Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

Understanding the Form CT 3 S New York S Corporation Franchise Tax Return

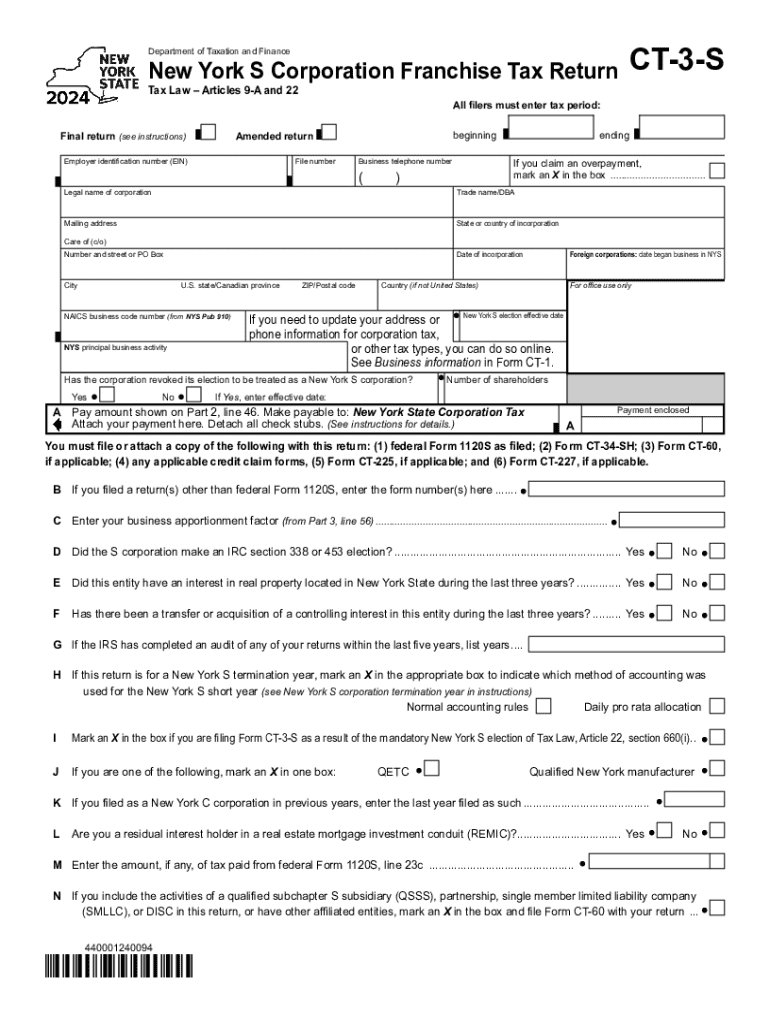

The Form CT 3 S is a crucial document for S corporations operating in New York. This form is specifically designed for the franchise tax return, allowing S corporations to report their income, deductions, and credits. It is essential for compliance with New York State tax laws and ensures that S corporations pay the appropriate amount of tax based on their income. The tax year for which the form is filed typically aligns with the corporation's fiscal year, making it important for businesses to understand their reporting obligations.

Steps to Complete the Form CT 3 S New York S Corporation Franchise Tax Return

Completing the Form CT 3 S involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Begin filling out the form by entering the corporation's identification information, including the name and Employer Identification Number (EIN).

- Report total income and allowable deductions in the appropriate sections of the form.

- Calculate the franchise tax due based on the income reported, applying any available credits.

- Review the completed form for accuracy and ensure all required attachments are included.

- Sign and date the form before submission.

How to Obtain the Form CT 3 S New York S Corporation Franchise Tax Return

The Form CT 3 S can be obtained directly from the New York State Department of Taxation and Finance website. It is available in both fillable and printable formats, allowing S corporations to choose the method that best suits their needs. Additionally, tax professionals and accountants may provide copies of the form as part of their services.

Key Elements of the Form CT 3 S New York S Corporation Franchise Tax Return

Several key elements are essential when filling out the Form CT 3 S:

- Identification Information: This includes the corporation's name, address, and EIN.

- Income Reporting: S corporations must report all sources of income, including sales and service revenue.

- Deductions: Corporations can deduct certain business expenses, which must be clearly itemized.

- Tax Calculation: The form includes sections for calculating the total tax liability based on reported income.

Filing Deadlines and Important Dates for Form CT 3 S

It is important for S corporations to be aware of the filing deadlines associated with the Form CT 3 S. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. Timely submission is crucial to avoid penalties and interest on unpaid taxes.

Legal Use of the Form CT 3 S New York S Corporation Franchise Tax Return

The Form CT 3 S serves a legal purpose by ensuring that S corporations comply with New York State tax regulations. By accurately completing and submitting this form, corporations affirm their commitment to fulfilling their tax obligations. Failure to file or inaccuracies in reporting can lead to legal repercussions, including fines and audits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3 s new york s corporation franchise tax return tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ct 3 s and how can airSlate SignNow help?

The form ct 3 s is a specific tax form used for reporting income and expenses. airSlate SignNow simplifies the process of completing and eSigning the form ct 3 s, ensuring that your documents are accurate and submitted on time.

-

How much does it cost to use airSlate SignNow for the form ct 3 s?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage the form ct 3 s efficiently.

-

What features does airSlate SignNow provide for managing the form ct 3 s?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the form ct 3 s. These features streamline the process, making it easier to manage your tax documents.

-

Can I integrate airSlate SignNow with other software for the form ct 3 s?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the form ct 3 s alongside your other business tools. This integration enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the form ct 3 s?

Using airSlate SignNow for the form ct 3 s provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are handled efficiently and securely, reducing the risk of errors.

-

Is airSlate SignNow user-friendly for completing the form ct 3 s?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the form ct 3 s. The intuitive interface guides you through the process, ensuring that you can eSign documents without any hassle.

-

How does airSlate SignNow ensure the security of the form ct 3 s?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your form ct 3 s and other documents. This commitment to security ensures that your sensitive information remains confidential.

Get more for Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

Find out other Form CT 3 S New York S Corporation Franchise Tax Return Tax Year

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure