Form CT 241 Claim for Clean Heating Fuel Credit Tax Year

Understanding the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

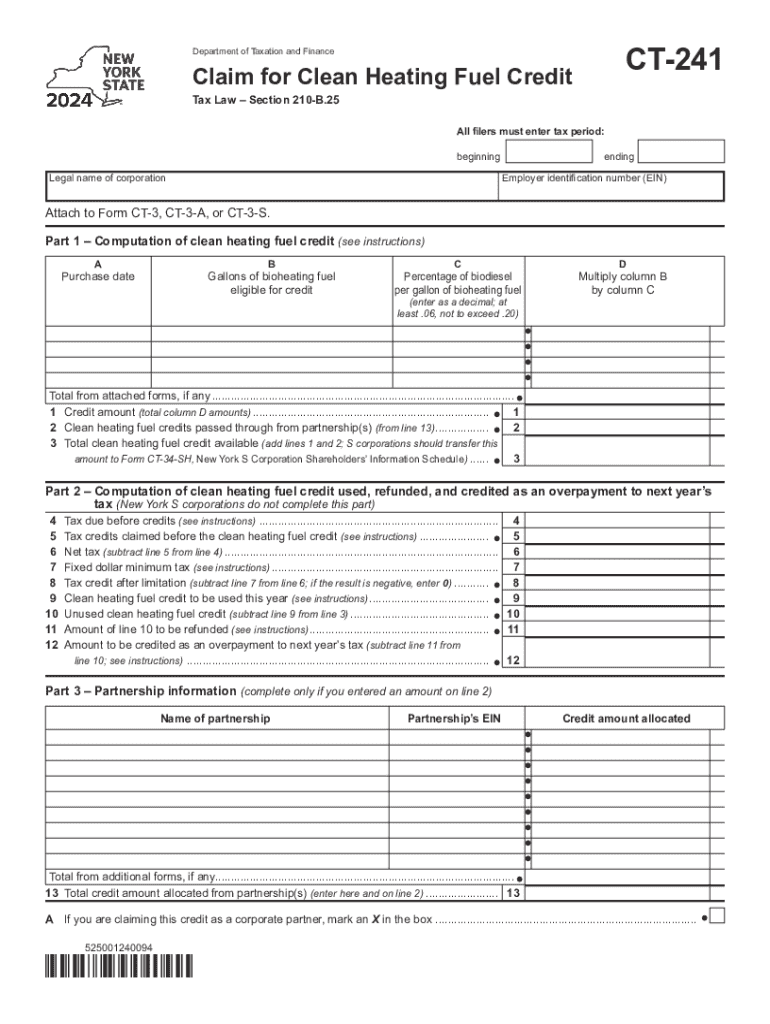

The Form CT 241 is designed for taxpayers in Connecticut who wish to claim a clean heating fuel credit. This credit is available for those who utilize clean heating fuels to heat their homes or businesses. The form allows eligible individuals to receive a tax credit based on the amount of clean heating fuel purchased during the tax year. Understanding the specifics of this form is crucial for ensuring accurate claims and maximizing potential credits.

How to Complete the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

Filling out the Form CT 241 requires careful attention to detail. Start by gathering all necessary documentation related to your clean heating fuel purchases. This may include receipts and invoices. The form will ask for information such as your name, address, and Social Security number, along with details about the fuel purchased. Ensure that all figures are accurate and that you have calculated your credit based on the guidelines provided by the state.

Eligibility Criteria for the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

To qualify for the clean heating fuel credit, you must meet specific eligibility requirements. Primarily, you must be a resident of Connecticut and have purchased clean heating fuel for your primary residence or business during the tax year. Additionally, the fuel must meet the state's definition of clean heating fuel, which is typically less polluting than traditional heating fuels. Review the eligibility criteria carefully to avoid any potential issues with your claim.

Required Documents for the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

When preparing to submit the Form CT 241, it is essential to have all required documents ready. These documents include proof of purchase for the clean heating fuel, such as receipts or invoices. You may also need to provide your tax returns from the previous year to establish your eligibility. Keeping these documents organized will streamline the filing process and help ensure that your claim is processed efficiently.

Filing Deadlines for the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

Timely submission of the Form CT 241 is crucial to receiving your credit. The filing deadline typically aligns with the state income tax return deadlines. For most taxpayers, this means the form should be submitted by April 15 of the following tax year. However, it is advisable to check for any updates or changes to deadlines, as they may vary based on specific circumstances or state regulations.

Submission Methods for the Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

The Form CT 241 can be submitted through various methods, providing flexibility for taxpayers. You may choose to file the form online through the Connecticut Department of Revenue Services website, which offers a streamlined process. Alternatively, you can mail a paper version of the form to the appropriate state address. In-person submissions may also be possible at designated state offices, allowing for direct assistance if needed.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 241 claim for clean heating fuel credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 241 new state feature in airSlate SignNow?

The 241 new state feature in airSlate SignNow allows users to streamline their document signing process by providing enhanced customization options. This feature enables businesses to create tailored workflows that meet their specific needs, ensuring a more efficient signing experience.

-

How does airSlate SignNow pricing work for the 241 new state feature?

airSlate SignNow offers competitive pricing plans that include access to the 241 new state feature. Depending on your business size and needs, you can choose from various subscription tiers that provide flexibility and cost-effectiveness.

-

What are the benefits of using the 241 new state feature?

The 241 new state feature enhances document management by allowing users to create custom signing workflows. This leads to increased efficiency, reduced turnaround times, and improved collaboration among team members, making it a valuable tool for any business.

-

Can I integrate the 241 new state feature with other applications?

Yes, airSlate SignNow supports integrations with various applications, allowing you to leverage the 241 new state feature seamlessly. This means you can connect your existing tools and enhance your document workflows without any hassle.

-

Is the 241 new state feature suitable for small businesses?

Absolutely! The 241 new state feature is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective solutions make it an ideal choice for those looking to improve their document signing processes.

-

How secure is the 241 new state feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and the 241 new state feature is no exception. The platform employs advanced encryption and compliance measures to ensure that your documents and data remain safe throughout the signing process.

-

What types of documents can I use with the 241 new state feature?

You can use the 241 new state feature with a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to streamline their entire document workflow, making it easier to manage and sign important paperwork.

Get more for Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

- Sheetrock drywall contract for contractor new york form

- Flooring contract template 497321098 form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract new york form

- Notice of intent to enforce forfeiture provisions of contact for deed new york form

- Final notice of forfeiture and request to vacate property under contract for deed new york form

- Buyers request for accounting from seller under contract for deed new york form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed new york form

- General notice of default for contract for deed new york form

Find out other Form CT 241 Claim For Clean Heating Fuel Credit Tax Year

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple