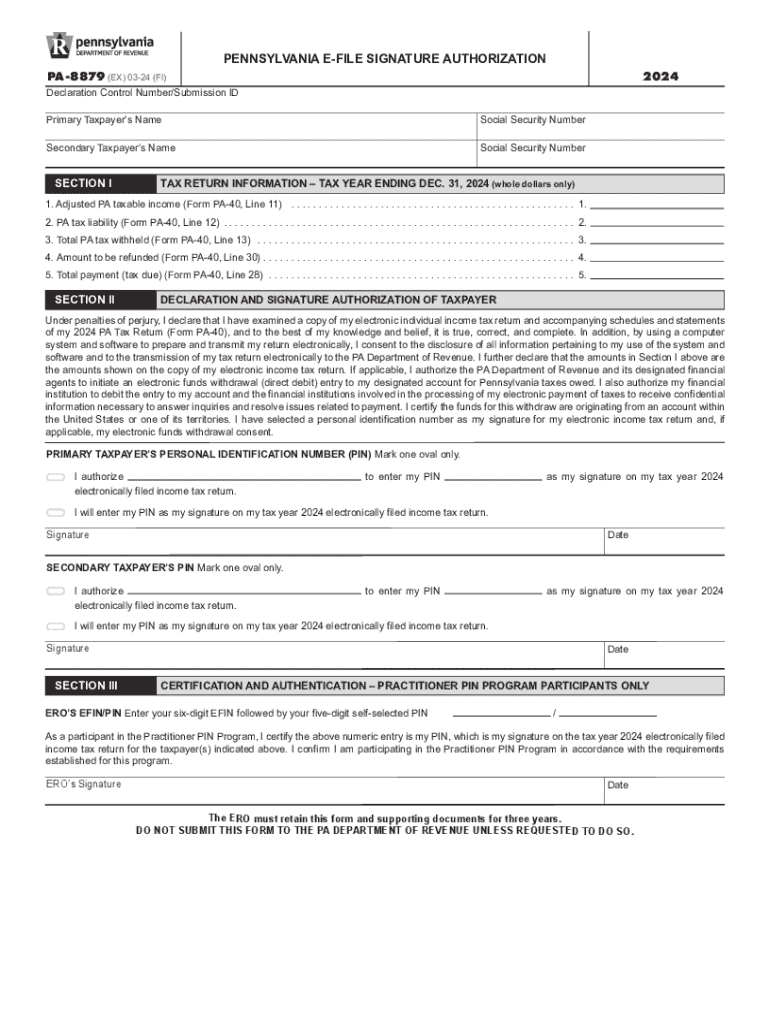

The Pennsylvania E file Signature Authorization PA 8879 is a critical form used by taxpayers in Pennsylvania to authorize electronic filing of their state tax returns. This form allows taxpayers to provide their consent for tax preparers to file their returns electronically on their behalf. The PA 8879 serves as a digital signature, ensuring that the return is submitted securely and in compliance with state regulations.

How to use the Pennsylvania E file Signature Authorization PA 8879

To use the Pennsylvania E file Signature Authorization PA 8879, taxpayers need to fill out the form accurately, providing necessary details such as their name, Social Security number, and the tax year for which the authorization is being granted. Once completed, the form must be signed by both the taxpayer and the tax preparer. This form can then be submitted electronically alongside the tax return, streamlining the filing process.

Steps to complete the Pennsylvania E file Signature Authorization PA 8879

Completing the Pennsylvania E file Signature Authorization PA 8879 involves several key steps:

- Obtain the PA 8879 form, available in PDF format.

- Fill in your personal information, including your name and Social Security number.

- Enter the tax year for which you are granting authorization.

- Sign the form to confirm your consent.

- Your tax preparer should also sign the form, indicating their acceptance of the authorization.

- Submit the completed form electronically with your tax return.

Key elements of the Pennsylvania E file Signature Authorization PA 8879

The key elements of the Pennsylvania E file Signature Authorization PA 8879 include:

- Taxpayer Information: This includes the taxpayer's name, address, and Social Security number.

- Tax Preparer Information: Details about the tax preparer, including their name and identification number.

- Tax Year: The specific year for which the authorization is being granted.

- Signatures: Both the taxpayer and tax preparer must sign the form to validate the authorization.

Legal use of the Pennsylvania E file Signature Authorization PA 8879

The legal use of the Pennsylvania E file Signature Authorization PA 8879 is essential for compliance with state tax laws. By signing this form, taxpayers authorize their preparers to submit their tax returns electronically, which is legally binding. It is important for both parties to retain a copy of the signed form for their records, as it may be required for any future inquiries or audits by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Pennsylvania E file Signature Authorization PA 8879 align with the state tax return deadlines. Typically, individual income tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that their PA 8879 form is submitted alongside their tax return by the due date to avoid penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania e file signature authorization pa 8879

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an authorization pa number and why is it important?

An authorization pa number is a unique identifier used in various business processes to validate and track authorization requests. It is crucial for ensuring that documents are processed correctly and securely, especially in industries that require compliance with regulations.

-

How does airSlate SignNow help with managing authorization pa numbers?

airSlate SignNow provides a streamlined platform for managing authorization pa numbers by allowing users to easily input, track, and reference these numbers within their documents. This feature enhances organization and ensures that all necessary authorizations are accounted for during the signing process.

-

Is there a cost associated with using airSlate SignNow for authorization pa number management?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features for managing authorization pa numbers, ensuring that you have the tools necessary for efficient document handling at a competitive price.

-

What features does airSlate SignNow offer for handling authorization pa numbers?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities that facilitate the management of authorization pa numbers. These features help streamline the document signing process and improve overall efficiency.

-

Can I integrate airSlate SignNow with other software to manage authorization pa numbers?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage authorization pa numbers seamlessly across different platforms. This flexibility ensures that your workflow remains uninterrupted and efficient.

-

What are the benefits of using airSlate SignNow for authorization pa number documentation?

Using airSlate SignNow for authorization pa number documentation provides numerous benefits, including enhanced security, improved compliance, and faster processing times. The platform's user-friendly interface makes it easy for teams to collaborate and manage documents effectively.

-

How secure is the information related to authorization pa numbers in airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect sensitive information, including authorization pa numbers. This commitment to security ensures that your documents and data remain safe throughout the signing process.

Get more for Pennsylvania E file Signature Authorization PA 8879

- Participant medical history and examination form

- R 1201 form

- Mba project completion certificate format in word

- Meiosis coloring worksheet answer key form

- Instructions for form 1042 annual withholding tax return for

- Schedule lep form 1040 rev december request for change in language preference

- Instrucciones para elformulario w 3c pr instructions for form w 3c pr rev diciembre instrucciones para elformulario w 3c pr

- Form 1040 es nr form 1040 es nr u s estimated tax for nonresident alien individuals

Find out other Pennsylvania E file Signature Authorization PA 8879

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast