California Form 3525 Substitute for Form W 2, Wage and Tax Statement, or Form 1099 R, Distributions from Pensions, Annuities, Re 2024-2026

Understanding the California Form 3525

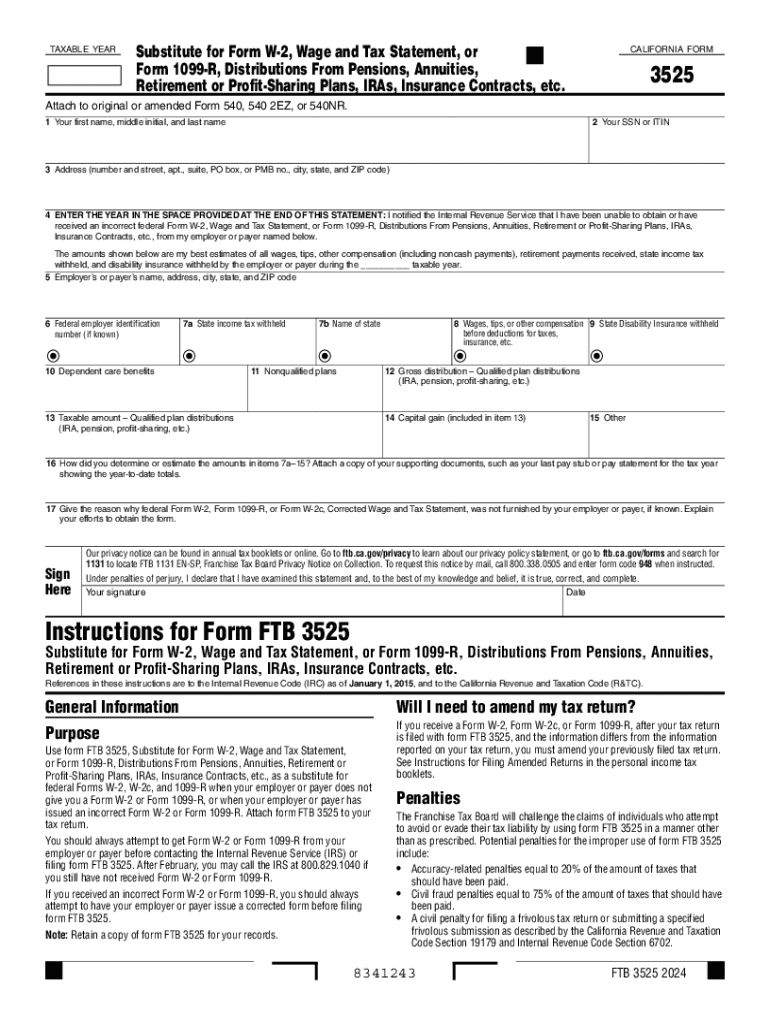

The California Form 3525 serves as a substitute for the federal Form W-2 and Form 1099-R. It is primarily used to report wages and tax information for California residents. This form is essential for individuals receiving income from pensions, annuities, retirement plans, or other distributions. By using Form 3525, taxpayers can ensure that their income is accurately reported to the California Franchise Tax Board, which is crucial for compliance with state tax regulations.

Steps to Complete the California Form 3525

Completing the California Form 3525 involves several key steps:

- Gather necessary documentation, including your Social Security number, income details, and any relevant tax documents.

- Fill out the form accurately, ensuring all income sources are reported and any deductions are correctly applied.

- Review the completed form for any errors or omissions before submission.

- Submit the form either electronically or via mail, depending on your preference and the requirements set by the California Franchise Tax Board.

Obtaining the California Form 3525

The California Form 3525 can be obtained through various means. It is available on the California Franchise Tax Board's official website, where taxpayers can download and print the form. Additionally, local tax offices may provide physical copies. It is important to ensure you have the most current version of the form to avoid any compliance issues.

Key Elements of the California Form 3525

When filling out the California Form 3525, there are several key elements to consider:

- Personal Information: This includes your name, address, and Social Security number.

- Income Reporting: Clearly list all sources of income, including pension distributions and any other taxable amounts.

- Tax Withholding: Indicate any state taxes that have been withheld from your income.

- Signature: Ensure that the form is signed and dated to validate the information provided.

Legal Use of the California Form 3525

The California Form 3525 is legally recognized for reporting income and tax information. It is essential for compliance with state tax laws, and failure to use this form correctly can result in penalties. Taxpayers should familiarize themselves with the legal implications of the information reported on this form, as it can affect their overall tax liability and compliance status.

Filing Deadlines for the California Form 3525

Timely filing of the California Form 3525 is crucial. The form must be submitted by the tax filing deadline, which typically aligns with federal tax deadlines. For most individuals, this is April 15 of each year. However, it is advisable to check for any updates or changes to deadlines that may occur due to specific circumstances or state regulations.

Create this form in 5 minutes or less

Find and fill out the correct california form 3525 substitute for form w 2 wage and tax statement or form 1099 r distributions from pensions annuities 772090729

Create this form in 5 minutes!

How to create an eSignature for the california form 3525 substitute for form w 2 wage and tax statement or form 1099 r distributions from pensions annuities 772090729

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb form 3525?

The ftb form 3525 is a California tax form used for reporting certain tax-related information. It is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding how to properly fill out the ftb form 3525 can help avoid penalties and streamline the filing process.

-

How can airSlate SignNow help with the ftb form 3525?

airSlate SignNow simplifies the process of completing and eSigning the ftb form 3525. Our platform allows users to easily upload, fill out, and send the form securely. This ensures that your tax documents are handled efficiently and in compliance with California regulations.

-

Is there a cost associated with using airSlate SignNow for the ftb form 3525?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing excellent value for features like eSigning and document management, including the ftb form 3525. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the ftb form 3525?

airSlate SignNow provides a range of features for managing the ftb form 3525, including customizable templates, secure eSigning, and real-time tracking. These features enhance the efficiency of document handling and ensure that your forms are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other applications for the ftb form 3525?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the ftb form 3525. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the ftb form 3525?

Using airSlate SignNow for the ftb form 3525 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, making it easier to manage your tax filings and maintain compliance.

-

Is airSlate SignNow user-friendly for completing the ftb form 3525?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users of all skill levels to easily navigate the platform and complete the ftb form 3525 without any hassle. Our step-by-step guidance ensures a smooth experience from start to finish.

Get more for California Form 3525 Substitute For Form W 2, Wage And Tax Statement, Or Form 1099 R, Distributions From Pensions, Annuities, Re

Find out other California Form 3525 Substitute For Form W 2, Wage And Tax Statement, Or Form 1099 R, Distributions From Pensions, Annuities, Re

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure