Form it 360 1 New York Change of City Resident in Lacerte 2024-2026

Understanding the 360 1 Form: New York Change of City Resident

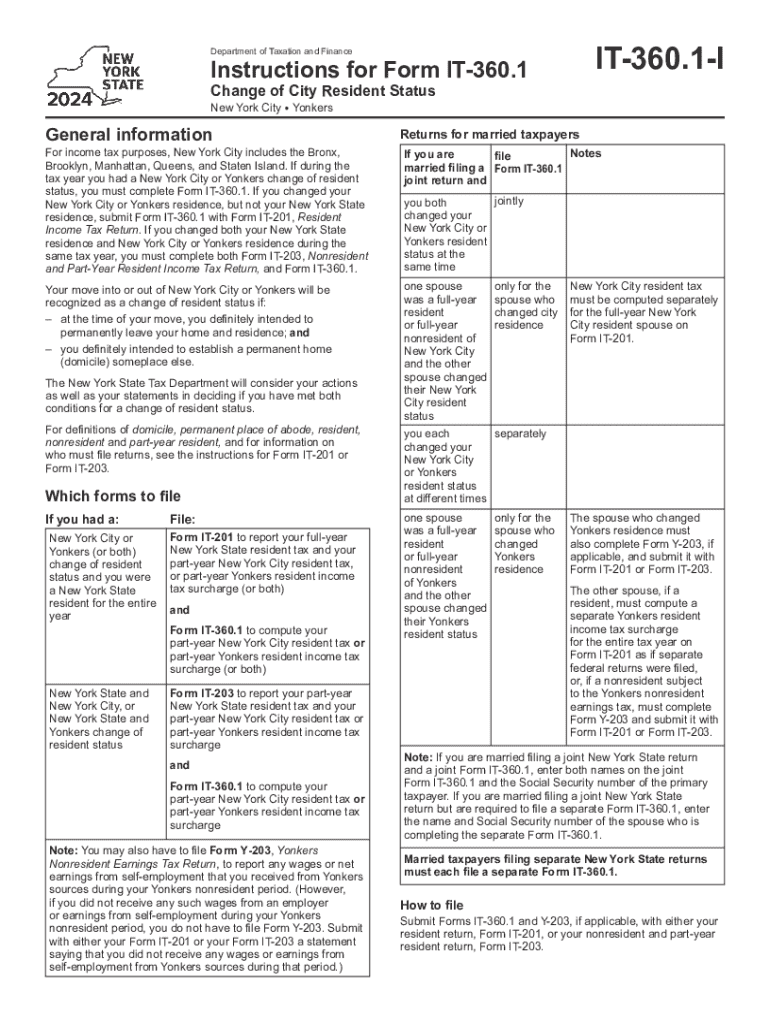

The 360 1 form, officially known as the New York Change of City Resident form, is used by individuals who have changed their city of residence within New York State. This form is crucial for ensuring that your local tax obligations are accurately reflected based on your current residency status. It helps update your information with the New York State Department of Taxation and Finance, which is essential for proper tax assessment and compliance.

Steps to Complete the 360 1 Form

Completing the 360 1 form involves several key steps:

- Gather Required Information: Collect personal details, including your previous and current addresses, Social Security number, and any relevant tax identification numbers.

- Fill Out the Form: Accurately enter your information in the designated fields. Ensure that there are no errors, as inaccuracies can lead to processing delays.

- Review Your Submission: Double-check all entries for completeness and correctness. This step is crucial to avoid complications with your tax records.

- Submit the Form: Choose your preferred method of submission, whether online, by mail, or in person, and follow the instructions accordingly.

Obtaining the 360 1 Form

The 360 1 form can be obtained through several channels:

- Online: Visit the New York State Department of Taxation and Finance website to download the form directly.

- Local Tax Offices: You can also request a physical copy at your local tax office or municipal building.

- Tax Preparation Software: Many tax preparation software programs include the 360 1 form as part of their offerings, allowing for easy access and completion.

Legal Use of the 360 1 Form

The legal use of the 360 1 form ensures compliance with New York State tax laws. By submitting this form, you formally notify the tax authorities of your change in residency, which is essential for determining your local tax obligations. Failure to submit this form can result in miscalculated taxes and potential penalties.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines associated with the 360 1 form. Generally, you should submit the form as soon as you change your residency to avoid any complications with your tax filings. Specific deadlines may vary depending on local tax regulations, so it is advisable to check with the New York State Department of Taxation and Finance for the most accurate information.

Required Documents for Submission

When submitting the 360 1 form, you may need to provide additional documentation to support your residency change. This can include:

- Proof of Residency: Documents such as utility bills, lease agreements, or government correspondence showing your new address.

- Identification: A valid form of identification, such as a driver’s license or state ID, may be required to verify your identity.

Create this form in 5 minutes or less

Find and fill out the correct form it 360 1 new york change of city resident in lacerte

Create this form in 5 minutes!

How to create an eSignature for the form it 360 1 new york change of city resident in lacerte

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 360 1 form and how does it work?

A 360 1 form is a comprehensive document designed for efficient data collection and processing. With airSlate SignNow, you can easily create, send, and eSign 360 1 forms, streamlining your workflow and ensuring accuracy in your documentation.

-

How can I integrate the 360 1 form with other applications?

airSlate SignNow offers seamless integrations with various applications, allowing you to connect your 360 1 form with tools like CRM systems, cloud storage, and project management software. This integration enhances your productivity by automating data transfer and reducing manual entry.

-

What are the pricing options for using the 360 1 form?

airSlate SignNow provides flexible pricing plans tailored to different business needs. You can choose a plan that includes features for creating and managing 360 1 forms, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the 360 1 form?

With airSlate SignNow, you can customize your 360 1 form with various fields, templates, and branding options. Additionally, the platform supports advanced features like automated workflows and real-time tracking, enhancing the overall user experience.

-

What are the benefits of using a 360 1 form for my business?

Using a 360 1 form can signNowly improve your business processes by reducing paperwork and increasing efficiency. airSlate SignNow allows for quick eSigning and document management, which can lead to faster decision-making and improved customer satisfaction.

-

Is it easy to create a 360 1 form with airSlate SignNow?

Yes, creating a 360 1 form with airSlate SignNow is straightforward and user-friendly. The platform provides intuitive tools and templates that guide you through the process, making it accessible even for those with limited technical skills.

-

Can I track the status of my 360 1 form submissions?

Absolutely! airSlate SignNow offers real-time tracking for all your 360 1 form submissions. You can easily monitor who has viewed or signed the document, ensuring you stay informed throughout the process.

Get more for Form IT 360 1 New York Change Of City Resident In Lacerte

Find out other Form IT 360 1 New York Change Of City Resident In Lacerte

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF