Department of Taxation and Finance Instructions for Form Department of Taxation and Finance Instructions for Form Allocation of 2021

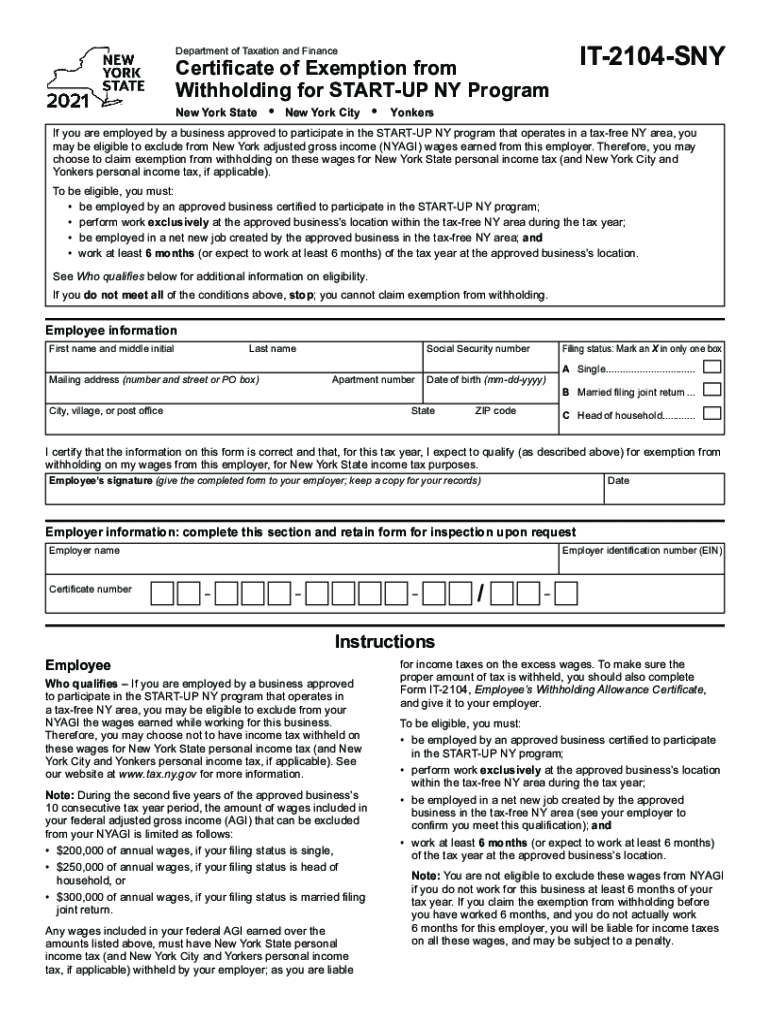

Understanding the 2104 SNY Form

The 2104 SNY form, also known as the Allocation of Withholding Tax, is a crucial document used by individuals and businesses in New York for tax purposes. This form allows taxpayers to allocate their withholding tax correctly, ensuring compliance with state tax regulations. Understanding the specific requirements and instructions for this form is essential for accurate tax reporting and to avoid potential penalties.

Steps to Complete the 2104 SNY Form

Completing the 2104 SNY form involves several key steps:

- Gather Required Information: Collect all necessary personal and financial information, including your Social Security number, income details, and any prior withholding amounts.

- Fill Out the Form: Carefully enter the required information in the designated fields. Ensure accuracy to prevent delays or issues with your tax filing.

- Review Your Entries: Double-check all information for accuracy and completeness. Mistakes can lead to complications with your tax obligations.

- Submit the Form: Follow the submission guidelines, whether filing online, by mail, or in person, to ensure your form is processed correctly.

Legal Use of the 2104 SNY Form

The 2104 SNY form is legally recognized for tax purposes in New York. It serves as an official document that outlines your withholding tax allocation, making it essential for compliance with state tax laws. Proper use of this form can help avoid legal issues and ensure that your tax obligations are met accurately and timely.

Key Elements of the 2104 SNY Form

When filling out the 2104 SNY form, several key elements must be included:

- Taxpayer Identification: Your name, address, and Social Security number.

- Income Information: Details regarding your income sources and amounts withheld.

- Allocation Percentages: Specify how you wish to allocate your withholding tax among various income sources.

- Signature: Your signature is required to validate the form and confirm the accuracy of the information provided.

Filing Deadlines for the 2104 SNY Form

It is important to be aware of the filing deadlines associated with the 2104 SNY form. Typically, this form must be submitted by the end of the tax year to ensure proper allocation of withholding tax for that year. Missing the deadline can result in penalties and complications with your tax filings.

Examples of Using the 2104 SNY Form

The 2104 SNY form can be used in various scenarios, including:

- Individuals who receive income from multiple sources and need to allocate their withholding tax accordingly.

- Businesses that must report withholding tax for employees working in different jurisdictions within New York.

- Taxpayers who have had changes in their income or withholding amounts during the tax year.

Quick guide on how to complete department of taxation and finance instructions for form department of taxation and finance instructions for form allocation of

Prepare Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of with ease

- Find Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, text message (SMS), or invite link, or download it to your computer.

Forget worries about lost or misplaced files, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and electronically sign Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of and ensure superior communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance instructions for form department of taxation and finance instructions for form allocation of

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance instructions for form department of taxation and finance instructions for form allocation of

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the 2104 sny and how does it work?

The 2104 sny is a document signing and management tool that enables businesses to send and eSign documents efficiently. With airSlate SignNow, users can create, customize, and automate their document workflows, making the signing process quicker and more streamlined.

-

How much does airSlate SignNow's 2104 sny cost?

Pricing for the 2104 sny varies depending on the features and the number of users. airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, ensuring that you get the best value for your budget when managing document signatures.

-

What features are included in the 2104 sny?

The 2104 sny includes a variety of features such as customizable templates, advanced document tracking, and real-time notifications. These features ensure that businesses can manage their documents effectively while enhancing collaboration and security.

-

Can I integrate the 2104 sny with my current tools?

Yes, the 2104 sny can integrate seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This flexibility allows businesses to streamline their workflows and enhance productivity without having to switch between different platforms.

-

What are the benefits of using the 2104 sny?

Using the 2104 sny offers numerous benefits, including faster turnaround times on documents, reduced paper usage, and enhanced compliance with eSignature laws. Businesses can also enjoy increased productivity and better organization through efficient document management.

-

Is the 2104 sny secure for document signing?

Absolutely. The 2104 sny ensures that all documents signed through airSlate SignNow are encrypted and comply with industry standards for security. This commitment to data protection gives businesses peace of mind when handling sensitive information.

-

How can I get started with the 2104 sny?

Getting started with the 2104 sny is simple. You can visit the airSlate SignNow website, sign up for a free trial, and explore the various features and functionalities available to you. This trial will help you assess how the tool meets your document signing needs.

Get more for Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of

Find out other Department Of Taxation And Finance Instructions For Form Department Of Taxation And Finance Instructions For Form Allocation Of

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later