DR 0100 Colorado Retail Sales Tax Return 2025-2026

What is the DR 0100 Colorado Retail Sales Tax Return

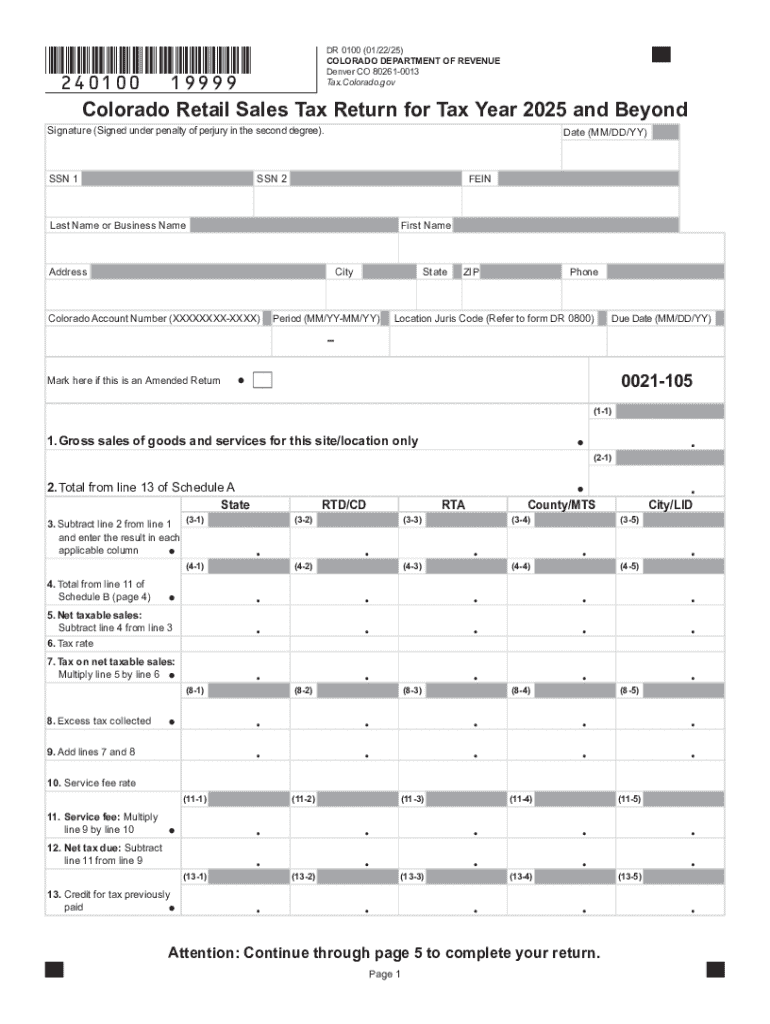

The DR 0100 Colorado Retail Sales Tax Return is an official document used by businesses in Colorado to report and remit sales tax collected on taxable sales. This form is essential for ensuring compliance with state tax laws. It includes information about the total sales made, the amount of sales tax collected, and any deductions or exemptions applicable to the business. The form is typically required for businesses that have a physical presence in Colorado or those that meet certain sales thresholds.

How to use the DR 0100 Colorado Retail Sales Tax Return

Using the DR 0100 involves several steps. First, businesses need to gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exempt sales. Next, fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy to avoid potential penalties. Once completed, the form can be submitted online or via mail, depending on the preference of the business.

Steps to complete the DR 0100 Colorado Retail Sales Tax Return

Completing the DR 0100 involves the following steps:

- Collect sales data for the reporting period.

- Determine the total taxable sales and any exemptions.

- Fill in the form with accurate figures.

- Review the completed form for errors.

- Submit the form by the deadline, either online or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the DR 0100 vary based on the frequency of sales tax reporting, which can be monthly, quarterly, or annually. Businesses must be aware of their specific filing schedule to ensure timely submission. Generally, the deadline for monthly filers is the 20th of the following month, while quarterly filers may have deadlines on the 20th of the month following the end of the quarter. Annual filers typically have a deadline of January 20 of the following year.

Required Documents

To complete the DR 0100, businesses should have the following documents on hand:

- Sales records for the reporting period.

- Invoices and receipts for taxable sales.

- Documentation for any exempt sales.

- Previous sales tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The DR 0100 can be submitted through various methods. Businesses have the option to file online through the Colorado Department of Revenue's website, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address provided by the department, or in some cases, submitted in person at local offices. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Handy tips for filling out DR 0100 Colorado Retail Sales Tax Return online

Quick steps to complete and e-sign DR 0100 Colorado Retail Sales Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a HIPAA and GDPR compliant service for maximum straightforwardness. Use signNow to e-sign and send DR 0100 Colorado Retail Sales Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct dr 0100 colorado retail sales tax return

Create this form in 5 minutes!

How to create an eSignature for the dr 0100 colorado retail sales tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for Colorado 2025 businesses?

airSlate SignNow provides a range of features tailored for Colorado 2025 businesses, including customizable templates, secure eSigning, and real-time tracking of document status. These tools streamline the signing process, making it efficient and user-friendly. Additionally, the platform supports various file formats, ensuring compatibility with your existing documents.

-

How does airSlate SignNow ensure document security for Colorado 2025 users?

For Colorado 2025 users, airSlate SignNow prioritizes document security through advanced encryption and compliance with industry standards. The platform employs secure servers and offers features like two-factor authentication to protect sensitive information. This commitment to security helps businesses confidently manage their documents.

-

What is the pricing structure for airSlate SignNow in Colorado 2025?

airSlate SignNow offers flexible pricing plans suitable for Colorado 2025 businesses, including monthly and annual subscriptions. Each plan is designed to accommodate different business sizes and needs, ensuring cost-effectiveness. You can choose a plan that best fits your budget while accessing all essential features.

-

Can airSlate SignNow integrate with other tools for Colorado 2025 companies?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms that Colorado 2025 companies may already be using. This includes popular CRM systems, cloud storage services, and productivity applications. These integrations enhance workflow efficiency and allow for a more streamlined document management process.

-

What are the benefits of using airSlate SignNow for Colorado 2025 businesses?

Using airSlate SignNow offers numerous benefits for Colorado 2025 businesses, such as increased efficiency, reduced turnaround times, and improved customer satisfaction. The platform simplifies the signing process, allowing teams to focus on core business activities. Additionally, it helps reduce paper usage, contributing to a more sustainable business model.

-

Is airSlate SignNow user-friendly for Colorado 2025 customers?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for Colorado 2025 customers to navigate the platform. The intuitive interface allows users to quickly create, send, and sign documents without extensive training. This ease of use is crucial for businesses looking to adopt eSigning solutions efficiently.

-

What support options are available for Colorado 2025 users of airSlate SignNow?

airSlate SignNow offers comprehensive support options for Colorado 2025 users, including live chat, email support, and an extensive knowledge base. This ensures that businesses can get assistance whenever they encounter issues or have questions. The dedicated support team is committed to helping users maximize their experience with the platform.

Get more for DR 0100 Colorado Retail Sales Tax Return

- Florence nightingale worksheets form

- Fluencycomprehensionsummary graph for seq levels 5 6 8 0 24 stories this graph for encore sequenced levels 5 68 0 includes form

- Set aside judgement hamilton county form

- Post exposure follow up form university of virginia virginia

- Altru release of information

- Boeingretirement changes com form

- Am i a protected veteran form

- Form i 131a application for carrier documentation

Find out other DR 0100 Colorado Retail Sales Tax Return

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney