FORM 1041ME INCOME TAX RETURN *1609100* Sign Return on Maine 2016

What is the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

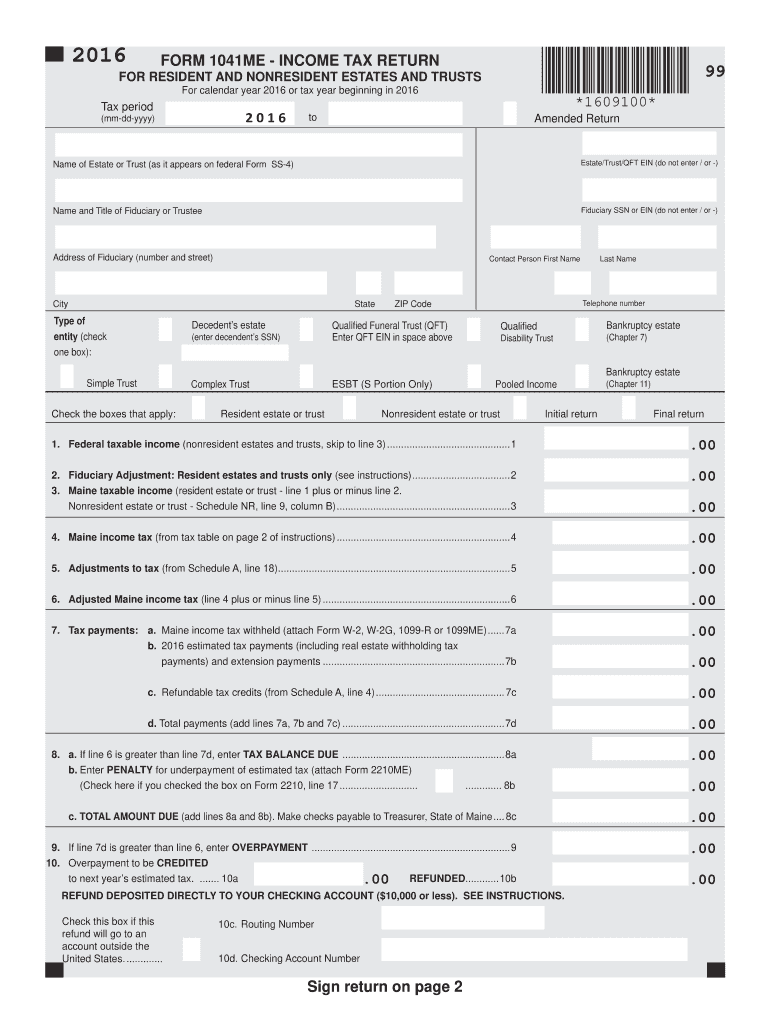

The FORM 1041ME INCOME TAX RETURN *1609100* is a specific tax return form used by estates and trusts in Maine to report income, deductions, and tax liability. This form is essential for fiduciaries responsible for managing the financial affairs of an estate or trust. It ensures compliance with state tax laws and provides the necessary information for the Maine Revenue Services to assess tax obligations accurately. Understanding the purpose and requirements of this form is crucial for proper tax management and compliance.

Steps to complete the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

Completing the FORM 1041ME involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements, expense receipts, and prior tax returns. Next, fill out the form by entering the required information, such as the estate or trust's income, deductions, and tax credits. After completing the form, review it for any errors or omissions. Finally, sign the return electronically or in print, depending on your submission method. Each step is vital to ensure the return is filed correctly and on time.

How to use the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

Using the FORM 1041ME for e-signing involves a straightforward process. Begin by accessing the digital version of the form through a trusted e-signature platform. Fill out the necessary fields with accurate information. Once completed, utilize the e-signature feature to sign the document securely. This method not only streamlines the filing process but also ensures that the signed document is legally binding and compliant with state regulations. Digital signing enhances efficiency and provides a clear audit trail for record-keeping.

Legal use of the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

The legal use of the FORM 1041ME is governed by specific regulations that ensure its validity. To be legally binding, the form must be signed by the authorized fiduciary, and the information provided must be accurate and complete. Electronic signatures are recognized under federal and state law, provided they comply with the ESIGN Act and UETA. This legal framework supports the use of e-signatures, making it a secure and efficient way to submit tax returns. Understanding these legal requirements is essential for ensuring the form's acceptance by tax authorities.

State-specific rules for the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

Maine has specific regulations and requirements for filing the FORM 1041ME. These include deadlines for submission, specific deductions allowed, and any additional schedules that may need to be attached. It is important for filers to familiarize themselves with Maine's tax laws to ensure compliance. Additionally, staying updated on any changes to state tax regulations can help prevent errors and potential penalties. Consulting the Maine Revenue Services website or a tax professional can provide valuable guidance on these state-specific rules.

Filing Deadlines / Important Dates

Filing deadlines for the FORM 1041ME are crucial for compliance and avoiding penalties. Generally, the return is due on the fifteenth day of the fourth month following the close of the estate or trust's tax year. For estates and trusts operating on a calendar year, this typically means the deadline falls on April 15. It is important to mark these dates on your calendar and allow ample time for preparation and submission. Late filings may result in penalties and interest on any taxes owed, making timely submission essential.

Quick guide on how to complete form 1041me income tax return 1609100 sign return on maine

Easily Prepare FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine on Any Device

Managing documents online has gained popularity among companies and individuals alike. It presents an ideal environmentally friendly substitute for conventional printed and signed materials, as you can obtain the appropriate template and safely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Handle FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine on any device via airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

Effortlessly Edit and eSign FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

- Find FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine and click Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1041me income tax return 1609100 sign return on maine

Create this form in 5 minutes!

How to create an eSignature for the form 1041me income tax return 1609100 sign return on maine

How to create an electronic signature for the Form 1041me Income Tax Return 1609100 Sign Return On Maine online

How to make an eSignature for the Form 1041me Income Tax Return 1609100 Sign Return On Maine in Google Chrome

How to generate an eSignature for putting it on the Form 1041me Income Tax Return 1609100 Sign Return On Maine in Gmail

How to generate an electronic signature for the Form 1041me Income Tax Return 1609100 Sign Return On Maine right from your mobile device

How to generate an electronic signature for the Form 1041me Income Tax Return 1609100 Sign Return On Maine on iOS

How to generate an eSignature for the Form 1041me Income Tax Return 1609100 Sign Return On Maine on Android OS

People also ask

-

What is the process to eSign the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

To eSign the FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine, simply upload your document to airSlate SignNow, add the necessary signature fields, and invite the signer. The platform provides a streamlined process for completion, ensuring your tax documents are signed efficiently and securely.

-

Are there any costs associated with eSigning FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While you can sign basic documents for free, accessing advanced features for FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine may require a subscription. Check our pricing page for detailed information.

-

What features does airSlate SignNow offer for handling FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

airSlate SignNow offers a variety of features for managing your FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine. These include customizable templates, multiple signature options, real-time tracking, and a user-friendly interface that enhances the signing experience for all parties involved.

-

Is airSlate SignNow compliant with regulations for signing FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

Absolutely! airSlate SignNow is compliant with strict regulations, ensuring that your FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine adheres to all necessary legal standards. Our platform employs advanced security measures to protect your sensitive information throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for my FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

Yes, airSlate SignNow supports various integrations with popular business applications, allowing you to streamline your workflow. You can integrate with tools like Google Drive, Dropbox, and more, facilitating easy access to documents required for your FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine.

-

How can airSlate SignNow benefit my business when handling FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

By using airSlate SignNow, your business can simplify the process of signing FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine, saving time and resources. The platform increases efficiency, reduces paperwork, and enhances collaboration among team members, helping you meet your tax obligations effortlessly.

-

Is there customer support available for issues related to FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine?

Yes, airSlate SignNow offers customer support to assist you with any challenges related to your FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine. Our knowledgeable support team is available through chat, email, and phone to ensure you receive timely assistance and resolve any questions you may have.

Get more for FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

- Westshore enforcement bureau swat operations ctapbrasil form

- Ruta quetzal bbva 2013 form

- Drop ball test form

- Modelo de formulario para autorizacao de viagem des ingles

- Cartrack subscriber application form

- Form mod 21 rfi

- Mod 24 rfi portal das finan as form

- Completed filled in certificate of origin form

Find out other FORM 1041ME INCOME TAX RETURN *1609100* Sign Return On Maine

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form