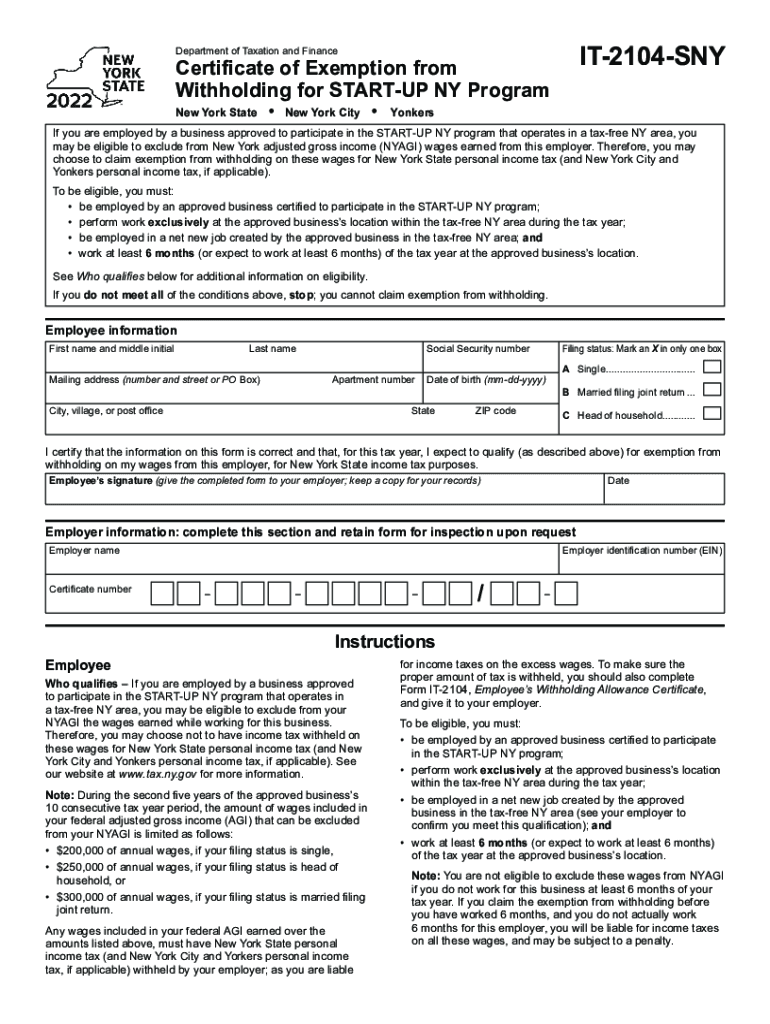

Form it 2104 SNY Certificate of Exemption from Withholding for START UP NY Program Tax Year 2022

What is the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

The Form IT 2104 SNY serves as a Certificate of Exemption from Withholding for individuals participating in the START UP NY program. This program is designed to encourage business growth and job creation in New York State by providing tax benefits to eligible businesses. By completing this form, participants can claim an exemption from state income tax withholding, which can significantly enhance cash flow for new businesses. It is essential for applicants to understand the specific criteria and requirements associated with this form to ensure compliance and maximize benefits.

Steps to complete the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

Completing the Form IT 2104 SNY involves several key steps:

- Gather Required Information: Collect necessary personal and business details, including your name, address, and tax identification number.

- Review Eligibility Criteria: Ensure that your business meets the requirements for the START UP NY program, as this will determine your eligibility for the exemption.

- Fill Out the Form: Accurately complete all sections of the form, paying close attention to any instructions provided.

- Sign and Date: Ensure that you sign and date the form to validate your submission.

- Submit the Form: Follow the appropriate submission methods, whether online or by mail, to ensure timely processing.

Legal use of the Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

Utilizing the Form IT 2104 SNY legally requires adherence to specific guidelines set forth by the New York State Department of Taxation and Finance. This form is intended for use exclusively by eligible businesses under the START UP NY program. Misuse of the form or providing false information can lead to penalties, including back taxes owed and interest. Therefore, it is crucial to maintain accurate records and ensure that the information provided is truthful and complete.

Eligibility Criteria

To qualify for the exemption outlined in the Form IT 2104 SNY, businesses must meet certain eligibility criteria, including:

- Being a qualified business under the START UP NY program.

- Operating within designated tax-free zones in New York State.

- Complying with all program requirements, including job creation and investment commitments.

It is advisable for applicants to review the full eligibility guidelines provided by the New York State Department of Taxation and Finance to confirm their status before submitting the form.

Form Submission Methods (Online / Mail / In-Person)

The Form IT 2104 SNY can be submitted through various methods to accommodate different preferences:

- Online Submission: Many applicants prefer to submit the form electronically through the New York State Department of Taxation and Finance website, ensuring faster processing.

- Mail Submission: Alternatively, the completed form can be mailed to the appropriate tax office. Ensure that you use the correct address to avoid delays.

- In-Person Submission: For those who prefer face-to-face interaction, visiting a local tax office is an option, allowing for immediate assistance and confirmation of submission.

Quick guide on how to complete form it 2104 sny certificate of exemption from withholding for start up ny program tax year 2022

Complete Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents promptly without delays. Manage Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to edit and eSign Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year without hassle

- Locate Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes necessitating the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2104 sny certificate of exemption from withholding for start up ny program tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 2104 sny certificate of exemption from withholding for start up ny program tax year 2022

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is 2104 sny and how does it benefit my business?

2104 sny is an innovative solution provided by airSlate SignNow that allows businesses to efficiently send and eSign documents. This feature streamlines your document management process, reducing time spent on paperwork and enhancing productivity. With 2104 sny, you can ensure that all signatures are captured legally and securely.

-

How much does the 2104 sny feature cost?

The 2104 sny feature is part of airSlate SignNow's range of flexible pricing plans. Depending on your team's size and required functionalities, plans can vary, ensuring a cost-effective solution for every business. For detailed pricing information, visit our pricing page or contact our sales team for a personalized quote.

-

What features are included with the 2104 sny solution?

2104 sny includes essential features such as document templates, real-time notifications, and comprehensive reporting. Additionally, it provides a user-friendly interface for easy navigation and handling of documents. These features are designed to optimize your workflow and improve collaboration among team members.

-

Can I integrate 2104 sny with other software applications?

Yes, 2104 sny can be easily integrated with a variety of software applications including CRMs, project management tools, and cloud storage services. This flexibility allows you to enhance your business processes and maintain a seamless workflow. Integration is straightforward and requires no extensive technical expertise.

-

Is 2104 sny secure for handling sensitive documents?

Absolutely! 2104 sny prioritizes security with features like encryption and secure data storage, ensuring that sensitive documents are handled with the utmost care. Your information is protected against unauthorized access, allowing you to eSign documents with confidence.

-

What are the advantages of using airSlate SignNow's 2104 sny over traditional methods?

Using 2104 sny provides signNow advantages over traditional methods, including faster turnaround times and reduced paper waste. The ease of eSigning and tracking documents digitally enhances overall efficiency and reduces administrative burdens. Your team can focus more on core business tasks rather than getting bogged down by paperwork.

-

How can 2104 sny help improve my team's collaboration?

2104 sny simplifies collaboration by allowing team members to eSign and share documents in real time, regardless of their location. This instant access to documents enhances communication and teamwork. Leveraging 2104 sny can lead to quicker decision-making and more agile project management.

Get more for Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

- Louisiana divorce 497308781 form

- Act of donation real estate from parents to children louisiana form

- Act of donation real estate from one individual to one individual louisiana form

- Louisiana act donation form

- Louisiana husband wife 497308785 form

- Act donation form

- Louisiana husband form

- Act of donation real estate from husband and wife to husband and wife louisiana form

Find out other Form IT 2104 SNY Certificate Of Exemption From Withholding For START UP NY Program Tax Year

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History