Form 941p Me 2017

What is the Form 941p Me

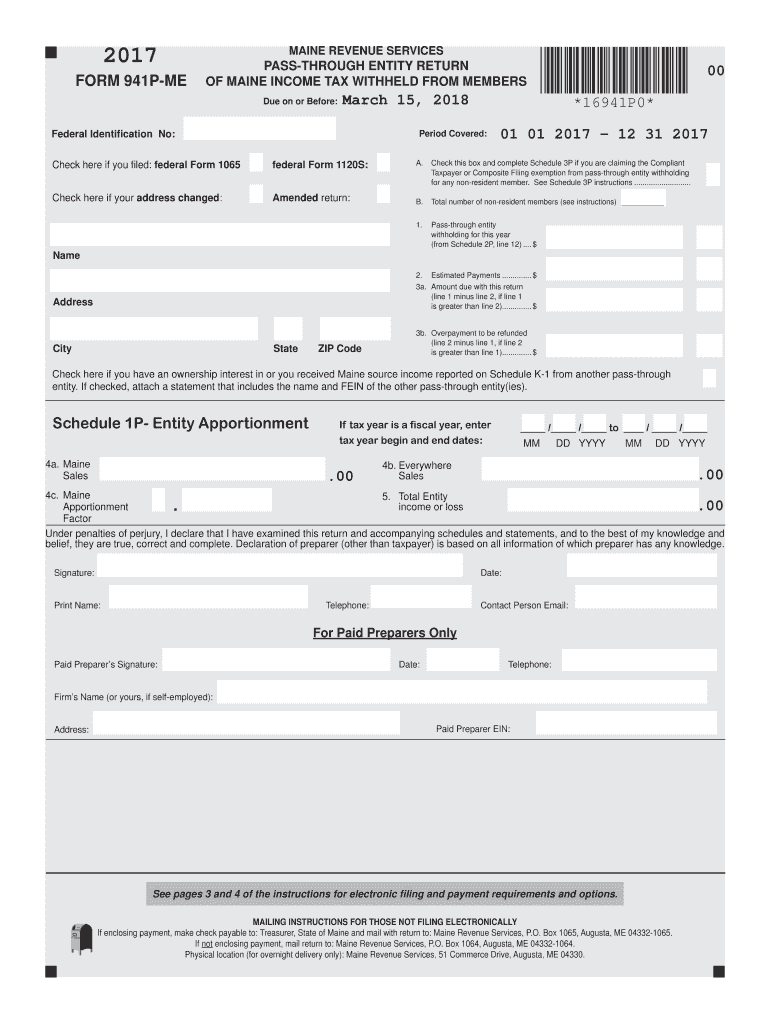

The Form 941p Me is a specific tax form used by employers in the United States to report payroll taxes, including income tax withheld and Social Security and Medicare taxes. This form is essential for businesses to ensure compliance with federal tax regulations. It provides the Internal Revenue Service (IRS) with detailed information about the wages paid to employees and the taxes withheld from those wages. Understanding the purpose and requirements of this form is crucial for maintaining accurate financial records and fulfilling tax obligations.

How to use the Form 941p Me

Using the Form 941p Me involves several steps to ensure accurate completion and submission. First, gather all necessary information, such as employee wages, tax withheld, and any adjustments for the reporting period. Next, fill out the form by entering the required data in the designated fields. It is important to double-check all entries for accuracy to avoid penalties. Once completed, the form can be submitted electronically or by mail, depending on the preferred method of filing. Utilizing a reliable eSignature solution can streamline this process, ensuring timely and secure submission.

Steps to complete the Form 941p Me

Completing the Form 941p Me requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant payroll records for the reporting period.

- Enter the total number of employees and their wages in the appropriate sections.

- Calculate the total taxes withheld for income tax, Social Security, and Medicare.

- Include any adjustments or credits that apply to your business.

- Review the form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the Form 941p Me

The legal use of the Form 941p Me is governed by IRS regulations, which stipulate that employers must accurately report payroll taxes to avoid penalties and interest. The form must be completed truthfully, reflecting all wages paid and taxes withheld. Failure to comply with these regulations can result in significant financial consequences for businesses. Additionally, using a secure platform for eSignature can help ensure that the form is legally binding and compliant with federal eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 941p Me are crucial for compliance. Employers are generally required to file this form quarterly. The deadlines for each quarter are as follows:

- First quarter (January to March): April 30

- Second quarter (April to June): July 31

- Third quarter (July to September): October 31

- Fourth quarter (October to December): January 31 of the following year

It is essential to adhere to these deadlines to avoid potential penalties and ensure timely processing of tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The Form 941p Me can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online: Employers can file the form electronically through the IRS e-file system, which offers a secure and efficient way to submit tax documents.

- Mail: The form can be printed and mailed to the appropriate IRS address, based on the business location and whether a payment is included.

- In-Person: While less common, some employers may choose to deliver the form in person at designated IRS offices.

Choosing the right submission method can enhance the efficiency of the filing process and ensure compliance with IRS requirements.

Quick guide on how to complete form 941p me 2017

Accomplish Form 941p Me seamlessly on any device

Web-based document administration has gained traction among companies and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can locate the suitable form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and eSign your documents swiftly without any holdups. Manage Form 941p Me on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Form 941p Me with ease

- Locate Form 941p Me and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that function.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Form 941p Me and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941p me 2017

Create this form in 5 minutes!

How to create an eSignature for the form 941p me 2017

How to generate an eSignature for the Form 941p Me 2017 online

How to make an eSignature for your Form 941p Me 2017 in Google Chrome

How to create an eSignature for putting it on the Form 941p Me 2017 in Gmail

How to generate an eSignature for the Form 941p Me 2017 right from your smartphone

How to create an eSignature for the Form 941p Me 2017 on iOS

How to create an eSignature for the Form 941p Me 2017 on Android

People also ask

-

What is Form 941p Me and how can it benefit my business?

Form 941p Me is a valuable tool for businesses to efficiently manage and submit their payroll taxes. By utilizing airSlate SignNow, you can easily eSign and send Form 941p Me, ensuring compliance and reducing paperwork errors. This streamlined process can save time and enhance accuracy for your tax filings.

-

How does airSlate SignNow simplify the process of filling out Form 941p Me?

AirSlate SignNow simplifies the process of filling out Form 941p Me by providing an intuitive interface that guides users through each step. With pre-filled fields and automatic calculations, you can avoid common mistakes associated with manual entries. This user-friendly experience helps ensure that your Form 941p Me is completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow with Form 941p Me?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, making it affordable to manage Form 941p Me submissions. Our plans include a variety of features tailored to enhance document management, eSigning, and collaboration. You can choose a plan that fits your budget while ensuring you have all the necessary tools for handling Form 941p Me.

-

Can I integrate airSlate SignNow with other software while using Form 941p Me?

Yes, airSlate SignNow provides seamless integration with numerous popular software applications, allowing you to connect your existing systems while managing Form 941p Me. This integration ensures that data flows smoothly between platforms, reducing the need for duplicate entries and improving overall efficiency. By using our integrations, your workflow becomes more streamlined.

-

What features does airSlate SignNow offer for electronic signature on Form 941p Me?

AirSlate SignNow comes equipped with advanced electronic signature features specifically designed to facilitate documents like Form 941p Me. With options for secure signing, customizable workflows, and real-time tracking, you can ensure your Form 941p Me is signed promptly and securely. These features provide peace of mind while complying with legal standards.

-

How does using airSlate SignNow improve compliance with tax regulations for Form 941p Me?

Using airSlate SignNow enhances compliance with tax regulations surrounding Form 941p Me by ensuring that all necessary steps are documented and executed correctly. Our platform maintains audit trails and logs, making it easier to verify that submissions are accurate. This level of transparency not only assists in fulfilling legal obligations but also helps mitigate potential issues with tax authorities.

-

Is it easy to track the status of my Form 941p Me submissions with airSlate SignNow?

Absolutely! AirSlate SignNow allows you to easily track the status of your Form 941p Me submissions in real-time. You'll receive notifications for key actions such as when the form is viewed, signed, and completed, providing you with complete visibility throughout the process. This transparency helps ensure you stay informed and can follow up as needed.

Get more for Form 941p Me

Find out other Form 941p Me

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF