Form it 2104 SNY Certificate of Exemption from Withholding for START UP NY Program Tax Year 2025-2026

What is the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

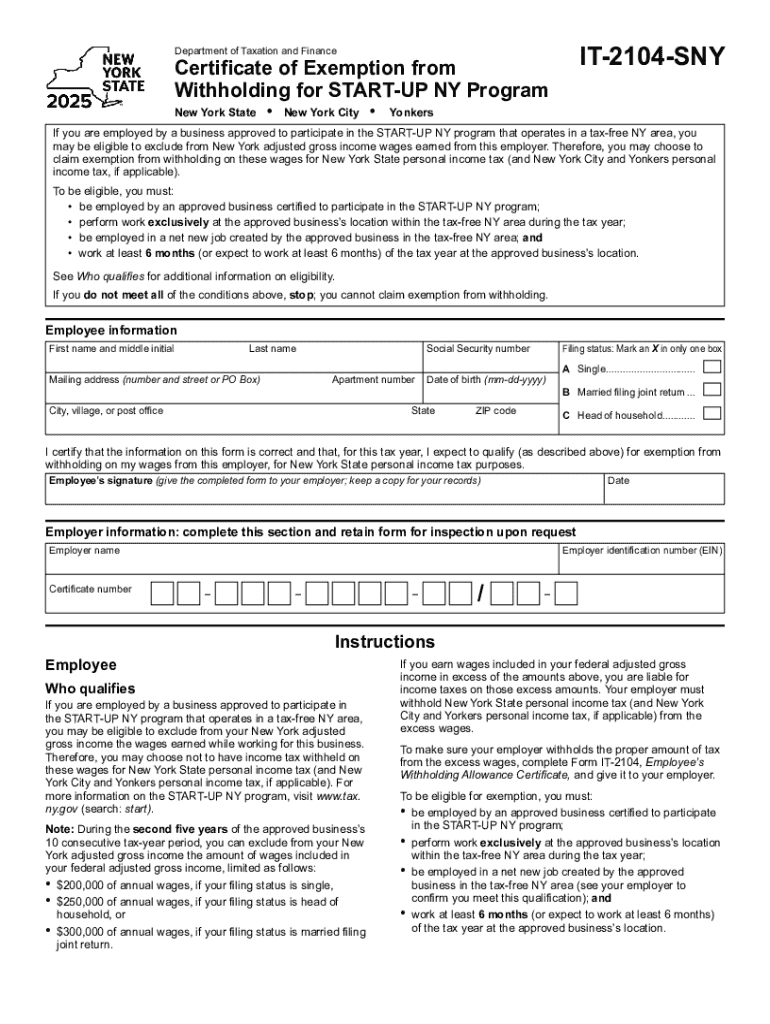

The Form IT 2104 SNY is a Certificate of Exemption from Withholding specifically designed for participants in the START-UP NY program in New York. This form allows eligible businesses to claim an exemption from state income tax withholding for employees who are part of the program. The START-UP NY initiative aims to stimulate economic growth by providing tax benefits to new businesses and startups that operate in designated areas within the state. By completing this form, businesses can ensure that they are not subject to withholding taxes, thereby enhancing their cash flow and supporting their growth potential.

How to use the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

Using the Form IT 2104 SNY is straightforward. First, ensure that your business qualifies under the START-UP NY program guidelines. Once eligibility is confirmed, complete the form by providing the necessary information, including your business details and the specific employees who will benefit from the exemption. After filling out the form, submit it to your payroll department or the appropriate tax authority as required. It is essential to keep a copy for your records and to ensure compliance with any future audits or inquiries related to tax withholding.

Steps to complete the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

Completing the Form IT 2104 SNY involves several key steps:

- Gather necessary information about your business and the employees involved.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your payroll department or relevant tax authority.

- Retain a copy of the submitted form for your records.

Eligibility Criteria

To qualify for the exemption using Form IT 2104 SNY, businesses must meet specific eligibility criteria set forth by the START-UP NY program. Generally, businesses must be newly established or relocating to a designated area in New York. Additionally, the business must create new jobs and contribute to the local economy. Employees must also meet certain qualifications, including residency and employment status. It is advisable to review the latest guidelines from the New York State Department of Taxation and Finance to ensure compliance with all eligibility requirements.

Required Documents

When applying for the exemption using Form IT 2104 SNY, certain documents may be required to support your application. These can include:

- Proof of business registration in New York.

- Documentation demonstrating eligibility for the START-UP NY program.

- Employee information, including names and Social Security numbers.

- Any additional forms or documentation specified by the New York State Department of Taxation and Finance.

Legal use of the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

The legal use of the Form IT 2104 SNY is governed by New York State tax laws and regulations. Businesses must ensure that they are using the form in accordance with the rules established for the START-UP NY program. Misuse or incorrect submission of the form can lead to penalties or disqualification from the program. It is crucial to stay informed about any updates to the law that may affect the use of this form and to consult with a tax professional if there are any uncertainties regarding compliance.

Create this form in 5 minutes or less

Find and fill out the correct form it 2104 sny certificate of exemption from withholding for start up ny program tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 2104 sny certificate of exemption from withholding for start up ny program tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ny it 2104sny and how does it work?

The ny it 2104sny is a powerful tool designed to streamline document signing and management. It allows users to send, sign, and store documents electronically, ensuring a seamless workflow. With its user-friendly interface, businesses can easily adopt the ny it 2104sny for their document needs.

-

How much does the ny it 2104sny cost?

Pricing for the ny it 2104sny varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes. You can find detailed pricing information on our website to determine the best fit for your needs.

-

What features are included with the ny it 2104sny?

The ny it 2104sny includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. Additionally, it supports multiple file formats and integrates with popular applications, enhancing your document management experience. These features make the ny it 2104sny a comprehensive solution for businesses.

-

What are the benefits of using the ny it 2104sny?

Using the ny it 2104sny offers numerous benefits, including increased efficiency and reduced turnaround time for document signing. It also enhances security by providing encrypted storage and compliance with legal standards. Overall, the ny it 2104sny helps businesses save time and resources.

-

Can the ny it 2104sny integrate with other software?

Yes, the ny it 2104sny can seamlessly integrate with various software applications, including CRM systems and cloud storage services. This integration allows for a more streamlined workflow and enhances productivity. You can easily connect the ny it 2104sny with your existing tools.

-

Is the ny it 2104sny suitable for small businesses?

Absolutely! The ny it 2104sny is designed to cater to businesses of all sizes, including small businesses. Its cost-effective pricing and user-friendly features make it an ideal choice for small teams looking to improve their document management processes.

-

How secure is the ny it 2104sny?

The ny it 2104sny prioritizes security with advanced encryption and compliance with industry standards. Your documents are stored securely in the cloud, ensuring that sensitive information is protected. Trust the ny it 2104sny for your document signing needs without compromising security.

Get more for Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

- The ucc connection free yourself from legal tyranny form

- Hazmat tactical worksheet springdalear form

- Champva form 10 0426 2016 2019

- Address change request form nasb

- Printed circuit board worksheet imagesfedexcom form

- Page 1 of 5 concept bspecialb brisksb ltd wwwbspecialb brisksbbcob form

- Sample resident bed bug reporting form extension entm purdue

- Registered name of dog asca form

Find out other Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure