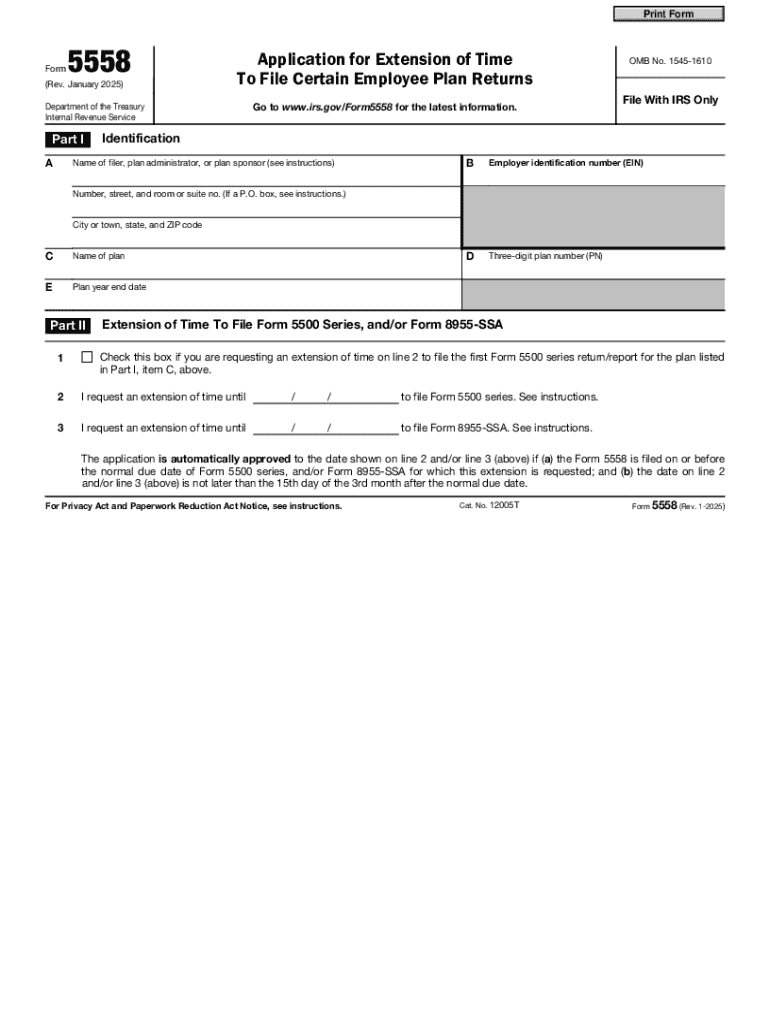

Form 5558 Rev January

What is the IRS 5500 Form?

The IRS 5500 form is an annual report that employee benefit plans must file to comply with the Employee Retirement Income Security Act (ERISA). This form provides the federal government with information about the plan's financial condition, investments, and operations. It is essential for ensuring that plans operate fairly and transparently. The IRS 5500 form is typically required for pension plans, health and welfare plans, and other employee benefit plans covering more than one participant.

Filing Deadlines / Important Dates

Filing the IRS 5500 form must be done annually, and the deadline is generally the last day of the seventh month after the plan year ends. For plans that follow a calendar year, this means the form is due by July 31. If an extension is needed, plan sponsors can file Form 5558 to request an additional two and a half months. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with federal regulations.

Steps to Complete the IRS 5500 Form

Completing the IRS 5500 form involves several key steps:

- Gather necessary information about the plan, including financial statements, participant data, and investment information.

- Determine which version of the form is applicable, as there are different forms for various types of plans, such as the standard IRS 5500 and the short form IRS 5500-SF.

- Fill out the required sections accurately, ensuring all data is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically through the EFAST2 system or via mail, depending on the filing method chosen.

Penalties for Non-Compliance

Failing to file the IRS 5500 form on time can result in significant penalties. The Department of Labor may impose a fine of up to $2,259 per day for late filings. Additionally, plans that do not file may face increased scrutiny from regulators, which can lead to further legal complications. It is important for plan sponsors to stay informed about their filing obligations to avoid these penalties.

Key Elements of the IRS 5500 Form

The IRS 5500 form consists of several key components that must be completed:

- Basic plan information, including the plan name, sponsor, and identification numbers.

- Financial information, detailing assets, liabilities, and income.

- Information on plan participants, including the number of active participants and beneficiaries.

- Compliance questions related to plan operations and adherence to regulations.

Each section must be filled out accurately to ensure compliance and provide a clear picture of the plan's status.

Form Submission Methods

The IRS 5500 form can be submitted in two primary ways: electronically or by mail. Electronic filing is encouraged and is done through the EFAST2 system, which offers a streamlined process for submitting the form. For those who prefer to file by mail, the completed form must be sent to the appropriate address as specified in the IRS instructions. Ensuring that the submission method aligns with IRS requirements is essential for compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5558 rev january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 5500 form and why is it important?

The IRS 5500 form is a crucial document that employee benefit plans must file annually to report financial information. It helps the IRS and the Department of Labor monitor compliance with the Employee Retirement Income Security Act (ERISA). Understanding the IRS 5500 form is essential for businesses to ensure they meet regulatory requirements.

-

How can airSlate SignNow help with the IRS 5500 form?

airSlate SignNow streamlines the process of preparing and submitting the IRS 5500 form by allowing users to eSign documents securely and efficiently. Our platform simplifies document management, ensuring that all necessary signatures are collected promptly. This helps businesses save time and reduce errors in their filings.

-

What features does airSlate SignNow offer for managing the IRS 5500 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the IRS 5500 form. These tools enable users to create, send, and monitor their forms easily. Additionally, our platform ensures compliance with legal standards, making the filing process smoother.

-

Is airSlate SignNow cost-effective for filing the IRS 5500 form?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to file the IRS 5500 form. Our pricing plans are designed to accommodate various business sizes and needs, ensuring that you get the best value for your investment. By reducing paperwork and streamlining the signing process, you can save both time and money.

-

Can I integrate airSlate SignNow with other software for IRS 5500 form management?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the IRS 5500 form. Whether you use accounting software or HR management tools, our platform can connect with them to streamline your workflow. This integration capability helps ensure that all relevant data is easily accessible.

-

What are the benefits of using airSlate SignNow for the IRS 5500 form?

Using airSlate SignNow for the IRS 5500 form provides numerous benefits, including enhanced security, improved efficiency, and reduced paperwork. Our eSigning solution ensures that your documents are signed quickly and securely, minimizing delays in the filing process. Additionally, our user-friendly interface makes it easy for anyone to navigate and complete their forms.

-

How does airSlate SignNow ensure the security of the IRS 5500 form?

airSlate SignNow prioritizes the security of your documents, including the IRS 5500 form, by employing advanced encryption and secure storage solutions. Our platform complies with industry standards to protect sensitive information during the signing process. You can trust that your data is safe and secure with airSlate SignNow.

Get more for Form 5558 Rev January

Find out other Form 5558 Rev January

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT