Pass through Entity Taxation and Revenue New Mexico 2022

What is the New Mexico Pass Through Entity Taxation?

The New Mexico Pass Through Entity Taxation refers to a tax structure where income generated by certain business entities, such as partnerships and limited liability companies (LLCs), is passed directly to the owners or shareholders. This means that the entity itself is not taxed at the corporate level; instead, the income is reported on the individual tax returns of the owners. This approach can simplify tax reporting and potentially reduce the overall tax burden for the business owners.

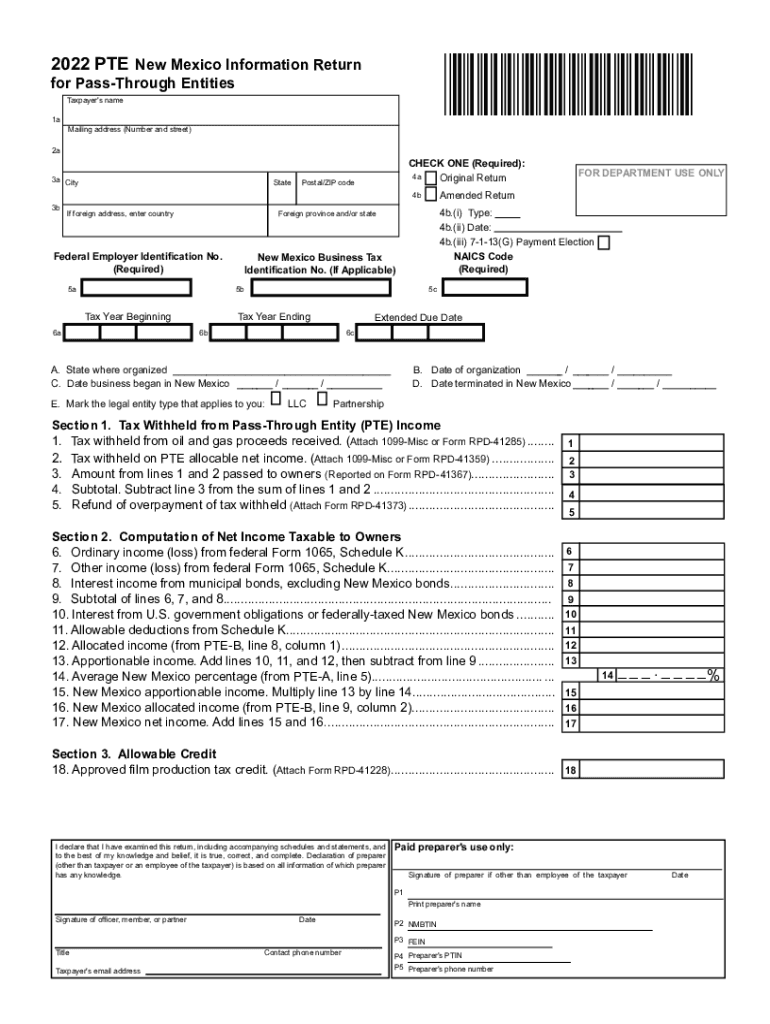

Steps to Complete the New Mexico PTE Information Return

Completing the New Mexico PTE information return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documentation, including income statements and expense reports. Next, access the official nm pte form, which can typically be found on the New Mexico Taxation and Revenue Department’s website. Fill out the form by entering the required information, such as the entity's name, tax identification number, and details of income distributed to owners. After completing the form, review it for any errors before submitting it to the appropriate state authority.

Legal Use of the New Mexico PTE Information Return

The legal use of the New Mexico PTE information return is essential for compliance with state tax regulations. This form must be filed accurately to report the income passed through to the owners. It is crucial to adhere to the guidelines set forth by the New Mexico Taxation and Revenue Department, as failure to do so may result in penalties or legal repercussions. Additionally, maintaining proper records and documentation is important for substantiating the information provided in the return.

Filing Deadlines for the New Mexico PTE Information Return

Filing deadlines for the New Mexico PTE information return are critical to avoid penalties. Typically, the return is due on the 15th day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the return is due by April 15. It is advisable to check for any updates or changes to these deadlines, as state regulations may evolve. Timely filing ensures compliance and helps maintain good standing with the state tax authorities.

Required Documents for the New Mexico PTE Information Return

To successfully complete the New Mexico PTE information return, several documents are required. These typically include:

- Financial statements detailing income and expenses

- Tax identification number for the entity

- Records of distributions made to owners

- Prior year tax returns, if applicable

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is accurately reported.

Examples of Using the New Mexico PTE Information Return

Examples of using the New Mexico PTE information return can illustrate its application in real-world scenarios. For instance, a partnership formed by three individuals may file the nm pte form to report their combined income and expenses. Each partner would then report their share of the income on their personal tax returns. Similarly, an LLC that elects to be treated as a partnership would also use this form to report earnings passed through to its members. These examples highlight the importance of the return in accurately reflecting the financial activities of pass-through entities.

Quick guide on how to complete pass through entity taxation and revenue new mexico

Handle Pass Through Entity Taxation And Revenue New Mexico easily on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Pass Through Entity Taxation And Revenue New Mexico on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related task today.

How to modify and electronically sign Pass Through Entity Taxation And Revenue New Mexico effortlessly

- Locate Pass Through Entity Taxation And Revenue New Mexico and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Pass Through Entity Taxation And Revenue New Mexico to ensure clear communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pass through entity taxation and revenue new mexico

Create this form in 5 minutes!

People also ask

-

What is nm pte and how does it relate to airSlate SignNow?

NM PTE refers to the document signing platform's capabilities that ensure secure electronic signatures. With airSlate SignNow, businesses can effectively use nm pte to streamline their document workflows while maintaining compliance and security standards.

-

What features does airSlate SignNow offer regarding nm pte?

AirSlate SignNow offers robust features such as customizable templates, real-time tracking, and cloud storage integration under the nm pte category. These features facilitate seamless document preparation and signing, making it a perfect fit for businesses seeking efficiency.

-

How does airSlate SignNow's nm pte pricing compare to other eSignature solutions?

AirSlate SignNow provides competitive pricing for its nm pte offerings, ensuring cost-efficiency for businesses of all sizes. By offering flexible plans, it allows users to choose the best option that fits their budget and document signing needs.

-

What are the benefits of using nm pte with airSlate SignNow?

Using nm pte with airSlate SignNow provides multiple benefits, including enhanced productivity, quicker turnaround times for document approvals, and reduced paper usage. This not only streamlines operations but also contributes to environmental sustainability.

-

Is airSlate SignNow's nm pte solution user-friendly?

Absolutely, airSlate SignNow is designed with ease of use in mind, making nm pte accessible even for those who are not tech-savvy. The intuitive interface allows users to send and eSign documents effortlessly within minutes.

-

Can I integrate other applications with nm pte in airSlate SignNow?

Yes, airSlate SignNow supports numerous integrations that allow you to enhance the nm pte experience further. This means that you can connect with CRM systems, cloud storage services, and other applications to streamline your document management process.

-

What types of documents can I send using airSlate SignNow's nm pte?

You can send a wide variety of documents using airSlate SignNow's nm pte, including contracts, agreements, and invoices. This versatility makes it suitable for several industries seeking efficient document processing solutions.

Get more for Pass Through Entity Taxation And Revenue New Mexico

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497321345 form

- Ny vacate form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential new york form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property new york form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property new 497321349 form

- Conditional waiver 497321351 form

- Ny landlord form

- Unconditional release lien final form

Find out other Pass Through Entity Taxation And Revenue New Mexico

- How To Sign Minnesota Residential lease agreement

- How Can I Sign California Residential lease agreement form

- How To Sign Georgia Residential lease agreement form

- Sign Nebraska Residential lease agreement form Online

- Sign New Hampshire Residential lease agreement form Safe

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe