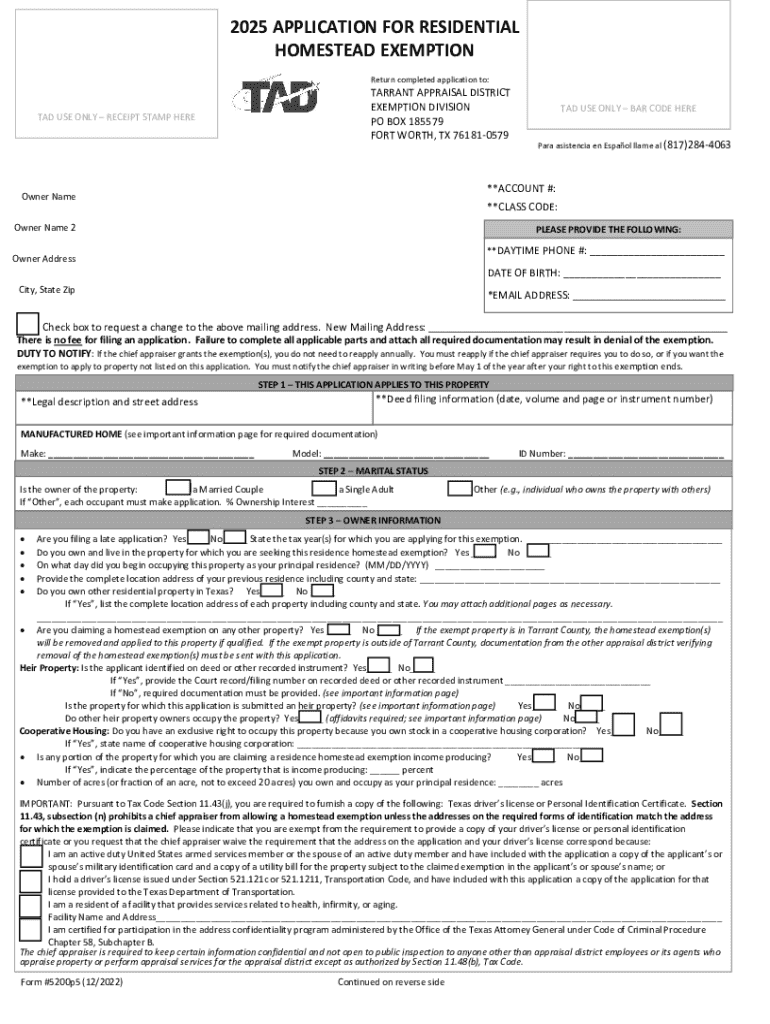

Applying for a Homestead Exemption Form

What is the 5200 homestead exemption?

The 5200 homestead exemption is a property tax exemption available to homeowners in Texas. This exemption reduces the taxable value of a home, which can lead to significant savings on property taxes. To qualify, the property must be the owner's primary residence, and the homeowner must meet specific eligibility criteria set by the local appraisal district.

Eligibility criteria for the 5200 homestead exemption

To qualify for the 5200 homestead exemption, homeowners must meet several criteria:

- The property must be the owner's principal residence.

- The owner must be a Texas resident.

- The owner must not claim a homestead exemption on any other property.

- The application must be submitted by the deadline established by the local appraisal district.

Steps to complete the 5200 homestead exemption application

Completing the 5200 homestead exemption application involves several steps:

- Obtain the TAD 5200 form from the local appraisal district or download it from their website.

- Fill out the form with accurate information, including property details and ownership status.

- Gather required documents, such as proof of residency and identification.

- Submit the completed form and documents to the local appraisal district by mail or in person.

Required documents for the 5200 homestead exemption

When applying for the 5200 homestead exemption, homeowners must provide certain documents to support their application:

- Proof of identity, such as a driver's license or state ID.

- Documentation proving residency, such as utility bills or bank statements.

- Any additional information required by the local appraisal district, which may vary by location.

Form submission methods for the 5200 homestead exemption

Homeowners can submit their 5200 homestead exemption applications through various methods:

- Online submission via the local appraisal district's website, if available.

- Mailing the completed form to the appropriate address of the appraisal district.

- In-person submission at the local appraisal district office during business hours.

Filing deadlines for the 5200 homestead exemption

It is crucial for homeowners to be aware of the filing deadlines for the 5200 homestead exemption. Typically, applications must be submitted by April 30 of the tax year for which the exemption is sought. However, specific dates may vary by local appraisal district, so it is advisable to check with the district for the exact deadline.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the applying for a homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5200 homestead exemption?

The 5200 homestead exemption is a property tax exemption that reduces the taxable value of a primary residence. This exemption can signNowly lower your property tax bill, making homeownership more affordable. Understanding how the 5200 homestead exemption works is essential for homeowners looking to maximize their savings.

-

How can airSlate SignNow help with the 5200 homestead exemption application process?

airSlate SignNow streamlines the application process for the 5200 homestead exemption by allowing you to easily fill out and eSign necessary documents. Our platform ensures that your applications are submitted quickly and securely, reducing the hassle of paperwork. With airSlate SignNow, you can focus on what matters most—your home.

-

Are there any fees associated with applying for the 5200 homestead exemption using airSlate SignNow?

Using airSlate SignNow to apply for the 5200 homestead exemption is cost-effective, with no hidden fees. Our pricing plans are designed to fit various budgets, ensuring that you can access essential eSigning features without breaking the bank. Enjoy the benefits of our platform while saving on application costs.

-

What features does airSlate SignNow offer for managing the 5200 homestead exemption documents?

airSlate SignNow provides a range of features to manage your 5200 homestead exemption documents efficiently. You can create templates, track document status, and securely store your files in the cloud. These features simplify the management of your exemption paperwork, making the process seamless.

-

Can I integrate airSlate SignNow with other tools for the 5200 homestead exemption?

Yes, airSlate SignNow offers integrations with various tools that can assist in managing your 5200 homestead exemption. Whether you use CRM systems or document management software, our platform can connect with them to enhance your workflow. This integration capability ensures a smooth experience when handling your exemption documents.

-

What are the benefits of using airSlate SignNow for the 5200 homestead exemption?

Using airSlate SignNow for the 5200 homestead exemption offers numerous benefits, including time savings and increased efficiency. Our user-friendly interface allows you to complete and eSign documents quickly, reducing the time spent on paperwork. Additionally, our secure platform ensures that your sensitive information is protected throughout the process.

-

Is airSlate SignNow suitable for both individuals and businesses applying for the 5200 homestead exemption?

Absolutely! airSlate SignNow is designed to cater to both individuals and businesses seeking the 5200 homestead exemption. Our flexible platform accommodates various needs, whether you're a homeowner or a real estate professional assisting clients with their exemption applications.

Get more for Applying For A Homestead Exemption

Find out other Applying For A Homestead Exemption

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document