New Mexico's Elective Pass through Entity Tax Regime 2023

Understanding New Mexico's Elective Pass Through Entity Tax Regime

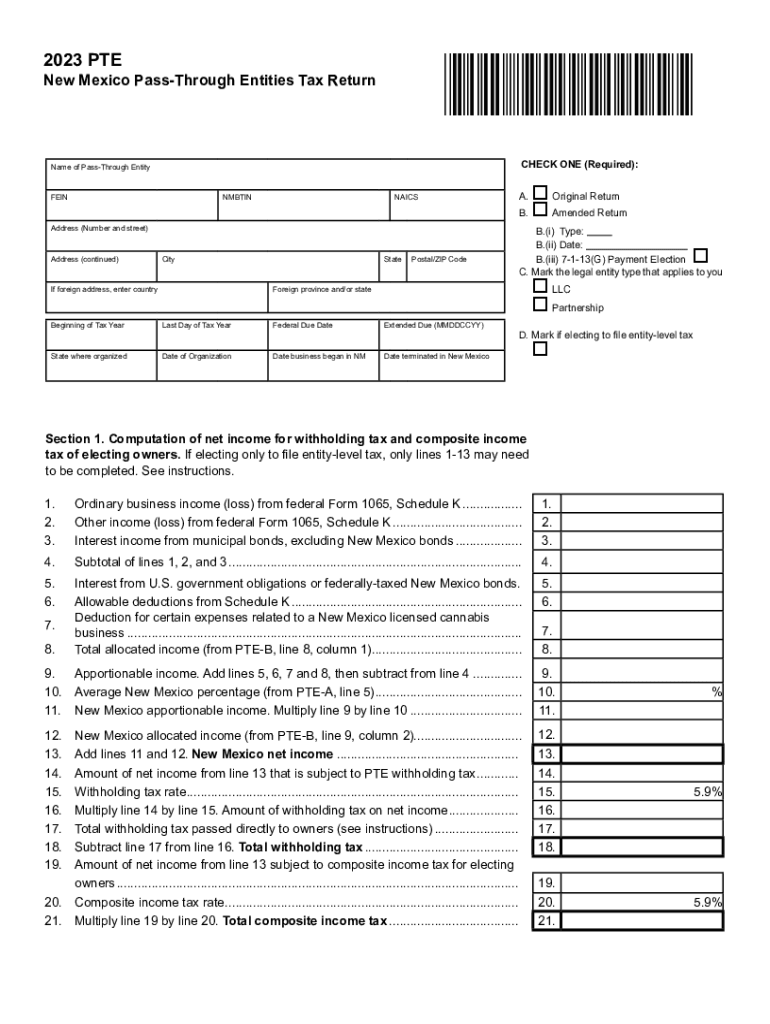

The New Mexico Elective Pass Through Entity (PTE) Tax Regime allows certain business entities to elect to pay state income tax at the entity level rather than having the individual owners pay tax on their share of the income. This regime is particularly beneficial for partnerships, limited liability companies (LLCs), and S corporations, as it can lead to potential tax savings for the owners. By opting into this regime, entities can avoid double taxation and streamline the tax filing process.

Steps to Complete the New Mexico Elective Pass Through Entity Tax Regime

Completing the New Mexico PTE tax process involves several key steps:

- Determine eligibility: Ensure your business qualifies as a pass-through entity under New Mexico law.

- Make the election: Submit the required form to elect into the PTE tax regime, typically done during the tax year.

- Calculate the tax: Compute the tax based on the entity's income, following the applicable tax rates.

- File the return: Complete the New Mexico PTE return, including all necessary schedules and documentation.

- Pay the tax: Ensure timely payment of any tax owed to avoid penalties.

Required Documents for New Mexico PTE Tax Filing

When filing under the New Mexico PTE tax regime, several documents are necessary to ensure compliance:

- The completed New Mexico PTE return form.

- Supporting schedules that detail income, deductions, and credits.

- Documentation proving the entity's election into the PTE tax regime.

- Any additional forms required by the New Mexico Taxation and Revenue Department.

Filing Deadlines and Important Dates

Staying aware of filing deadlines is crucial for compliance with the New Mexico PTE tax regime. Typically, the following dates are important:

- The election to opt into the PTE tax must be made by the due date of the entity's income tax return.

- The PTE return is generally due on the 15th day of the fourth month following the end of the tax year.

- Any tax payments owed should be made by the same deadline to avoid interest and penalties.

Eligibility Criteria for the New Mexico PTE Tax Regime

Not all entities can elect to be taxed under the New Mexico PTE tax regime. The following criteria must be met:

- The entity must be classified as a partnership, LLC, or S corporation under New Mexico law.

- The entity must have chosen to be taxed as a pass-through entity for federal tax purposes.

- All owners must agree to the election to be taxed under the PTE regime.

Penalties for Non-Compliance with New Mexico PTE Tax Regulations

Failure to comply with the New Mexico PTE tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate based on the number of days the return is overdue.

- Interest on unpaid taxes, which is calculated from the due date until the tax is paid in full.

- Potential audits by the New Mexico Taxation and Revenue Department, leading to further scrutiny of the entity's financial records.

Quick guide on how to complete new mexicos elective pass through entity tax regime

Complete New Mexico's Elective Pass Through Entity Tax Regime effortlessly on any device

Digital document management has gained prominence among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents quickly and without delays. Handle New Mexico's Elective Pass Through Entity Tax Regime on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and electronically sign New Mexico's Elective Pass Through Entity Tax Regime with ease

- Locate New Mexico's Elective Pass Through Entity Tax Regime and then click Get Form to begin.

- Utilize our tools to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from your chosen device. Modify and electronically sign New Mexico's Elective Pass Through Entity Tax Regime and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexicos elective pass through entity tax regime

Create this form in 5 minutes!

How to create an eSignature for the new mexicos elective pass through entity tax regime

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the new mexico form pte instructions 2023?

The new mexico form pte instructions 2023 provides detailed guidelines on how to accurately complete the Personal Income Tax Form PTE for New Mexico. By following these instructions, taxpayers can ensure they are filing correctly and taking advantage of any available deductions or credits. Familiarizing yourself with these instructions is crucial for compliance and to avoid potential penalties.

-

How can airSlate SignNow help with the completion of the new mexico form pte instructions 2023?

airSlate SignNow streamlines the document signing process, making it easier to complete the new mexico form pte instructions 2023 efficiently. Our platform allows users to fill out, sign, and send the form securely, ensuring compliance with state regulations. This reduces the hassle of paper forms and facilitates quicker submissions.

-

Are there any costs associated with using airSlate SignNow for new mexico form pte instructions 2023?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for handling documents including the new mexico form pte instructions 2023. You can select a plan that best suits your usage frequency and team size, potentially saving money compared to traditional paper methods.

-

Can airSlate SignNow integrate with other tools for the new mexico form pte instructions 2023?

Absolutely! airSlate SignNow seamlessly integrates with a variety of platforms, enhancing your workflow while completing the new mexico form pte instructions 2023. Whether you use CRM systems or accounting software, our integrations allow for a smooth data flow and efficient document management.

-

What features does airSlate SignNow offer for managing the new mexico form pte instructions 2023?

airSlate SignNow offers key features such as customizable templates, secure cloud storage, and real-time tracking for managing the new mexico form pte instructions 2023. These features help enhance productivity, ensure document security, and provide users with insights about their document status.

-

How does using airSlate SignNow benefit small businesses for new mexico form pte instructions 2023?

Using airSlate SignNow can signNowly benefit small businesses by simplifying the process of completing the new mexico form pte instructions 2023. The platform’s user-friendly interface and cost-effectiveness allow small businesses to focus on core activities rather than paperwork, enabling better productivity and operational efficiency.

-

Is airSlate SignNow compliant with New Mexico state regulations for the new mexico form pte instructions 2023?

Yes, airSlate SignNow maintains compliance with New Mexico state regulations when processing documents, including the new mexico form pte instructions 2023. Our platform adheres to security standards and industry regulations, ensuring that your documents are handled safely and in accordance with legal requirements.

Get more for New Mexico's Elective Pass Through Entity Tax Regime

- Football officials crew card ohio high school athletic association ohsaa form

- Teacher evaluation tool form

- State of ohio performance and payment bond form

- Stna registry ohio form

- Cincinnati form cli 6149

- Marketing materials request form geaugaparkdistrictorg

- Notice to employee this form is being used to document the fod osu

- Ode online fillable iep form

Find out other New Mexico's Elective Pass Through Entity Tax Regime

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement