State of New Mexico Taxation and Revenue Departmen 2022-2026

Understanding the State of New Mexico Taxation and Revenue Department

The State of New Mexico Taxation and Revenue Department is responsible for administering the state's tax laws and collecting various taxes. This department oversees income tax, gross receipts tax, and property tax, among others. It plays a crucial role in ensuring compliance with state tax regulations and providing necessary services to taxpayers.

Steps to Complete the State of New Mexico Taxation and Revenue Department Form

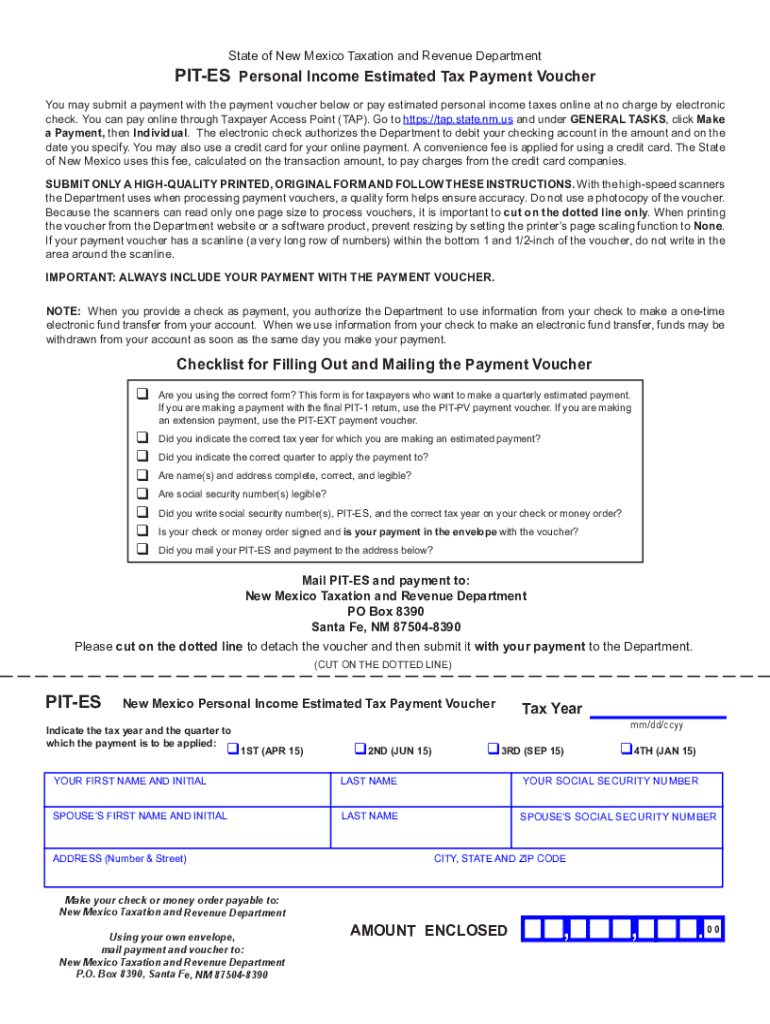

Completing forms for the State of New Mexico Taxation and Revenue Department involves several key steps:

- Gather necessary information, including personal identification and financial details.

- Download the appropriate form from the department's website or obtain a physical copy.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form via the designated method, whether online, by mail, or in person.

Required Documents for the State of New Mexico Taxation and Revenue Department

When filing forms with the State of New Mexico Taxation and Revenue Department, certain documents are typically required. These may include:

- Proof of identification, such as a driver's license or Social Security number.

- Financial statements or income records for the relevant tax year.

- Any previous tax returns that may be relevant to the current filing.

- Supporting documents for deductions or credits being claimed.

Form Submission Methods

The State of New Mexico Taxation and Revenue Department offers various methods for submitting forms:

- Online: Many forms can be completed and submitted electronically through the department's website.

- Mail: Forms can be printed, completed, and sent to the appropriate address listed on the form.

- In-Person: Taxpayers can visit local offices to submit forms directly and receive assistance.

Penalties for Non-Compliance

Failing to comply with the regulations set forth by the State of New Mexico Taxation and Revenue Department can result in various penalties. These may include:

- Fines based on the amount of tax owed and the duration of non-compliance.

- Interest charges on unpaid taxes, which can accumulate over time.

- Legal action, including liens or garnishments, for severe cases of non-compliance.

Eligibility Criteria for Filing

To file forms with the State of New Mexico Taxation and Revenue Department, individuals and businesses must meet specific eligibility criteria. These criteria may include:

- Residency status in New Mexico or conducting business within the state.

- Meeting income thresholds that necessitate tax filing.

- Compliance with previous tax obligations, ensuring no outstanding issues.

Create this form in 5 minutes or less

Find and fill out the correct state of new mexico taxation and revenue departmen

Create this form in 5 minutes!

How to create an eSignature for the state of new mexico taxation and revenue departmen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to pit es?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. It simplifies the signing process, making it more efficient and cost-effective, which is essential for any organization looking to streamline their operations. The term 'pit es' refers to the ease of use and integration capabilities that airSlate SignNow offers.

-

How much does airSlate SignNow cost?

The pricing for airSlate SignNow is designed to be affordable for businesses of all sizes. Plans start at a competitive rate, allowing users to choose a package that best fits their needs. With airSlate SignNow, you can find a cost-effective solution that aligns with your budget while still providing the features necessary for effective document management, which is crucial for understanding 'pit es.'

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as customizable templates, document tracking, and secure cloud storage. These features enhance the user experience and ensure that your documents are managed efficiently. Understanding these features is key to leveraging the full potential of 'pit es' in your business operations.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document management and signing processes. This leads to increased productivity and faster turnaround times for contracts and agreements. The benefits of airSlate SignNow directly relate to the concept of 'pit es,' as it provides a streamlined approach to handling important documents.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow is designed to integrate seamlessly with various business applications, enhancing its functionality. Whether you use CRM systems, project management tools, or other software, airSlate SignNow can connect with them to create a cohesive workflow. This integration capability is a vital aspect of 'pit es' that many businesses appreciate.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to send and sign documents on the go. This flexibility ensures that you can manage your documents anytime, anywhere, which is a signNow advantage in today's fast-paced business environment. The mobile accessibility of airSlate SignNow enhances the overall 'pit es' experience.

-

What security measures does airSlate SignNow implement?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. This ensures that your sensitive information remains protected throughout the signing process. Understanding the security features of airSlate SignNow is essential for businesses looking to maintain 'pit es' while managing their documents.

Get more for State Of New Mexico Taxation And Revenue Departmen

Find out other State Of New Mexico Taxation And Revenue Departmen

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile