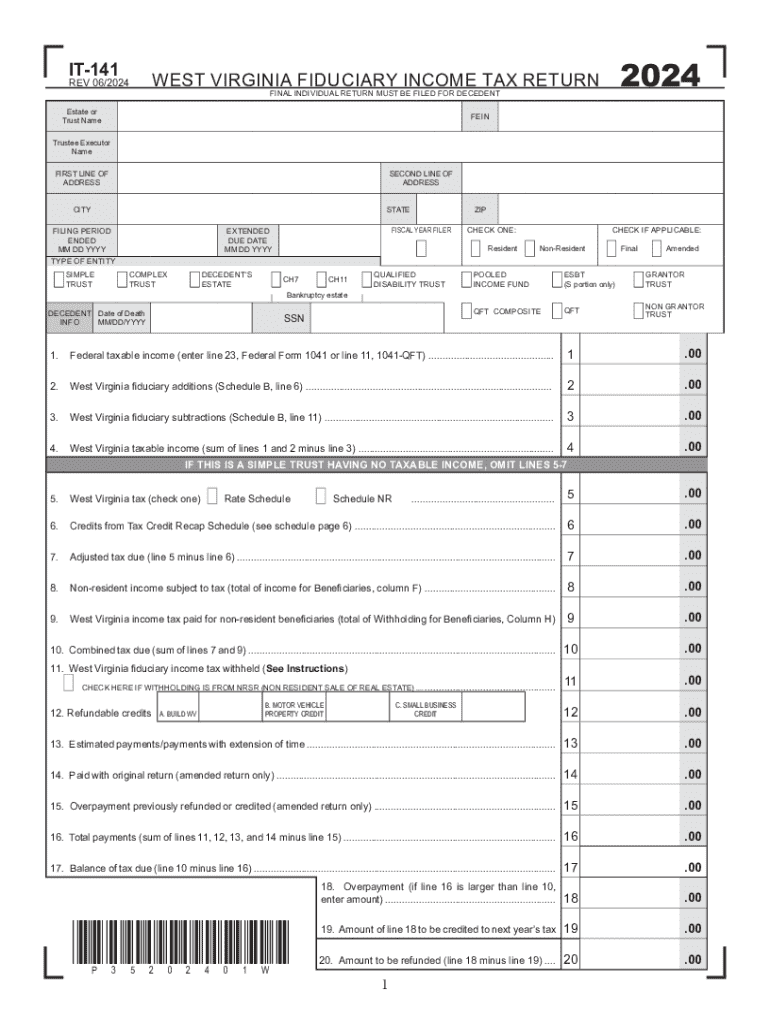

It 141 WEST VIRGINIA FIDUCIARY INCOME TAX RET Form

What is the IT 141 West Virginia Fiduciary Income Tax Return?

The IT 141 West Virginia Fiduciary Income Tax Return is a tax form used by fiduciaries to report income, deductions, and credits for estates and trusts in West Virginia. This form is essential for ensuring compliance with state tax laws and accurately reporting the financial activities of the estate or trust. Fiduciaries, including executors and trustees, are responsible for filing this return on behalf of the entities they manage.

Steps to Complete the IT 141 West Virginia Fiduciary Income Tax Return

Completing the IT 141 form involves several key steps:

- Gather necessary financial documents, including income statements, expense records, and prior tax returns.

- Fill out the form accurately, ensuring that all income and deductions are reported. This includes interest, dividends, and capital gains.

- Calculate the total tax liability based on the income reported.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the IT 141 West Virginia Fiduciary Income Tax Return

The IT 141 form can be obtained through the West Virginia State Tax Department's official website. It is available in PDF format for download, allowing fiduciaries to print and complete the form manually. Additionally, some tax preparation software may offer the option to fill out this form electronically, streamlining the process for users.

Filing Deadlines / Important Dates

Fiduciaries must be aware of the filing deadlines associated with the IT 141 form. Generally, the return is due on the fifteenth day of the fourth month following the close of the taxable year. For estates and trusts that operate on a calendar year, this typically means the form is due by April 15. It is crucial to adhere to these deadlines to avoid potential penalties.

Required Documents for the IT 141 Filing

To complete the IT 141 form, fiduciaries need to gather several documents, including:

- Income statements for the estate or trust.

- Records of all deductions and expenses incurred.

- Prior year tax returns, if applicable.

- Any supporting documentation for credits claimed.

Legal Use of the IT 141 West Virginia Fiduciary Income Tax Return

The IT 141 form is legally required for fiduciaries managing estates and trusts in West Virginia. Filing this return ensures compliance with state tax laws and helps avoid penalties for non-compliance. It is essential for fiduciaries to understand their legal obligations and the implications of failing to file accurately and on time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 141 west virginia fiduciary income tax ret

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wv it 141 and how does it relate to airSlate SignNow?

wv it 141 refers to a specific compliance requirement that businesses must adhere to when managing electronic signatures. airSlate SignNow is designed to meet these compliance standards, ensuring that your eSigning processes are secure and legally binding.

-

How much does airSlate SignNow cost for businesses needing wv it 141 compliance?

The pricing for airSlate SignNow varies based on the features and number of users. For businesses focused on wv it 141 compliance, we offer tailored plans that provide the necessary tools for secure document management at a competitive price.

-

What features does airSlate SignNow offer to support wv it 141 compliance?

airSlate SignNow includes features such as secure document storage, audit trails, and customizable workflows that are essential for wv it 141 compliance. These features help ensure that all electronic signatures are valid and traceable.

-

Can airSlate SignNow integrate with other software for wv it 141 compliance?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow while ensuring wv it 141 compliance. This allows businesses to streamline their processes and maintain compliance across different platforms.

-

What are the benefits of using airSlate SignNow for wv it 141 compliance?

Using airSlate SignNow for wv it 141 compliance provides businesses with a reliable and efficient way to manage electronic signatures. It reduces paperwork, speeds up the signing process, and ensures that all documents meet legal standards.

-

Is airSlate SignNow user-friendly for those needing wv it 141 compliance?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and utilize its features. This user-friendly interface is particularly beneficial for businesses needing to comply with wv it 141.

-

How does airSlate SignNow ensure the security of documents related to wv it 141?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect documents related to wv it 141. This ensures that sensitive information remains confidential and secure throughout the signing process.

Get more for IT 141 WEST VIRGINIA FIDUCIARY INCOME TAX RET

- Pptc 057 f suppl ment renseignements personnels documents support identit r f rences cic gc form

- Wafaqi mohtasib ombudsmans secretariat form a

- Wisconsin department of revenue pdffiller form

- How to fill the change of college form

- Prior authorization request uhccommunityplan com form

- Affidavit of domestic partner form centurylink benefits home

- Wine authorized representative certificate of approval form

- Welder continuity log pdf 416411360 form

Find out other IT 141 WEST VIRGINIA FIDUCIARY INCOME TAX RET

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document