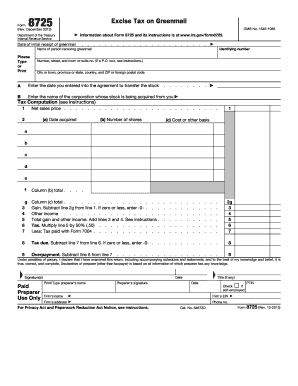

Form 8725 2013

What is the Form 8725

The Form 8725 is a tax form used by businesses to report certain transactions related to the sale or exchange of real estate. Specifically, it is utilized for reporting the sale of a principal residence as well as other real estate transactions that may qualify for tax relief under specific conditions. This form is essential for ensuring compliance with IRS regulations and helps taxpayers accurately report their financial activities related to real estate.

How to use the Form 8725

Using the Form 8725 involves several steps to ensure proper completion and submission. Taxpayers must first gather all necessary documentation related to their real estate transactions, including purchase agreements, closing statements, and any relevant financial records. Once the required information is collected, the taxpayer can fill out the form, providing details about the transaction, such as the sale price, date of sale, and any applicable deductions. After completing the form, it must be submitted to the IRS as part of the taxpayer's annual tax return.

Steps to complete the Form 8725

Completing the Form 8725 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documents related to the real estate transaction.

- Fill out the taxpayer information section, including name, address, and Social Security number.

- Provide details about the property sold, including its address and the date of sale.

- Report the sale price and any adjustments to the basis of the property.

- Indicate whether the sale qualifies for any exemptions or deductions.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 8725. Generally, the form must be submitted along with the taxpayer's annual income tax return, which is typically due on April fifteenth of each year. However, if the taxpayer files for an extension, the deadline may be extended to October fifteenth. Being aware of these dates helps ensure timely compliance and avoids potential penalties.

Required Documents

To successfully complete and file the Form 8725, several documents are necessary. These include:

- Closing statements from the sale of the property.

- Purchase agreements and contracts related to the transaction.

- Records of any improvements made to the property that may affect its basis.

- Documentation of any claimed deductions or exemptions.

Penalties for Non-Compliance

Failure to file the Form 8725 or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filings, and taxpayers may also be subject to additional taxes if the form is not submitted correctly. It is essential to understand the importance of compliance to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct form 8725

Create this form in 5 minutes!

How to create an eSignature for the form 8725

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8725 and how can airSlate SignNow help?

Form 8725 is a tax form used for reporting certain transactions related to the IRS. airSlate SignNow simplifies the process of completing and eSigning form 8725, ensuring that your documents are securely signed and submitted on time.

-

Is there a cost associated with using airSlate SignNow for form 8725?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and eSigning of form 8725, making it a cost-effective solution for your document management.

-

What features does airSlate SignNow offer for managing form 8725?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage specifically designed for managing form 8725. These tools enhance efficiency and ensure compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software for form 8725?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to connect your existing tools for managing form 8725. This integration helps streamline your workflow and enhances productivity.

-

How does airSlate SignNow ensure the security of my form 8725?

Security is a top priority for airSlate SignNow. We use advanced encryption and secure access protocols to protect your form 8725 and other sensitive documents, ensuring that your information remains confidential and safe.

-

Can I track the status of my form 8725 with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for your documents, including form 8725. You can easily monitor who has viewed or signed the document, providing you with peace of mind and transparency throughout the process.

-

Is airSlate SignNow user-friendly for completing form 8725?

Yes, airSlate SignNow is designed with user experience in mind. The intuitive interface makes it easy for anyone to complete and eSign form 8725, regardless of their technical expertise.

Get more for Form 8725

- Russell property managementrent in greenville nc form

- Business greenvillenc orgmembersmemberrussell property management llcreal estate management form

- Idoc pubdocumentsnewark opra request form 8newark opra request form 8jlky6j368n5 idoc pub

- Application for employment dmepos form

- Resident s name aspen convergencecms form

- Landlord tenant authorization form city of black diamond

- Eviction rent assistance program erap form

- Form 213 042 000 570175560

Find out other Form 8725

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free