Colorado Retail Sales Tax Return and DR 0100 2022

What is the Colorado Retail Sales Tax Return and DR 0100

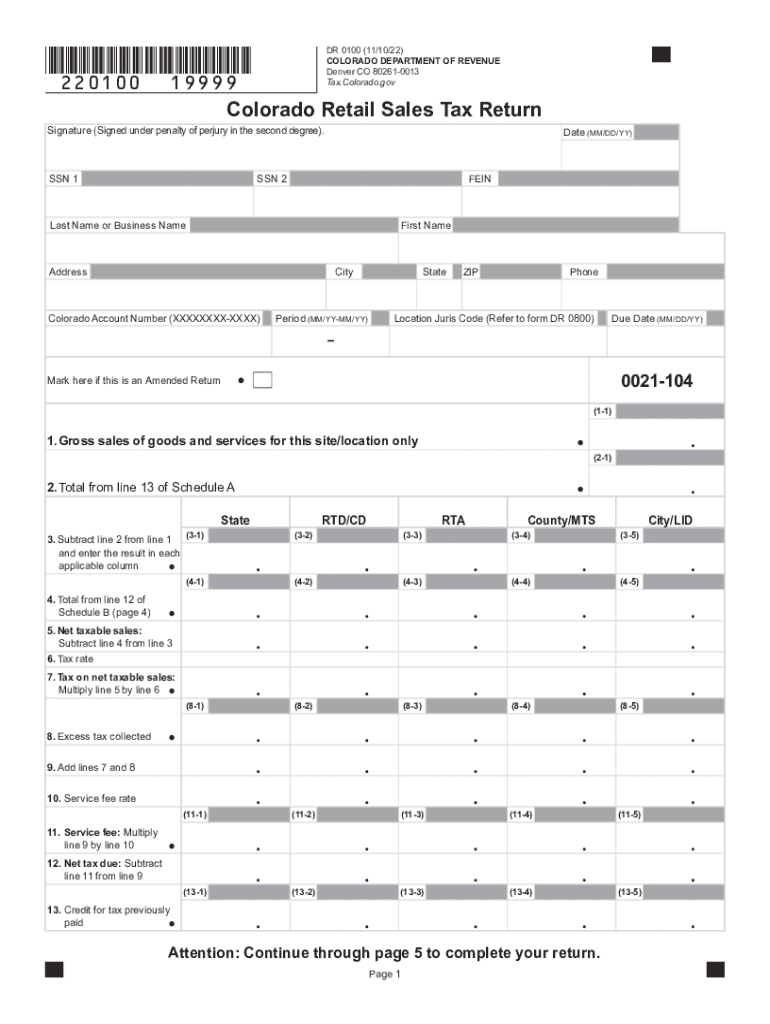

The Colorado Retail Sales Tax Return, commonly referred to as the DR 0100, is a crucial document for businesses operating within the state of Colorado. This form is used to report sales tax collected from customers and to remit the appropriate amount to the Colorado Department of Revenue. It encompasses various sales tax rates applicable to different regions and types of sales, ensuring compliance with state tax laws. Understanding the purpose of the DR 0100 is essential for maintaining accurate tax records and fulfilling legal obligations.

Steps to Complete the Colorado Retail Sales Tax Return and DR 0100

Completing the DR 0100 involves several key steps to ensure accuracy and compliance. Begin by gathering sales records for the reporting period, including total sales, taxable sales, and any exempt sales. Next, determine the appropriate sales tax rates based on your business location and the types of goods or services sold. Fill out the form by entering the required information, including total sales, tax collected, and any deductions. Finally, review the completed form for accuracy before submitting it to the Colorado Department of Revenue.

Legal Use of the Colorado Retail Sales Tax Return and DR 0100

The DR 0100 serves as a legally binding document when filed correctly. Compliance with state tax regulations is mandatory, and failure to submit the form accurately can result in penalties. The form must be signed and dated by an authorized representative of the business to validate its contents. Additionally, businesses should retain copies of the submitted forms and any supporting documentation for their records, as these may be requested during audits or reviews by tax authorities.

Filing Deadlines / Important Dates

Timely filing of the DR 0100 is essential to avoid late fees and penalties. The filing frequency may vary depending on the amount of sales tax collected, with options for monthly, quarterly, or annual submissions. Businesses should be aware of specific deadlines for each reporting period, which are typically outlined by the Colorado Department of Revenue. Keeping a calendar of these important dates can help ensure compliance and avoid unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The DR 0100 can be submitted through various methods to accommodate different business needs. Online submission is available through the Colorado Department of Revenue's website, providing a quick and efficient way to file. Alternatively, businesses may choose to mail the completed form to the appropriate address or deliver it in person at a local tax office. Each submission method has its own processing times, so businesses should plan accordingly to ensure timely filing.

Required Documents

When completing the DR 0100, certain documents may be required to support the information provided. These may include sales records, invoices, and any documentation related to exempt sales. It is important to have these documents readily available to ensure accurate reporting and compliance with state regulations. Maintaining organized records will facilitate the completion of the form and assist in any future audits or inquiries from tax authorities.

Quick guide on how to complete colorado retail sales tax return and dr 0100

Effortlessly prepare Colorado Retail Sales Tax Return And DR 0100 on any device

The management of documents online has gained traction among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Handle Colorado Retail Sales Tax Return And DR 0100 on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-dependent process today.

The simplest method to alter and electronically sign Colorado Retail Sales Tax Return And DR 0100 with ease

- Obtain Colorado Retail Sales Tax Return And DR 0100 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then press the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Colorado Retail Sales Tax Return And DR 0100 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado retail sales tax return and dr 0100

Create this form in 5 minutes!

How to create an eSignature for the colorado retail sales tax return and dr 0100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to colorado 2022?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents digitally. In the context of colorado 2022, it provides a secure and efficient way for businesses across Colorado to manage their document workflows, streamlining processes while maintaining compliance with state regulations.

-

How much does airSlate SignNow cost for users in colorado 2022?

The pricing for airSlate SignNow varies based on the plan you choose. For businesses in colorado 2022, our flexible pricing options ensure that you can find a solution that fits your budget while benefiting from enhanced document management and eSignature capabilities.

-

What features does airSlate SignNow offer that benefit businesses in colorado 2022?

airSlate SignNow offers a range of features such as customizable templates, advanced signing options, and real-time tracking. For companies in colorado 2022, these features facilitate quick, legally binding signatures while improving overall efficiency and collaboration in the workplace.

-

Are there any integrations available with airSlate SignNow for colorado 2022 users?

Yes, airSlate SignNow integrates seamlessly with numerous applications relevant for users in colorado 2022, such as Salesforce, Google Drive, and Microsoft Office. These integrations enable businesses to enhance their workflow and document management capabilities, making signing easier than ever.

-

What are the benefits of using airSlate SignNow for colorado 2022 businesses?

Using airSlate SignNow in colorado 2022 provides numerous benefits, including cost savings, time efficiency, and improved document security. Businesses can easily manage their paperwork, reduce turnaround times, and increase productivity by adopting our user-friendly eSignature solution.

-

Is airSlate SignNow compliant with Colorado regulations in 2022?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, including those unique to colorado 2022. Our platform ensures that digital signatures are legally binding, providing peace of mind for businesses operating within state compliance frameworks.

-

Can I try airSlate SignNow before committing in colorado 2022?

Yes, interested users in colorado 2022 can take advantage of a free trial period for airSlate SignNow. This allows you to explore the features and benefits of our platform without any financial commitment, helping you make an informed decision about your document signing needs.

Get more for Colorado Retail Sales Tax Return And DR 0100

- Dte dehumidifier rebate form

- Lost receipt affidavit emory finance emory university finance emory form

- Uta tax exempt form

- St4 form

- T1044 cch site builder form

- Pain clinic referral form the ottawa hospital

- Medical practice management service agreement template form

- Member interest sale agreement template form

Find out other Colorado Retail Sales Tax Return And DR 0100

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation