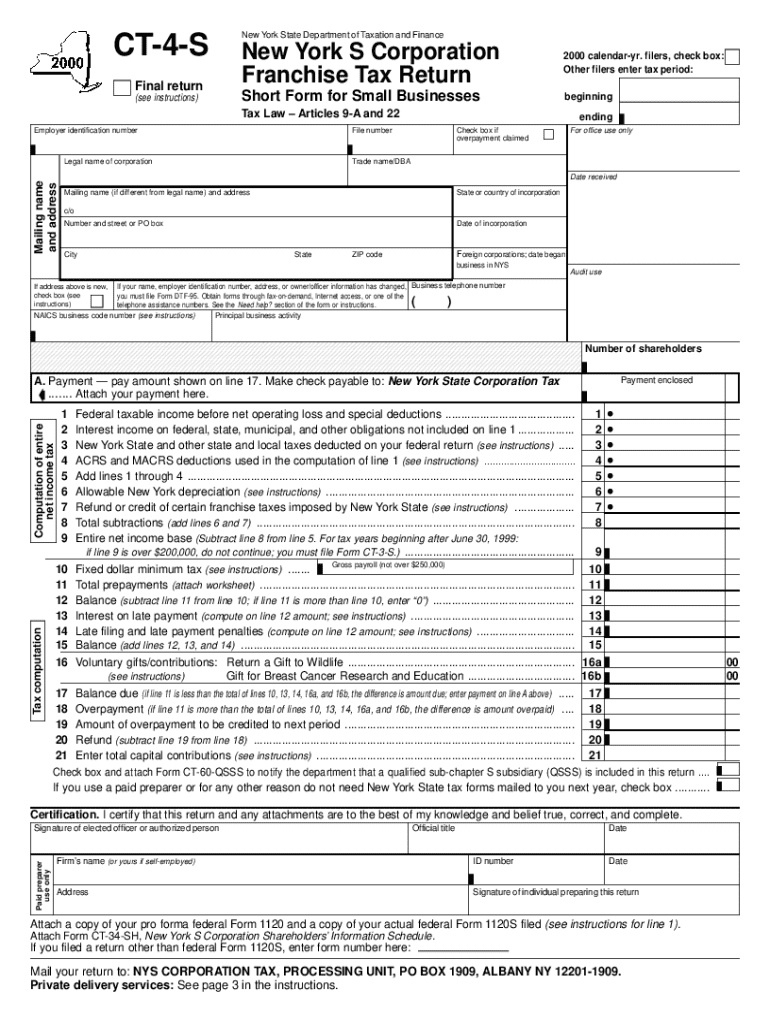

Form CT 4 S 2000-2026

What is the Form CT 4 S

The Form CT 4 S is a state-specific tax form used in Connecticut for S Corporations. This form is essential for reporting income, deductions, and credits specific to S Corporations, which are pass-through entities. The income generated by an S Corporation is passed directly to shareholders, who then report it on their personal tax returns. This form helps ensure that the state tax obligations are met accurately and efficiently.

How to use the Form CT 4 S

Using the Form CT 4 S involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form with the required information, such as income, deductions, and credits. It is important to follow the instructions carefully to avoid errors. Once completed, the form must be submitted to the Connecticut Department of Revenue Services by the specified deadline.

Steps to complete the Form CT 4 S

Completing the Form CT 4 S requires attention to detail. Here are the steps to follow:

- Gather necessary financial records, including previous tax returns.

- Fill in the business information section, including the S Corporation's name and federal employer identification number.

- Report total income and allowable deductions in the appropriate sections.

- Calculate the tax liability based on the provided instructions.

- Review the form for accuracy before submission.

Legal use of the Form CT 4 S

The Form CT 4 S is legally required for S Corporations operating in Connecticut. Proper use of this form ensures compliance with state tax laws. Failing to file or inaccuracies in reporting can lead to penalties. It is crucial for businesses to understand their obligations regarding this form to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 4 S are critical for compliance. Typically, the form must be filed by the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. Staying aware of these deadlines helps avoid penalties and ensures timely processing of tax obligations.

Required Documents

To complete the Form CT 4 S, several documents are necessary:

- Income statements detailing revenue generated by the S Corporation.

- Records of deductible expenses incurred during the tax year.

- Previous tax returns for reference and accuracy.

- Any supporting documentation for credits claimed.

Form Submission Methods

The Form CT 4 S can be submitted through various methods to accommodate different preferences. Businesses can file the form online through the Connecticut Department of Revenue Services website, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate state office or submitted in person at designated locations. Choosing the right submission method can facilitate timely processing.

Create this form in 5 minutes or less

Find and fill out the correct form ct 4 s

Create this form in 5 minutes!

How to create an eSignature for the form ct 4 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 4 S and how can airSlate SignNow help?

Form CT 4 S is a tax form used for certain business tax filings in Connecticut. airSlate SignNow simplifies the process of completing and eSigning Form CT 4 S, ensuring that your documents are filled out accurately and submitted on time.

-

How much does it cost to use airSlate SignNow for Form CT 4 S?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage Form CT 4 S efficiently.

-

What features does airSlate SignNow provide for managing Form CT 4 S?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for Form CT 4 S. These features streamline the process, making it easier to manage your tax documents.

-

Can I integrate airSlate SignNow with other software for Form CT 4 S?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage Form CT 4 S alongside your existing tools. This enhances your workflow and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for Form CT 4 S?

Using airSlate SignNow for Form CT 4 S provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can complete your tax forms faster and with greater accuracy, minimizing the risk of errors.

-

Is airSlate SignNow secure for handling Form CT 4 S?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form CT 4 S. Your data is encrypted and stored securely, ensuring compliance with industry standards.

-

How can I get started with airSlate SignNow for Form CT 4 S?

Getting started with airSlate SignNow for Form CT 4 S is easy. Simply sign up for an account, choose your plan, and start creating or uploading your Form CT 4 S documents to eSign and manage them efficiently.

Get more for Form CT 4 S

Find out other Form CT 4 S

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement