NC DoR D 403 K 1 Form 2022

What is the NC DoR D 403 K 1 Form

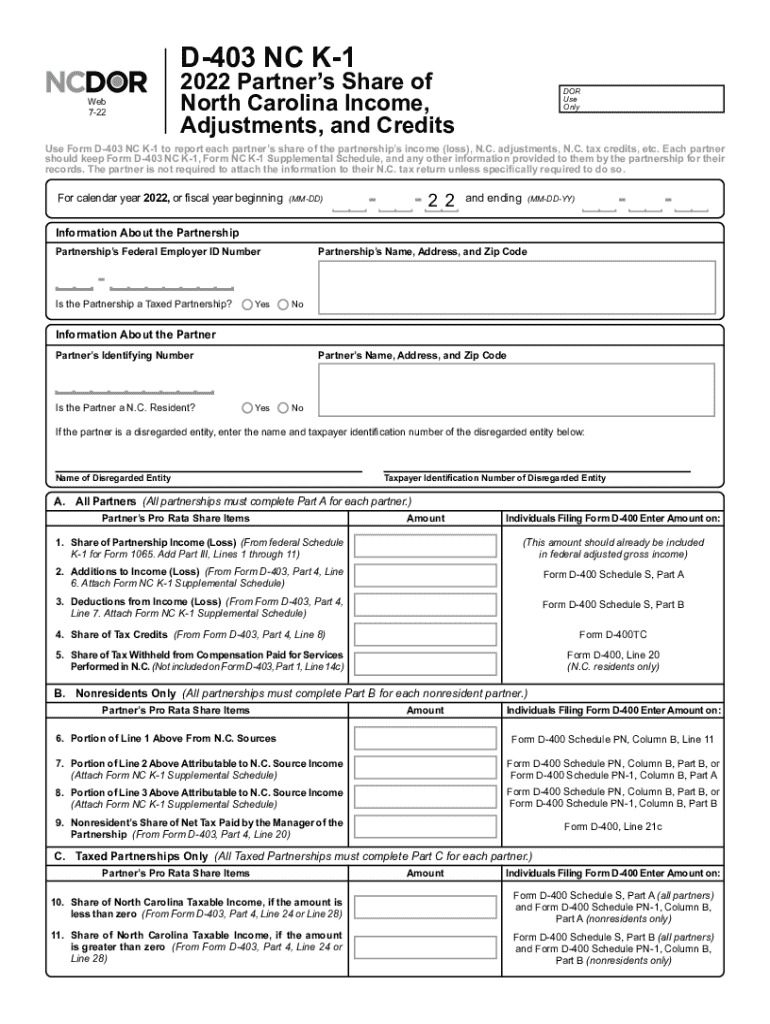

The NC DoR D 403 K 1 Form is a tax document used in North Carolina to report income from partnerships, S corporations, and limited liability companies (LLCs). This form provides essential information about the income, deductions, and credits allocated to each partner or shareholder. It serves as a crucial tool for individuals and businesses to accurately report their income and ensure compliance with state tax regulations.

Steps to complete the NC DoR D 403 K 1 Form

Completing the NC DoR D 403 K 1 Form involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including income statements and prior tax returns.

- Fill in the entity details: Provide the name, address, and identification number of the partnership or S corporation.

- Report income and deductions: Accurately enter the income earned and any deductions applicable to the business.

- Allocate income to partners: Distribute the income or loss among partners based on their ownership percentages.

- Review and verify: Double-check all entries for accuracy before submission.

How to obtain the NC DoR D 403 K 1 Form

The NC DoR D 403 K 1 Form can be obtained through the North Carolina Department of Revenue's official website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, many tax preparation software programs include this form, making it easier for users to complete their taxes electronically.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the NC DoR D 403 K 1 Form to avoid penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For most businesses operating on a calendar year, this means the deadline is April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day.

Legal use of the NC DoR D 403 K 1 Form

The NC DoR D 403 K 1 Form is legally binding when completed accurately and submitted on time. It must adhere to the guidelines set forth by the North Carolina Department of Revenue. Failure to file the form or providing incorrect information can result in penalties, including fines or additional tax liabilities. It is crucial for taxpayers to understand the legal implications of this form to ensure compliance with state tax laws.

Key elements of the NC DoR D 403 K 1 Form

Several key elements are included in the NC DoR D 403 K 1 Form:

- Entity information: Details about the partnership or corporation, including name and address.

- Income section: Reporting of total income earned during the tax year.

- Deductions: Any applicable deductions that can reduce taxable income.

- Partner allocations: Breakdown of income or losses allocated to each partner or shareholder.

- Signature line: Required signatures from authorized individuals to validate the form.

Quick guide on how to complete nc dor d 403 k 1 form

Complete NC DoR D 403 K 1 Form effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage NC DoR D 403 K 1 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-centered process today.

The easiest way to modify and eSign NC DoR D 403 K 1 Form seamlessly

- Locate NC DoR D 403 K 1 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and possesses the same legal significance as a conventional wet ink signature.

- Verify all details and then click the Done button to save your changes.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

No more lost or misfiled documents, laborious form searching, or errors that necessitate the reprinting of new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign NC DoR D 403 K 1 Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nc dor d 403 k 1 form

Create this form in 5 minutes!

How to create an eSignature for the nc dor d 403 k 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form d 403 instructions provided by airSlate SignNow?

The form d 403 instructions provided by airSlate SignNow guide users through the electronic signing process for important documents. These instructions ensure that you complete the form accurately and efficiently, saving you time and reducing errors in documentation.

-

How does airSlate SignNow simplify the form d 403 instructions?

airSlate SignNow simplifies the form d 403 instructions by providing an intuitive interface that allows users to easily navigate through the signing and documentation process. Our platform includes helpful prompts and tips to ensure you follow the steps correctly and complete your forms in no time.

-

Is there a cost associated with using airSlate SignNow for form d 403 instructions?

airSlate SignNow offers competitive pricing plans that can be tailored to your business needs, making the use of form d 403 instructions affordable. You can explore various subscription options, including monthly and annual plans, to find the one that best fits your budget.

-

What features does airSlate SignNow offer for managing form d 403 instructions?

AirSlate SignNow provides features such as document templates, real-time tracking, and secure cloud storage to enhance the management of form d 403 instructions. Additionally, the platform allows for collaboration and ensures compliance with legal standards for electronic signatures.

-

Can I integrate airSlate SignNow with other applications for my form d 403 instructions?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and Salesforce. This allows you to streamline your workflow while handling form d 403 instructions and ensures that your documents are easily accessible across platforms.

-

What are the benefits of using airSlate SignNow for form d 403 instructions?

Using airSlate SignNow for form d 403 instructions facilitates a more efficient and organized signing process. The platform's user-friendly design, combined with advanced security features, assures that your documents are signed swiftly and safely, enhancing productivity and saving resources.

-

How can I ensure compliance when following the form d 403 instructions?

By using airSlate SignNow, you benefit from built-in compliance features that help ensure that all form d 403 instructions are adhered to according to federal regulations. Our platform maintains high-security standards and provides an audit trail for each document, demonstrating compliance.

Get more for NC DoR D 403 K 1 Form

- Simplii financial pre authorized debit form

- Pag ibig request slip form

- Chelsea football academy registration form

- Icici demat account closure form

- Odsp rental agreement form

- Boc password reset form

- Fillable online job application form template manor

- Ssa 1199 op3 direct deposit sign up form australia

Find out other NC DoR D 403 K 1 Form

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now