Form CT DRS CT 945 Fill Online, Printable

What is the Form CT DRS CT 945 Fill Online, Printable

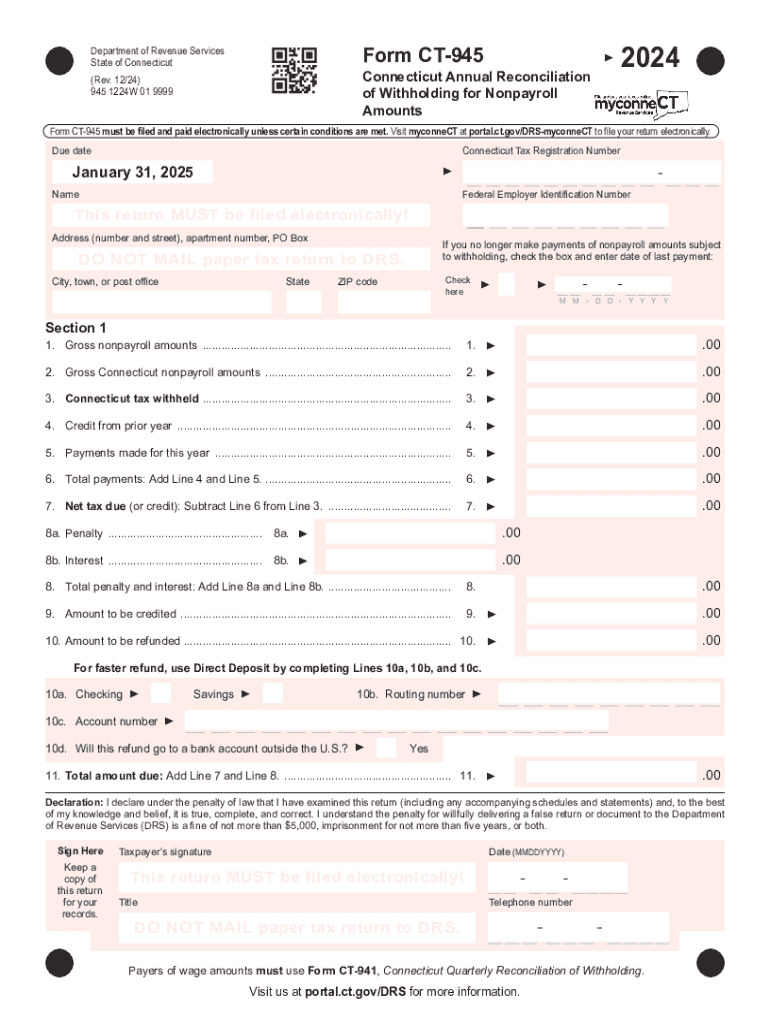

The Form CT DRS CT 945 is a tax form used by businesses in Connecticut to report and reconcile income tax withholding. This form is essential for employers who withhold income taxes from their employees' wages. The 945 form allows businesses to accurately report the total amount withheld and remit the appropriate payments to the state. It is available in both online and printable formats, making it accessible for various filing preferences.

Steps to complete the Form CT DRS CT 945 Fill Online, Printable

Completing the Form CT DRS CT 945 involves several key steps:

- Gather necessary information, including employer identification details and the total amount of withholding.

- Access the online form through the official Connecticut Department of Revenue Services website or download the printable version.

- Fill in the required fields, ensuring accurate reporting of all withheld amounts.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your chosen method.

Key elements of the Form CT DRS CT 945 Fill Online, Printable

Understanding the key elements of the Form CT DRS CT 945 is crucial for accurate completion. The form typically includes:

- Employer Information: This section requires details about the employer, including name, address, and identification number.

- Withholding Amounts: Employers must report the total income tax withheld from employees during the reporting period.

- Payment Information: This section outlines the payment methods and deadlines for remitting the withheld taxes.

- Signature: The form must be signed by an authorized representative of the business, affirming the accuracy of the information provided.

Legal use of the Form CT DRS CT 945 Fill Online, Printable

The legal use of the Form CT DRS CT 945 is essential for compliance with state tax laws. Employers are required to file this form annually to report withholding amounts accurately. Failure to file or incorrect reporting can result in penalties and interest charges. It is important to understand the legal implications of this form to avoid potential issues with the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT DRS CT 945 are critical for compliance. Typically, the form must be submitted by January thirty-first of the year following the tax year being reported. Employers should also be aware of any additional deadlines for making payments related to the withheld taxes to avoid penalties. Keeping track of these dates ensures timely filing and remittance.

Form Submission Methods (Online / Mail / In-Person)

The Form CT DRS CT 945 can be submitted through various methods to accommodate different preferences:

- Online Submission: Employers can fill out and submit the form electronically through the Connecticut Department of Revenue Services website.

- Mail Submission: For those who prefer a paper format, the completed form can be printed and mailed to the designated address.

- In-Person Submission: Employers may also have the option to submit the form in person at local tax offices, depending on state guidelines.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct drs ct 945 fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 945 drs fill feature in airSlate SignNow?

The 945 drs fill feature in airSlate SignNow allows users to easily fill out and sign documents electronically. This feature streamlines the document management process, making it efficient and user-friendly for businesses of all sizes.

-

How does airSlate SignNow's 945 drs fill feature improve workflow?

By utilizing the 945 drs fill feature, businesses can signNowly enhance their workflow. It reduces the time spent on manual document handling, allowing teams to focus on more critical tasks while ensuring that all documents are filled out accurately and promptly.

-

What are the pricing options for using the 945 drs fill feature?

airSlate SignNow offers competitive pricing plans that include access to the 945 drs fill feature. Depending on your business needs, you can choose from various subscription tiers that provide different levels of functionality and support.

-

Can I integrate the 945 drs fill feature with other applications?

Yes, the 945 drs fill feature in airSlate SignNow can be seamlessly integrated with various applications. This allows businesses to connect their existing tools and enhance their document management processes without any disruptions.

-

What benefits does the 945 drs fill feature provide for remote teams?

The 945 drs fill feature is particularly beneficial for remote teams, as it enables them to collaborate on documents from anywhere. This feature ensures that all team members can fill out and sign documents in real-time, improving efficiency and reducing delays.

-

Is the 945 drs fill feature secure for sensitive documents?

Absolutely, the 945 drs fill feature in airSlate SignNow is designed with security in mind. It employs advanced encryption and compliance measures to protect sensitive documents, ensuring that your data remains safe throughout the signing process.

-

How can I get started with the 945 drs fill feature?

Getting started with the 945 drs fill feature is easy. Simply sign up for an airSlate SignNow account, choose a pricing plan that suits your needs, and you can begin using the feature to fill out and sign documents instantly.

Get more for Form CT DRS CT 945 Fill Online, Printable

- Overdraft program disclosure form

- Form 710 updated 04 12 23 1 pdf

- Sample quiet title complaint 495567773 form

- Answer affirmative defenses court form

- Hastings shopwatch mg11 blank form

- Immigration reference letter sample letters ampampamp templates form

- Mobile home lot rental agreement pdf form

- Subcontractor39s requisition for payment haskell form

Find out other Form CT DRS CT 945 Fill Online, Printable

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF