New Mexico Pit B Form 2013

What is the New Mexico Pit B Form

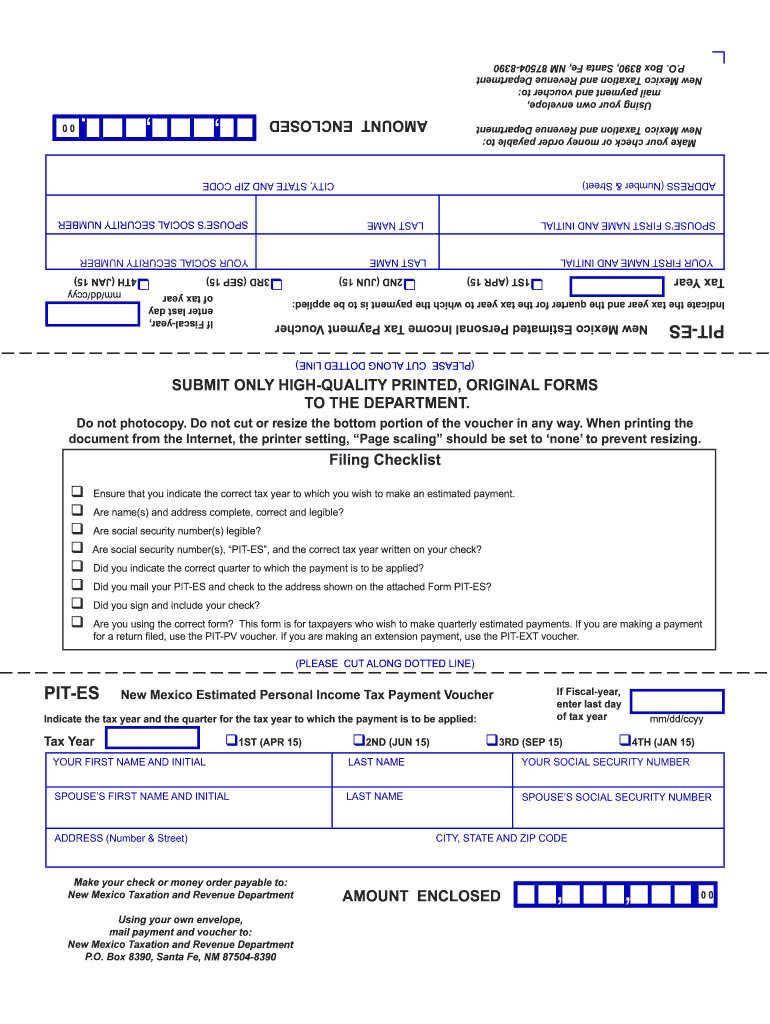

The New Mexico Pit B Form is a tax document specifically designed for reporting income from businesses operating in New Mexico. This form is essential for individuals and entities engaged in business activities within the state, as it helps ensure compliance with state tax regulations. The form collects information about business income, deductions, and credits, allowing the New Mexico Taxation and Revenue Department to assess tax liabilities accurately.

How to use the New Mexico Pit B Form

To use the New Mexico Pit B Form effectively, begin by gathering all necessary financial documents related to your business activities. This includes income statements, expense receipts, and any relevant tax documents. Once you have the required information, you can fill out the form either online or by hand. Ensure that all fields are completed accurately to avoid delays in processing. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the New Mexico Pit B Form

Completing the New Mexico Pit B Form involves several key steps:

- Gather all necessary financial documentation, including income and expense records.

- Access the form online or obtain a paper version from the New Mexico Taxation and Revenue Department.

- Fill in your business information, including your business name, address, and tax identification number.

- Report your total income and any applicable deductions or credits.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the guidelines provided by the tax authority.

Legal use of the New Mexico Pit B Form

The New Mexico Pit B Form is legally recognized for tax reporting purposes within the state. It must be completed and submitted by businesses operating in New Mexico to remain compliant with state tax laws. Failing to file this form can result in penalties or fines, making it crucial for business owners to understand their obligations regarding this document. Additionally, the form must be signed and dated by the taxpayer or an authorized representative to validate its submission.

Filing Deadlines / Important Dates

Timely filing of the New Mexico Pit B Form is essential to avoid penalties. The typical deadline for submitting this form aligns with the federal tax filing deadline, which is usually April fifteenth. However, businesses may have different deadlines based on their fiscal year or specific circumstances. It is important to check the New Mexico Taxation and Revenue Department's website for any updates or changes to filing deadlines to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The New Mexico Pit B Form can be submitted through several methods, providing flexibility for business owners. Options include:

- Online Submission: Businesses can file the form electronically through the New Mexico Taxation and Revenue Department's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address specified by the tax authority.

- In-Person: Some taxpayers may choose to deliver the form in person at a local tax office for direct submission.

Quick guide on how to complete new mexico pit b 2013 form

Your assistance manual on how to prepare your New Mexico Pit B Form

If you are interested in knowing how to create and dispatch your New Mexico Pit B Form, here are some concise guidelines on how to make tax reporting less challenging.

To begin, you only need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly intuitive and powerful documentation solution that allows you to alter, draft, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and return to modify answers as needed. Streamline your tax management with advanced PDF editing, eSigning, and easy sharing options.

Follow the instructions below to complete your New Mexico Pit B Form in just a few minutes:

- Set up your account and start working on PDFs in minutes.

- Use our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your New Mexico Pit B Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if necessary).

- Examine your document and rectify any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes digitally with airSlate SignNow. Please keep in mind that submitting in paper format can lead to return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct new mexico pit b 2013 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

What's the easiest way to build a form in Excel 2013 that creates a new sheet containing the form-input for each time you fill it in?

If you must keep it just within Excel, create a VBA UserForm. Go to Excel VBA Userform for a tutorial.Another option is to put together a PDF form that collects information from each field and creates a new record each time it is submitted. This can be difficult to set up, and you would need either signNow or similar pdf creator/editor.The third (and easiest) option is to use Google Forms to create a form with all your necessary fields, which will automatically collect the data into a Google spreadsheet accessible by only you and those you grant access to. The form itself can be shared as a short link with anyone who needs to fill it out. You can very easily download this sheet as an Excel file and use it as necessary. I used this two days ago and it took me about 15 minutes to create a form with multiple input fields, test it, and send it out.

-

How do I fill out the New Zealand visa form?

Hi,Towards the front of your Immigration Form there is a check list. This check list explains the documents you will need to include with your form (i.e. passport documents, proof of funds, medical information etc). With any visa application it’s important to ensure that you attach all the required information or your application may be returned to you.The forms themselves will guide you through the process, but you must ensure you have the correct form for the visa you want to apply for. Given that some visa applications can carry hefty fees it may also be wise to check with an Immigration Adviser or Lawyer as to whether you qualify for that particular visa.The form itself will explain which parts you need to fill out and which parts you don’t. If you don’t understand the form you may wish to get a friend or a family member to explain it to you. There is a part at the back of the form for them to complete saying that they have assisted you in the completion of it.If all else fails you may need to seek advice from a Immigration Adviser or Lawyer. However, I always suggest calling around so you can ensure you get the best deal.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How much time does it take to fill the pit formed by chicken pox?

I got chicken pox almost 9 years ago and I got few of it on my face and it got really itchy so when it dried I had scratched it a lot and plucked it out (I was a dumb kid) .. there goes my clean spotless face…. :/. I have been having few pits scars (width around 1mm to 3mm) because of it, in my face for almost 9 years and it doesn't seem to go away naturally. I have recently started applying some scar cream( mederma) i see a very very small improvement, I have been using for a month. I will update the post if it really helps out, but the process seems to be very slow.

-

What are the new Schenzen visa requirements? How do I fill out the online form?

You can find every detail you are looking for about a Schengen tourist Visa in the following article. You can download the form and take a print out or fill it electronically.10 answers you need to know about Schengen Tourist Visa in 2018Thank you for upvoting

-

What is the new procedure in filling out the AIIMS 2019 form? What is the last date to fill out its form?

AIIMS has introduced the PAAR facility (Prospective Applicant Advanced Registration) for filling up the application form. Through PAAR facility, the process application form is divided into two steps- basic registration and final registration.Basic Registration:On this part you have to fill up your basic details like Full name, parent’s name, date of birth, gender, category, state of domicile, ID proof/number and others. No paAIIMS Final RegistrationA Code will be issued to the candidates who complete the Basic Registration. You have to use the same code to login again and fill the form.At this stage, candidates are required to fill out the entire details of their personal, professional and academic background. Also, they have to submit the application fee as per their category.Here I have explained the two steps for AIIMS 2019 form.For more details visit aim4aiims’s website:About AIIMS Exam 2019

Create this form in 5 minutes!

How to create an eSignature for the new mexico pit b 2013 form

How to create an eSignature for your New Mexico Pit B 2013 Form online

How to make an eSignature for your New Mexico Pit B 2013 Form in Chrome

How to make an eSignature for putting it on the New Mexico Pit B 2013 Form in Gmail

How to make an electronic signature for the New Mexico Pit B 2013 Form from your smartphone

How to generate an electronic signature for the New Mexico Pit B 2013 Form on iOS devices

How to create an eSignature for the New Mexico Pit B 2013 Form on Android devices

People also ask

-

What is the New Mexico Pit B Form?

The New Mexico Pit B Form is a crucial document used for specific regulatory purposes in New Mexico. It is designed to ensure compliance with state laws regarding the management and reporting of certain business activities. airSlate SignNow simplifies the process of completing and submitting the New Mexico Pit B Form electronically, making it efficient and reliable.

-

How can I fill out the New Mexico Pit B Form using airSlate SignNow?

Filling out the New Mexico Pit B Form with airSlate SignNow is straightforward. Simply upload the form to our platform, fill in the required fields using our intuitive editor, and then eSign it. Our user-friendly interface ensures that you can complete the form quickly and accurately.

-

Is airSlate SignNow compliant with New Mexico regulations for the Pit B Form?

Yes, airSlate SignNow is fully compliant with New Mexico regulations regarding the New Mexico Pit B Form. We ensure that all electronic signatures and submissions meet the legal requirements set forth by the state. Our platform prioritizes security and legality, giving you peace of mind.

-

What are the benefits of using airSlate SignNow for the New Mexico Pit B Form?

Using airSlate SignNow for the New Mexico Pit B Form offers multiple benefits, including time savings and increased efficiency. You can complete and submit your forms quickly without the hassle of printing and mailing. Additionally, the secure eSigning process enhances the integrity of your submissions.

-

What pricing options does airSlate SignNow offer for eSigning the New Mexico Pit B Form?

airSlate SignNow offers flexible pricing plans to cater to different business needs, whether you need a single user or a team solution. Our plans are competitively priced, allowing you to eSign documents like the New Mexico Pit B Form affordably. You can choose a plan that best fits your usage requirements.

-

Can I integrate airSlate SignNow with other applications for the New Mexico Pit B Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications and tools, making it easy to manage your workflow. You can connect our platform with services you already use to streamline the process of handling the New Mexico Pit B Form and other documents.

-

How does airSlate SignNow ensure the security of my New Mexico Pit B Form data?

We take the security of your data seriously at airSlate SignNow. Our platform utilizes advanced encryption protocols and secure servers to protect your information when you complete the New Mexico Pit B Form. You can trust that your sensitive data is safe and confidential.

Get more for New Mexico Pit B Form

Find out other New Mexico Pit B Form

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title