Electronic Return Originator ERO Technical Fact Sheet IRS 2022

What is the Electronic Return Originator ERO Technical Fact Sheet IRS

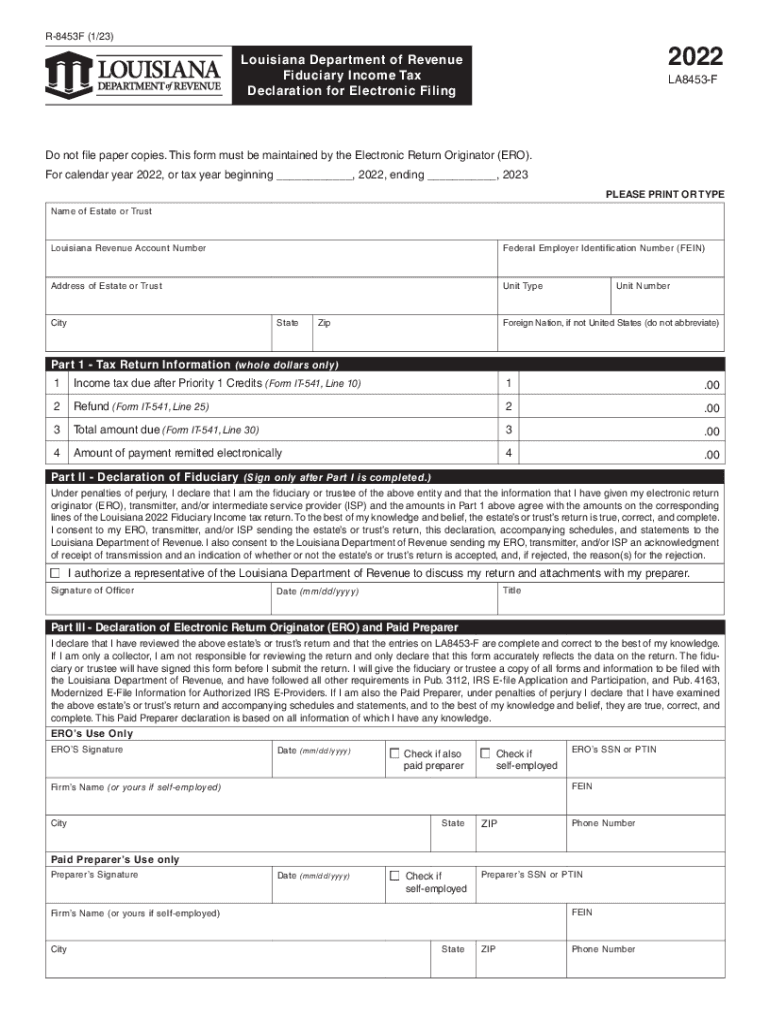

The Electronic Return Originator (ERO) Technical Fact Sheet is a crucial document provided by the IRS that outlines the responsibilities and requirements for EROs when submitting electronic tax returns. This fact sheet serves as a guide for tax professionals who assist clients in filing their income tax returns electronically. It details the necessary procedures, compliance standards, and technical specifications that EROs must follow to ensure accurate and timely submissions.

How to use the Electronic Return Originator ERO Technical Fact Sheet IRS

To effectively use the ERO Technical Fact Sheet, tax professionals should first familiarize themselves with its contents. This involves reviewing the guidelines on electronic filing, understanding the required documentation, and ensuring compliance with IRS regulations. EROs can utilize this fact sheet as a reference during the filing process to confirm that all necessary steps are followed, minimizing the risk of errors or delays in tax return processing.

Steps to complete the Electronic Return Originator ERO Technical Fact Sheet IRS

Completing the ERO Technical Fact Sheet involves several key steps:

- Review the document thoroughly to understand the requirements.

- Gather all necessary information and documentation from clients.

- Ensure compliance with IRS guidelines and technical standards.

- Complete the electronic filing process as outlined in the fact sheet.

- Keep a copy of the completed fact sheet for your records and client reference.

Key elements of the Electronic Return Originator ERO Technical Fact Sheet IRS

Important elements of the ERO Technical Fact Sheet include:

- Definitions of key terms related to electronic filing.

- Requirements for obtaining an ERO status.

- Technical specifications for electronic submissions.

- Compliance obligations for EROs, including security measures.

- Information on penalties for non-compliance with IRS regulations.

IRS Guidelines

The IRS provides comprehensive guidelines that govern the electronic filing of tax returns. These guidelines outline the roles and responsibilities of EROs, the technical requirements for software used in electronic submissions, and the security measures that must be implemented to protect taxpayer information. Staying updated with these guidelines is essential for EROs to ensure compliance and maintain the integrity of the electronic filing process.

Filing Deadlines / Important Dates

Filing deadlines are critical for EROs and their clients. The IRS typically sets specific dates for electronic submissions, including the final deadline for filing individual income tax returns. EROs should be aware of these dates to ensure that all returns are filed on time to avoid penalties. It is advisable to keep a calendar of important tax dates and deadlines to facilitate timely submissions.

Quick guide on how to complete electronic return originator ero technical fact sheet irs

Complete Electronic Return Originator ERO Technical Fact Sheet IRS effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without complications. Manage Electronic Return Originator ERO Technical Fact Sheet IRS on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and eSign Electronic Return Originator ERO Technical Fact Sheet IRS with ease

- Obtain Electronic Return Originator ERO Technical Fact Sheet IRS and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Electronic Return Originator ERO Technical Fact Sheet IRS and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct electronic return originator ero technical fact sheet irs

Create this form in 5 minutes!

How to create an eSignature for the electronic return originator ero technical fact sheet irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska income tax rate for individuals?

The Nebraska income tax rate for individuals varies based on income levels, ranging from 2.46% to 6.84%. It’s important to understand these rates when filing taxes to ensure compliance and optimize deductions. Our airSlate SignNow solution can assist in managing the documentation related to your tax filings efficiently.

-

How does the Nebraska income tax rate affect businesses?

The Nebraska income tax rate impacts businesses by influencing their overall tax liability. Corporations are subject to a flat rate of 5.58% on their taxable income. Having effective document management through airSlate SignNow can streamline the process of filing taxes and maintaining compliance with state tax laws.

-

Are there any tax deductions related to the Nebraska income tax rate?

Yes, there are several deductions available which can effectively lower your taxable income in Nebraska. These include deductions for mortgage interest, property taxes, and certain business expenses. By utilizing airSlate SignNow, you can securely eSign and manage documents related to these deductions, ensuring all your paperwork is in order when filing.

-

How can businesses optimize their tax filings with airSlate SignNow?

Businesses can optimize their tax filings by using airSlate SignNow to organize and eSign necessary documents like W-2s, 1099s, and other relevant tax forms. This automation reduces errors and saves time, while ensuring that everything is compliant with the Nebraska income tax rate. Streamlined documentation will keep your tax processes efficient and worry-free.

-

What integrations does airSlate SignNow offer for tax professionals?

airSlate SignNow offers seamless integrations with various accounting and finance software such as QuickBooks and Xero, enhancing your tax professionals' workflow. This compatibility means that keeping track of deductions and ensuring accurate filings aligned with the Nebraska income tax rate is more manageable. By using these integrations, you maximize efficiency in the tax preparation process.

-

How does airSlate SignNow ensure data security for sensitive tax documents?

airSlate SignNow prioritizes data security through advanced encryption and secure servers, ensuring that sensitive tax documents remain confidential. As you manage documents related to the Nebraska income tax rate, knowing your data is protected gives you peace of mind. Secure document management is essential for maintaining compliance and safeguarding personal information.

-

Is there a trial period available for airSlate SignNow?

Yes, airSlate SignNow offers a trial period that allows prospective users to explore its features without commitment. During this time, you can test how effectively the platform can aid you in managing documents related to the Nebraska income tax rate. The trial empowers you to make informed decisions about the benefits of our eSigning solution.

Get more for Electronic Return Originator ERO Technical Fact Sheet IRS

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children texas form

- Claim against form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497327206 form

- Tx corporation search 497327207 form

- Texas corporation 497327208 form

- Professional corporation package for texas texas form

- Texas pre incorporation agreement shareholders agreement and confidentiality agreement texas form

- Domestic for profit corporation texas form

Find out other Electronic Return Originator ERO Technical Fact Sheet IRS

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template