D 403 NC K 1 Web 7 23 Partner S Share of nor 2023

What is the D-403 NC K-1 Web 7 23 Partner’s Share Of Nor

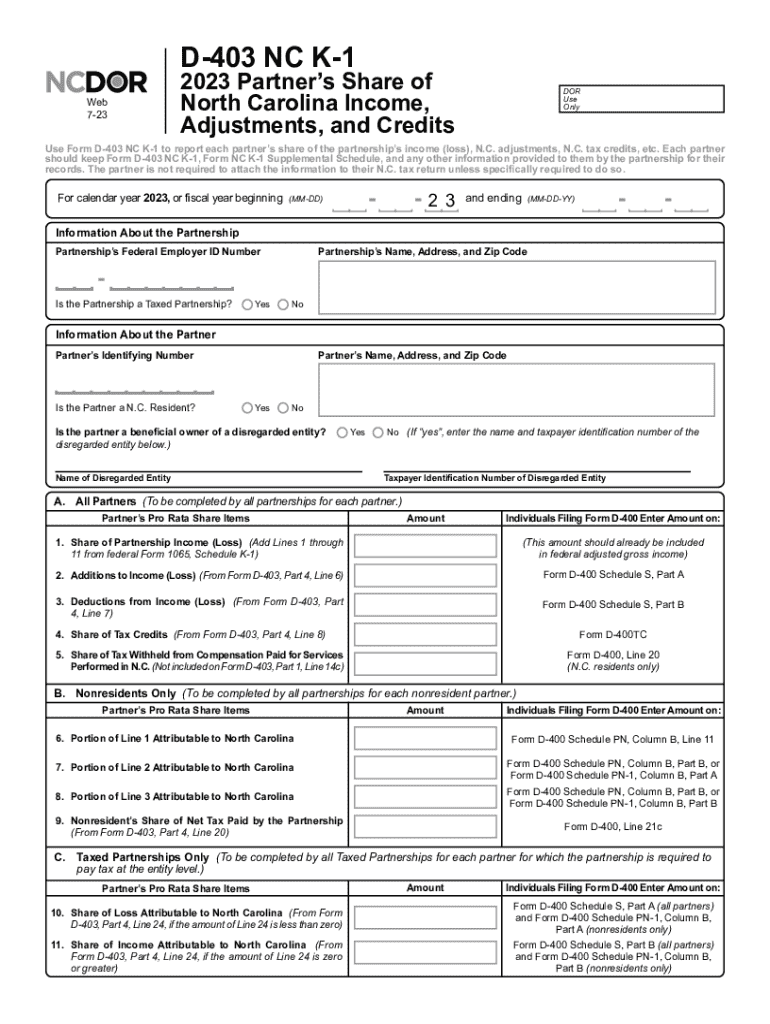

The D-403 NC K-1 Web 7 23 form is a tax document used in North Carolina to report a partner's share of income, deductions, and credits from partnerships. This form is essential for partners in a partnership to accurately report their share of the partnership's financial activities on their individual tax returns. It includes detailed information about the partner's income, losses, and any adjustments that may apply. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the D-403 NC K-1 Web 7 23

Completing the D-403 NC K-1 Web 7 23 involves several key steps:

- Gather all necessary financial information from the partnership, including income statements and expense reports.

- Fill out the partner's identifying information, such as name, address, and tax identification number.

- Report the partner's share of income, losses, and deductions as provided by the partnership.

- Include any adjustments that may affect the partner's tax situation.

- Review the completed form for accuracy before submission.

Legal use of the D-403 NC K-1 Web 7 23

The D-403 NC K-1 Web 7 23 is legally required for partners in a partnership to report their share of income and deductions. Failure to accurately complete and submit this form can result in penalties from the North Carolina Department of Revenue. It is important for partners to understand their legal obligations regarding this form to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

Partners must file the D-403 NC K-1 Web 7 23 by the tax deadline, which typically aligns with the federal tax filing date. For most taxpayers, this means the form should be submitted by April 15 of the following tax year. Staying informed about these deadlines is essential to avoid late filing penalties.

Key elements of the D-403 NC K-1 Web 7 23

Key elements of the D-403 NC K-1 Web 7 23 include:

- Partner’s name and address

- Partnership’s name and identification number

- Details of the partner’s share of income, deductions, and credits

- Adjustments specific to the partner’s tax situation

Who Issues the Form

The D-403 NC K-1 Web 7 23 is issued by the North Carolina Department of Revenue. Partnerships are responsible for providing this form to their partners, ensuring that all information is complete and accurate for tax reporting purposes.

Quick guide on how to complete d 403 nc k 1 web 7 23 partners share of nor

Effortlessly Prepare D 403 NC K 1 Web 7 23 Partner s Share Of Nor on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without any delays. Manage D 403 NC K 1 Web 7 23 Partner s Share Of Nor on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign D 403 NC K 1 Web 7 23 Partner s Share Of Nor effortlessly

- Obtain D 403 NC K 1 Web 7 23 Partner s Share Of Nor and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that reason.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign D 403 NC K 1 Web 7 23 Partner s Share Of Nor and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct d 403 nc k 1 web 7 23 partners share of nor

Create this form in 5 minutes!

How to create an eSignature for the d 403 nc k 1 web 7 23 partners share of nor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the nc d 403 instructions 2021?

The nc d 403 instructions 2021 provide a comprehensive guideline for completing specific documentation required by North Carolina's Division of Motor Vehicles. These instructions are crucial for ensuring that you fill out the forms correctly, minimizing any delays in processing.

-

How can airSlate SignNow help with the nc d 403 instructions 2021?

airSlate SignNow streamlines the process of completing and signing the nc d 403 instructions 2021 by allowing users to fill out documents electronically. This ensures accurate data entry and provides options for easy eSignature, making the entire process more efficient.

-

Is there a cost associated with using airSlate SignNow for nc d 403 instructions 2021?

airSlate SignNow offers various pricing plans designed to fit different needs, including those focused on completing nc d 403 instructions 2021. Many users find that the cost is justified by the time and hassle saved through digital document management.

-

What features does airSlate SignNow offer for handling nc d 403 instructions 2021?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure cloud storage, all of which are essential for managing nc d 403 instructions 2021. These tools enhance user experience and ensure that documents remain compliant with regulatory requirements.

-

What are the benefits of using airSlate SignNow for nc d 403 instructions 2021?

Using airSlate SignNow for nc d 403 instructions 2021 provides signNow benefits, including increased efficiency, reduced paperwork, and the ability to track document status easily. This leads to faster processing times while maintaining compliance with state regulations.

-

Can I integrate airSlate SignNow with other platforms when working on nc d 403 instructions 2021?

Yes, airSlate SignNow supports integrations with various platforms to facilitate the management of nc d 403 instructions 2021. This ensures that you can seamlessly collaborate with team members and access necessary data from your preferred applications.

-

What types of businesses use airSlate SignNow for the nc d 403 instructions 2021?

A wide range of businesses, from small startups to large enterprises, use airSlate SignNow for the nc d 403 instructions 2021. Its versatility and ease of use make it an ideal solution for any organization needing to manage documentation efficiently.

Get more for D 403 NC K 1 Web 7 23 Partner s Share Of Nor

- Health profile form

- Overtime request form 406243228

- Ohsu finance ampamp accounting account enable form

- Incident investigation form

- General intake form unm health sciences center

- Fms minors release form tufts university

- Ecampus security access request university of rhode island form

- Complete applications must be submitted with all documentation including itemized bill 30 days in advance of form

Find out other D 403 NC K 1 Web 7 23 Partner s Share Of Nor

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now