Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

What is the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

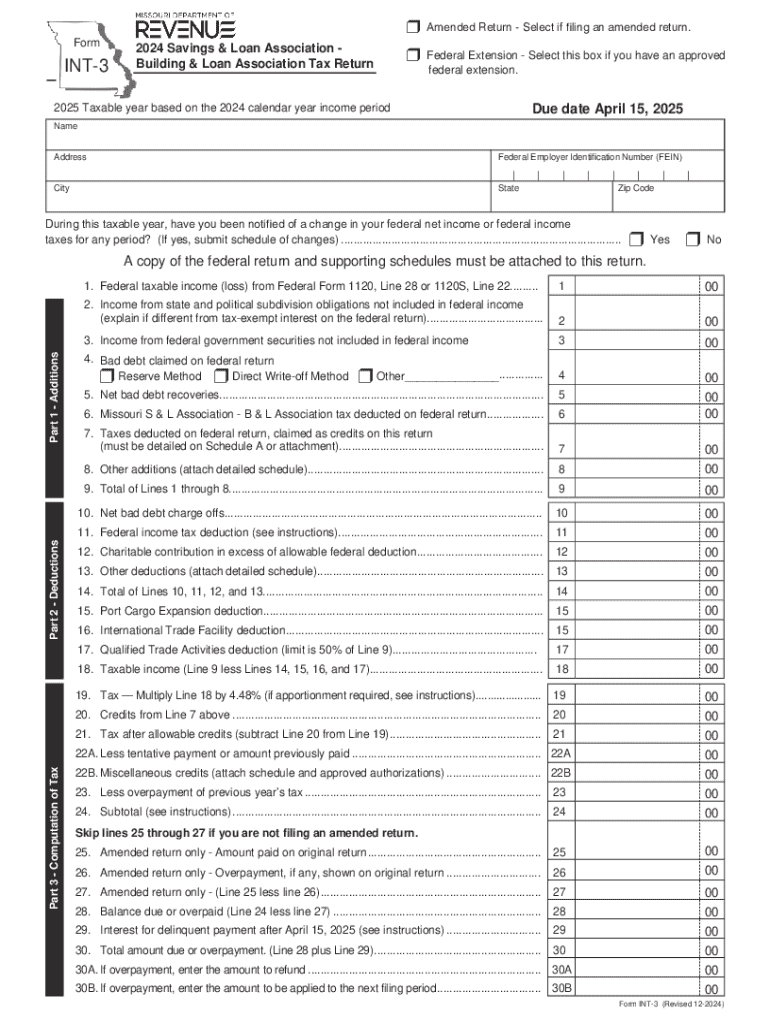

The Form INT 3 is a tax return specifically designed for Savings and Loan Associations and Building and Loan Associations in the United States. This form is used to report income, deductions, and credits related to the operations of these financial institutions. It is essential for compliance with federal tax regulations and helps ensure that these entities accurately report their financial activities to the Internal Revenue Service (IRS).

How to use the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

To use the Form INT 3, organizations must gather all necessary financial information, including income statements, balance sheets, and any applicable deductions or credits. The form is structured to guide users through the reporting process, requiring specific details about the association's financial activities. It is crucial to complete each section accurately to avoid potential penalties or issues with the IRS.

Steps to complete the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

Completing the Form INT 3 involves several key steps:

- Gather all relevant financial documents, including income statements and balance sheets.

- Fill out the identification section, including the association's name, address, and Employer Identification Number (EIN).

- Report all sources of income, including interest and dividends.

- Detail any deductions applicable to the association, such as operating expenses.

- Calculate the total taxable income and any credits that may apply.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important for Savings and Loan Associations and Building and Loan Associations to be aware of filing deadlines for the Form INT 3. Typically, the form must be submitted by the fifteenth day of the third month following the end of the association's tax year. For example, if the tax year ends on December thirty-first, the form would be due by March fifteenth of the following year. Extensions may be available, but they must be requested in advance.

Penalties for Non-Compliance

Failure to file the Form INT 3 on time or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, non-compliance can result in increased scrutiny from the IRS, leading to audits or further penalties. It is essential for associations to ensure timely and accurate filing to avoid these consequences.

Legal use of the Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

The Form INT 3 is legally required for Savings and Loan Associations and Building and Loan Associations to report their financial activities to the IRS. Proper use of this form ensures compliance with federal tax laws and helps maintain the integrity of the financial system. Associations must adhere to all guidelines set forth by the IRS when completing and submitting this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form int 3 savings loan association building loan association tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form INT 3 Savings & Loan Association Building & Loan Association Tax Return?

Form INT 3 is a tax return specifically designed for Savings and Loan Associations and Building and Loan Associations. It is used to report income, deductions, and other relevant financial information to the IRS. Understanding this form is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with Form INT 3 Savings & Loan Association Building & Loan Association Tax Return?

airSlate SignNow provides an efficient platform for preparing and eSigning Form INT 3. Our solution simplifies the document management process, allowing you to easily fill out, send, and sign your tax return electronically, ensuring a smooth filing experience.

-

What are the pricing options for using airSlate SignNow for Form INT 3?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to features that streamline the completion of Form INT 3 Savings & Loan Association Building & Loan Association Tax Return.

-

What features does airSlate SignNow offer for tax document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking. These tools are designed to enhance your workflow when handling Form INT 3 Savings & Loan Association Building & Loan Association Tax Return, making the process faster and more efficient.

-

Is airSlate SignNow compliant with tax regulations for Form INT 3?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your Form INT 3 Savings & Loan Association Building & Loan Association Tax Return is handled securely and in accordance with IRS guidelines. We prioritize data security and compliance to protect your sensitive information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software. This allows you to seamlessly manage your Form INT 3 Savings & Loan Association Building & Loan Association Tax Return alongside your other financial documents, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for my tax returns?

Using airSlate SignNow for your tax returns, including Form INT 3, provides numerous benefits such as time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring your tax documents are filed correctly and on time.

Get more for Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

- The law firm of kavesh minor otis inc form

- Car show judging form

- 8175000800 form

- Service animal and partner registration form university of georgia drc uga

- Bott 2013 form lbc

- Payment reimbursement form severna park boosters severnaparkboosters wildapricot

- Enander family foundation grant application nocofoundation form

- Driving abstract form

Find out other Form INT 3 Savings & Loan Association Building & Loan Association Tax Return

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT