D 403 NC K 1 Web 7 24 Partner S Share of nor 2024-2026

Understanding the D 403 NC K 1 Partner’s Share

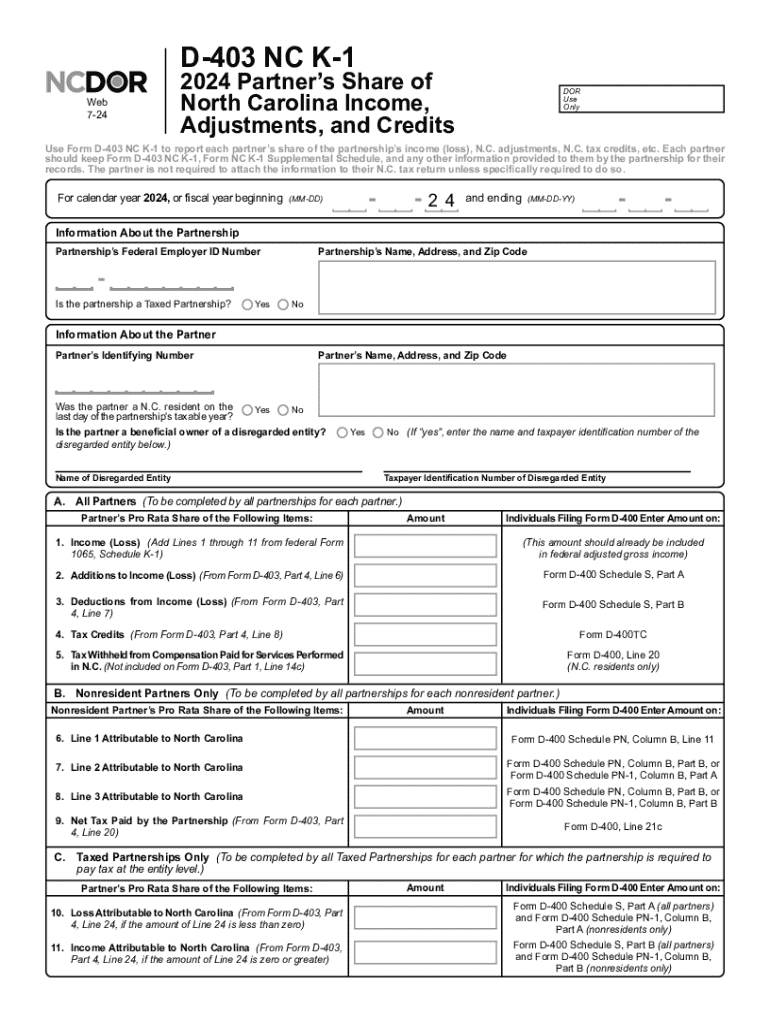

The D 403 NC K 1 form is a crucial document used in North Carolina for reporting a partner's share of income, deductions, and credits from partnerships. This form is specifically designed for partnerships and is essential for ensuring accurate tax reporting. It provides detailed information about the partner's financial share, which is necessary for both individual and partnership tax returns. Understanding the components of this form helps partners accurately report their income and comply with state tax regulations.

Steps to Complete the D 403 NC K 1

Completing the D 403 NC K 1 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial information related to the partnership. This includes income statements, expense reports, and any other relevant financial documents. Next, fill out the form by entering the partner's name, address, and tax identification number. Then, detail the partner's share of income, deductions, and credits as provided by the partnership. Review the form for any errors or omissions before submission to ensure it meets all requirements.

Obtaining the D 403 NC K 1 Form

The D 403 NC K 1 form can be obtained through the North Carolina Department of Revenue's official website or directly from the partnership that issued it. It is important to ensure that you are using the most current version of the form to comply with state regulations. If you are unable to access the form online, you may request a physical copy from the partnership or the Department of Revenue.

Legal Use of the D 403 NC K 1

The D 403 NC K 1 must be used in accordance with North Carolina tax laws. It is legally required for partners in a partnership to report their share of income and deductions accurately. Failure to use this form correctly can result in penalties and interest on unpaid taxes. It is essential for partners to understand their obligations under state law and ensure that the information reported on the D 403 NC K 1 is complete and accurate.

Key Elements of the D 403 NC K 1

The D 403 NC K 1 form includes several key elements that are critical for accurate reporting. These elements typically consist of the partner's identifying information, the partnership's details, and specific financial figures such as the partner's share of income, deductions, and credits. Understanding these elements is vital for partners to ensure they report their tax obligations correctly and avoid any potential issues with the North Carolina Department of Revenue.

Filing Deadlines for the D 403 NC K 1

Filing deadlines for the D 403 NC K 1 are aligned with the overall tax filing deadlines in North Carolina. Typically, these forms must be filed by the same date as the partnership's tax return. It is important for partners to be aware of these deadlines to ensure timely submission and avoid any late fees or penalties. Keeping track of important dates is essential for compliance and maintaining good standing with tax authorities.

Examples of Using the D 403 NC K 1

Using the D 403 NC K 1 can vary based on the specific circumstances of the partnership. For example, a partner in a real estate investment partnership may report rental income and related expenses, while a partner in a service-based partnership may report income from services rendered. Each partner's situation will dictate how they complete the form and report their share of the partnership's financial activities. Understanding these examples can help partners navigate their reporting responsibilities more effectively.

Create this form in 5 minutes or less

Find and fill out the correct d 403 nc k 1 web 7 24 partners share of nor

Create this form in 5 minutes!

How to create an eSignature for the d 403 nc k 1 web 7 24 partners share of nor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is d 403 nc k 1 and how does it relate to airSlate SignNow?

The d 403 nc k 1 is a specific document type that can be easily managed and signed using airSlate SignNow. This platform allows users to streamline the signing process, ensuring that documents like d 403 nc k 1 are handled efficiently and securely.

-

How much does airSlate SignNow cost for managing d 403 nc k 1 documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost for managing d 403 nc k 1 documents is affordable, providing excellent value for the features and capabilities included in each plan.

-

What features does airSlate SignNow offer for d 403 nc k 1 document signing?

airSlate SignNow provides a range of features for d 403 nc k 1 document signing, including customizable templates, real-time tracking, and secure cloud storage. These features enhance the signing experience and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other tools for d 403 nc k 1 management?

Yes, airSlate SignNow offers seamless integrations with various applications to enhance your workflow for d 403 nc k 1 management. This includes popular tools like Google Drive, Salesforce, and more, allowing for a streamlined process.

-

What are the benefits of using airSlate SignNow for d 403 nc k 1?

Using airSlate SignNow for d 403 nc k 1 provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform simplifies the signing process, making it easier for businesses to manage their documents.

-

Is airSlate SignNow user-friendly for signing d 403 nc k 1 documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to sign d 403 nc k 1 documents. The intuitive interface ensures that users can navigate the platform without any technical expertise.

-

How does airSlate SignNow ensure the security of d 403 nc k 1 documents?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures for d 403 nc k 1 documents. This ensures that all signed documents are protected and that user data remains confidential.

Get more for D 403 NC K 1 Web 7 24 Partner s Share Of Nor

- Us life insurance company income tax return internal form

- Internal revenue service department of the treasury gpogov form

- Form 8821 rev february 2020 tax information authorization

- Henderson county ky bank deposit franchise tax ecode360 form

- Fbi fingerprint form fd 258

- Labor housing inspection checklist form

- Responsibility statement for supervisors of an associate professional clinical counselor responsibility statement for form

- Publication 18 03 form

Find out other D 403 NC K 1 Web 7 24 Partner s Share Of Nor

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement