PTE *247080200* New Mexico Pass through Entit 2024-2026

What is the PTE *247080200* New Mexico Pass Through Entit

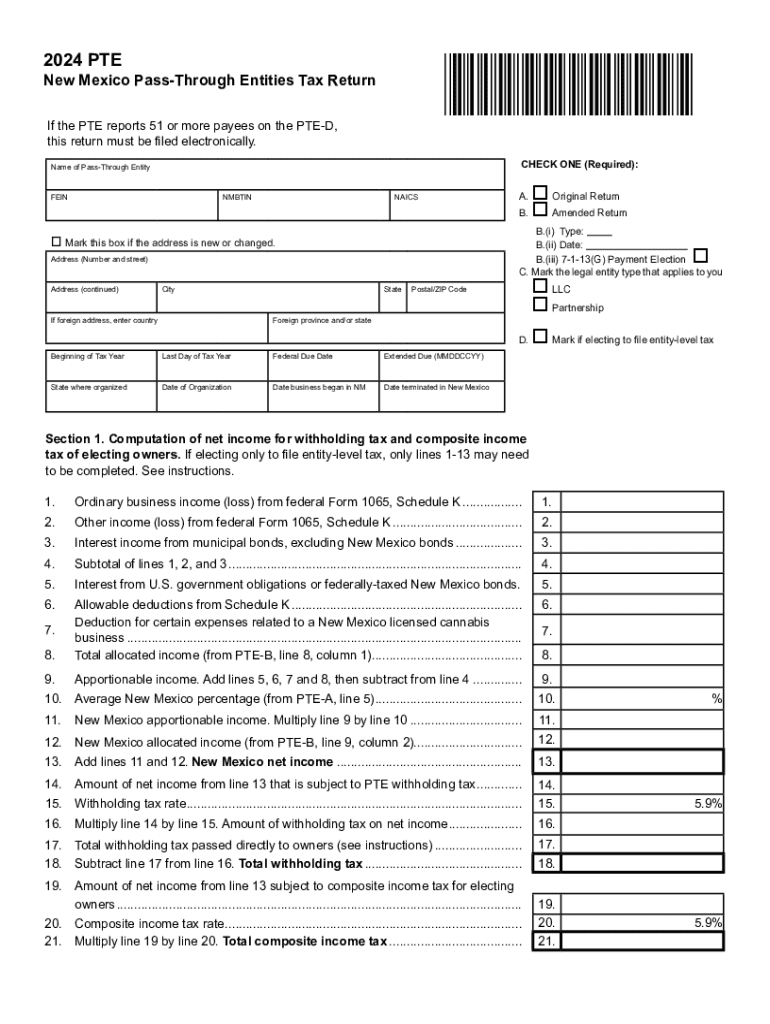

The PTE *247080200* New Mexico Pass Through Entity is a specific tax form used by pass-through entities in New Mexico. This form allows partnerships, limited liability companies (LLCs), and S corporations to report their income, deductions, and credits to the state. Unlike traditional corporations, pass-through entities do not pay income tax at the corporate level; instead, income is passed through to the owners or shareholders, who report it on their individual tax returns. The PTE form is essential for ensuring compliance with state tax regulations and for accurately reflecting the financial activities of the entity.

Steps to complete the PTE *247080200* New Mexico Pass Through Entit

Completing the PTE *247080200* New Mexico Pass Through Entity form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Identify all owners or shareholders and their respective ownership percentages.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or via mail.

Following these steps helps ensure that the form is filled out correctly, minimizing the risk of errors or penalties.

Legal use of the PTE *247080200* New Mexico Pass Through Entit

The PTE *247080200* New Mexico Pass Through Entity form is legally required for entities that choose to be taxed as pass-through entities in New Mexico. By filing this form, these entities comply with state tax laws and provide necessary information to the New Mexico Taxation and Revenue Department. Failure to file this form can result in penalties and interest on unpaid taxes. It is essential for entities to understand their legal obligations regarding this form to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the PTE *247080200* New Mexico Pass Through Entity form typically align with the state’s tax calendar. Generally, the form must be submitted by the 15th day of the fourth month following the close of the entity's tax year. For entities operating on a calendar year, this means the form is due by April 15. It is crucial for entities to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with state tax regulations.

Required Documents

To complete the PTE *247080200* New Mexico Pass Through Entity form, several documents are required:

- Financial statements, including profit and loss statements.

- Records of all income received and expenses incurred during the tax year.

- Information on each owner or shareholder, including their ownership percentages.

- Any applicable tax credits or deductions that the entity is eligible for.

Having these documents ready will facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Who Issues the Form

The PTE *247080200* New Mexico Pass Through Entity form is issued by the New Mexico Taxation and Revenue Department. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within New Mexico. Entities must obtain the form directly from the department's official resources to ensure they are using the most current version and following the latest guidelines.

Create this form in 5 minutes or less

Find and fill out the correct pte 247080200 new mexico pass through entit

Create this form in 5 minutes!

How to create an eSignature for the pte 247080200 new mexico pass through entit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is PTE *247080200* New Mexico Pass Through Entit?

PTE *247080200* New Mexico Pass Through Entit refers to a specific tax classification for entities in New Mexico that allows for pass-through taxation. This means that the income is taxed at the individual level rather than at the corporate level, providing potential tax benefits for business owners.

-

How can airSlate SignNow help with PTE *247080200* New Mexico Pass Through Entit documentation?

airSlate SignNow simplifies the process of managing documents related to PTE *247080200* New Mexico Pass Through Entit. With our eSigning capabilities, you can easily send, sign, and store important tax documents securely, ensuring compliance and efficiency.

-

What are the pricing options for airSlate SignNow for PTE *247080200* New Mexico Pass Through Entit?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses dealing with PTE *247080200* New Mexico Pass Through Entit. Our plans are designed to be cost-effective, allowing you to choose the features that best suit your business requirements.

-

What features does airSlate SignNow provide for managing PTE *247080200* New Mexico Pass Through Entit?

With airSlate SignNow, you gain access to features such as customizable templates, automated workflows, and secure cloud storage, all of which are beneficial for managing PTE *247080200* New Mexico Pass Through Entit documentation. These features streamline your processes and enhance productivity.

-

Are there any integrations available for airSlate SignNow with PTE *247080200* New Mexico Pass Through Entit?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in managing PTE *247080200* New Mexico Pass Through Entit. This includes accounting software and CRM systems, allowing for a more cohesive workflow and better data management.

-

What are the benefits of using airSlate SignNow for PTE *247080200* New Mexico Pass Through Entit?

Using airSlate SignNow for PTE *247080200* New Mexico Pass Through Entit offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. Our platform ensures that you can focus on your business while we handle the documentation process.

-

Is airSlate SignNow secure for handling PTE *247080200* New Mexico Pass Through Entit documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your PTE *247080200* New Mexico Pass Through Entit documents. You can trust that your sensitive information is safe with us.

Get more for PTE *247080200* New Mexico Pass Through Entit

- License plate applicationpub hawaiian humane society hawaiianhumane form

- Southport sharks employment application form

- Sales agreement pdf meka world form

- Unlawful detainer san diego superior court state of sdcourt ca form

- Sgt ssg promotion packet composition fillable form

- Rtca sports participation agreement for interscholastic athleticsdocx form

- Employment application sutter yuba mosquito vector control district sutter yubamvcd form

- Borang jabatan tenaga kerja ministry of human resources form

Find out other PTE *247080200* New Mexico Pass Through Entit

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement