Form 8453 FE 2024-2026

Understanding Form 8453 FE

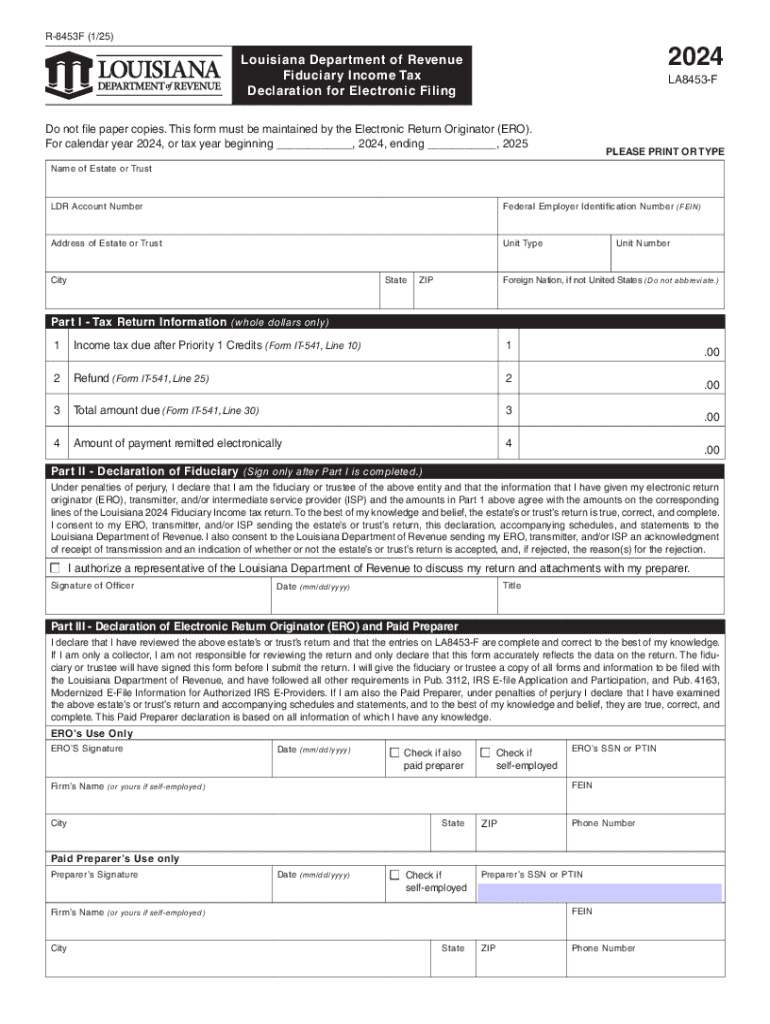

Form 8453 FE is a crucial document used by taxpayers in the United States to authenticate electronic submissions of certain tax forms. This form is specifically designed for filers who are submitting Form 1040 or 1040-SR electronically while also opting to attach specific documents that cannot be submitted online. The form serves as a declaration of the taxpayer's identity and ensures that the information provided is accurate and complete.

How to Use Form 8453 FE

To effectively use Form 8453 FE, taxpayers must first ensure they have completed their electronic tax return. Once the electronic return is prepared, the taxpayer should print Form 8453 FE, sign it, and attach any required documents. This form must then be mailed to the appropriate IRS address provided in the instructions. It is essential to keep a copy of the signed form for personal records.

Steps to Complete Form 8453 FE

Completing Form 8453 FE involves several key steps:

- Gather necessary documents, such as W-2s and other income statements.

- Complete your electronic tax return using tax preparation software.

- Print Form 8453 FE from the software or the IRS website.

- Sign the form where indicated.

- Attach any required supporting documents.

- Mail the completed form to the IRS at the address specified in the form's instructions.

Legal Use of Form 8453 FE

Form 8453 FE is legally binding when signed by the taxpayer. By signing the form, the taxpayer certifies that the information provided in the electronic return is true and correct to the best of their knowledge. The IRS requires this form to maintain the integrity of electronic filings and to ensure compliance with tax regulations. Failure to submit this form when required may result in penalties or delays in processing the tax return.

Filing Deadlines for Form 8453 FE

Taxpayers must be aware of the filing deadlines associated with Form 8453 FE. Generally, the form must be submitted by the same deadline as the electronic tax return, which is typically April 15 for most taxpayers. If additional time is needed, taxpayers may file for an extension, but they must still submit Form 8453 FE by the extended deadline to avoid penalties.

Required Documents for Form 8453 FE

When submitting Form 8453 FE, taxpayers need to include specific documents that support their electronic tax return. Common required documents include:

- W-2 forms from employers

- 1099 forms for other income

- Any schedules or additional forms that support deductions or credits claimed

It is important to review the instructions for Form 8453 FE to ensure all necessary documents are included to avoid processing delays.

Create this form in 5 minutes or less

Find and fill out the correct form 8453 fe

Create this form in 5 minutes!

How to create an eSignature for the form 8453 fe

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8453 FE and how is it used?

Form 8453 FE is a tax form used for electronic filing of federal tax returns. It serves as a declaration that the taxpayer has reviewed their return and authorizes the e-filing process. Using airSlate SignNow, you can easily eSign and submit Form 8453 FE, streamlining your tax filing experience.

-

How does airSlate SignNow simplify the process of signing Form 8453 FE?

airSlate SignNow simplifies the signing process by providing an intuitive platform for eSigning Form 8453 FE. Users can quickly upload their documents, add signatures, and send them securely. This eliminates the need for printing and scanning, making the process faster and more efficient.

-

What are the pricing options for using airSlate SignNow to manage Form 8453 FE?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while providing access to features for managing Form 8453 FE. Visit our pricing page for detailed information on each plan.

-

Can I integrate airSlate SignNow with other software for handling Form 8453 FE?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow for handling Form 8453 FE. You can connect with popular platforms like CRM systems, document management tools, and accounting software to streamline your processes. This integration capability ensures that your eSigning experience is efficient and cohesive.

-

What security measures does airSlate SignNow implement for Form 8453 FE?

airSlate SignNow prioritizes security by employing advanced encryption and authentication protocols for all documents, including Form 8453 FE. Your data is protected throughout the signing process, ensuring confidentiality and compliance with industry standards. This commitment to security gives users peace of mind when handling sensitive tax documents.

-

Is it easy to track the status of Form 8453 FE with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your Form 8453 FE. You can see when the document is viewed, signed, and completed, ensuring you stay informed throughout the process. This transparency helps you manage your documents effectively.

-

What are the benefits of using airSlate SignNow for Form 8453 FE?

Using airSlate SignNow for Form 8453 FE offers numerous benefits, including time savings, increased efficiency, and reduced paperwork. The platform allows for quick eSigning and document management, which can signNowly speed up your tax filing process. Additionally, the user-friendly interface makes it accessible for everyone, regardless of technical expertise.

Get more for Form 8453 FE

- Order appointing guardian 497300545 form

- Notice of appointment of emergency guardian and notice of right to hearing pursuant to 15 14 312 crs colorado form

- Substitute guardian form

- Order appointing guardian for adult colorado form

- Colorado subpoena 497300549 form

- Guardian s report adult colorado form

- Co successor form

- Instructions for appointment of a conservator minor colorado form

Find out other Form 8453 FE

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement