Form it 223 Innovation Hot Spot Deduction Tax Year 2024-2026

What is the Form IT-223 Innovation Hot Spot Deduction Tax Year

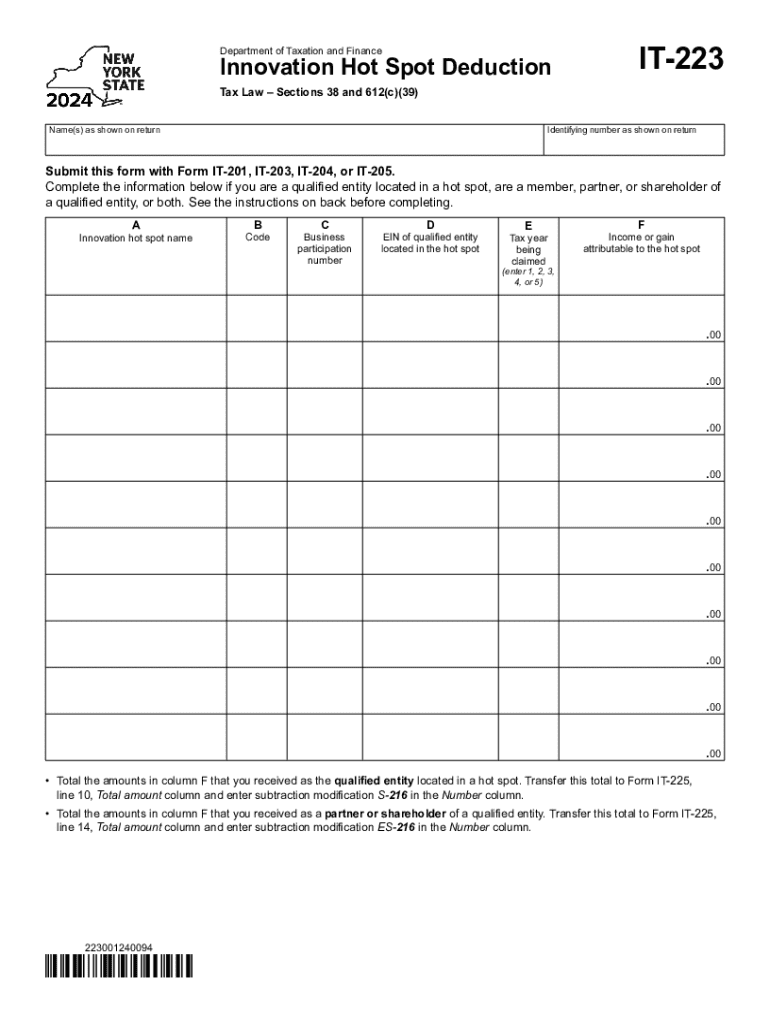

The Form IT-223 is a tax form used in New York for claiming the Innovation Hot Spot Deduction. This deduction is designed to encourage businesses located in designated innovation hot spots to invest in research and development activities. By utilizing this form, eligible businesses can reduce their taxable income, ultimately lowering their tax liability. The form is specifically tailored for the tax year in which the deduction is being claimed, ensuring that businesses can take advantage of the benefits during the appropriate tax period.

How to use the Form IT-223 Innovation Hot Spot Deduction Tax Year

Using the Form IT-223 involves several steps to ensure accurate completion and submission. First, businesses need to determine their eligibility based on the criteria established by the New York State Department of Taxation and Finance. Once eligibility is confirmed, businesses should gather all necessary documentation, including proof of location within an innovation hot spot and records of qualifying research and development expenses. After filling out the form, it should be submitted along with the business's tax return, either electronically or by mail, depending on the filing method chosen.

Steps to complete the Form IT-223 Innovation Hot Spot Deduction Tax Year

Completing the Form IT-223 requires careful attention to detail. Here are the steps to follow:

- Review the eligibility criteria for the Innovation Hot Spot Deduction.

- Gather supporting documents, such as financial statements and expense reports.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check calculations related to the deduction amount.

- Submit the form along with your tax return by the specified deadline.

Eligibility Criteria

To qualify for the Innovation Hot Spot Deduction using Form IT-223, businesses must meet specific eligibility criteria. These criteria include being located in a designated innovation hot spot, engaging in qualified research and development activities, and having a valid business registration in New York. Additionally, the business must demonstrate that the expenses claimed on the form directly relate to the innovation activities conducted within the hot spot area.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT-223 align with the standard tax return deadlines for businesses in New York. Typically, businesses must submit their tax returns by March 15 for corporations and April 15 for individuals and partnerships. It is essential to be aware of any changes to these dates, as well as any extensions that may apply, to ensure timely submission of the form and avoid penalties.

Key elements of the Form IT-223 Innovation Hot Spot Deduction Tax Year

The Form IT-223 includes several key elements that must be completed for a successful submission. These elements consist of the business's identification information, details regarding the innovation hot spot location, and a breakdown of qualifying expenses. Additionally, the form requires a calculation of the deduction amount being claimed, which must be supported by the documentation provided. Accurate completion of these elements is crucial for maximizing the benefits of the deduction.

Create this form in 5 minutes or less

Find and fill out the correct form it 223 innovation hot spot deduction tax year 772088479

Create this form in 5 minutes!

How to create an eSignature for the form it 223 innovation hot spot deduction tax year 772088479

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the New York spot?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents seamlessly. In the New York spot, it provides a cost-effective way for companies to manage their document workflows efficiently, ensuring compliance and security.

-

How much does airSlate SignNow cost for businesses in the New York spot?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be budget-friendly for businesses in the New York spot. You can select from various subscription options that cater to different needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for users in the New York spot?

airSlate SignNow offers a range of features including document templates, real-time tracking, and secure eSigning. For users in the New York spot, these features enhance productivity and streamline the signing process, making it easier to manage documents.

-

Can airSlate SignNow integrate with other tools commonly used in the New York spot?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Microsoft Office. This makes it an ideal choice for businesses in the New York spot looking to enhance their existing workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow in the New York spot?

Using airSlate SignNow in the New York spot offers numerous benefits, including faster document turnaround times and improved collaboration. It empowers businesses to operate more efficiently, reducing the time spent on manual processes and enhancing overall productivity.

-

Is airSlate SignNow secure for businesses in the New York spot?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Businesses in the New York spot can trust that their documents are protected, ensuring confidentiality and integrity throughout the signing process.

-

How can I get started with airSlate SignNow in the New York spot?

Getting started with airSlate SignNow in the New York spot is easy. Simply visit our website, choose a plan that suits your needs, and sign up for an account. You'll be able to start sending and signing documents in no time.

Get more for Form IT 223 Innovation Hot Spot Deduction Tax Year

- Online haccp forms

- Enlisted record brief form

- Christian life school of theology form

- Transcript request form the purpose of this form i

- Mercyhurst transcript form

- Michigan uniform undergraduate guest application fillable

- Trident university transcript request form

- Oakton community college transcripts form

Find out other Form IT 223 Innovation Hot Spot Deduction Tax Year

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form