Form 8725 Rev December Internal Revenue Service 2015-2026

What is the Form 8725?

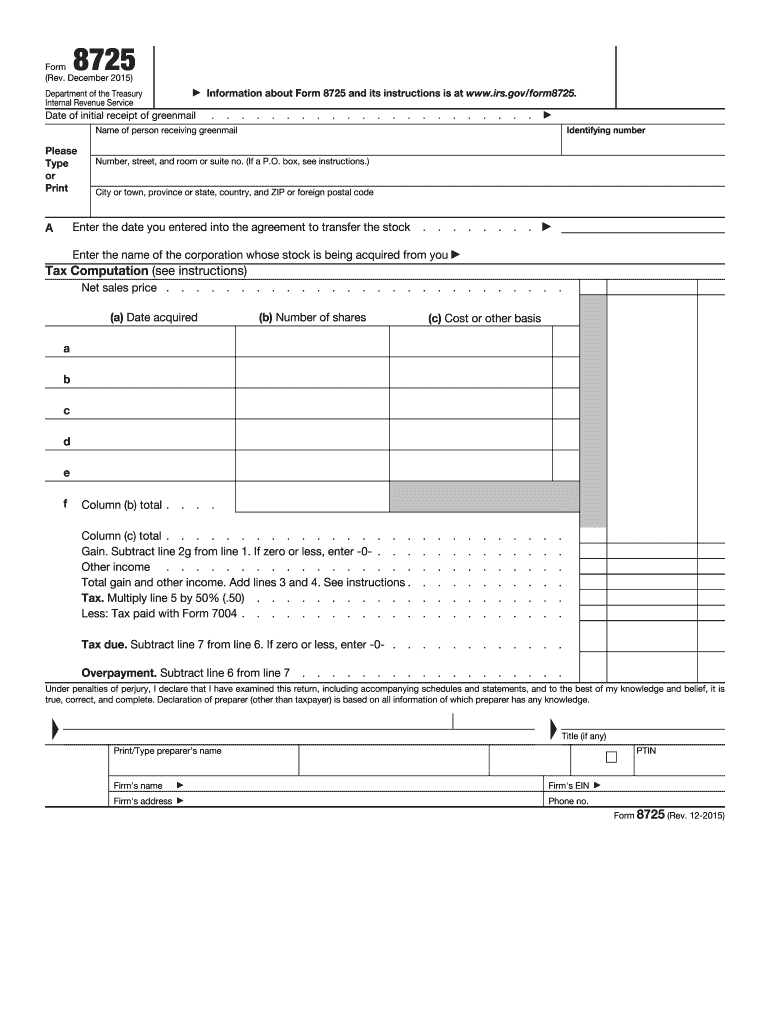

The Form 8725 is a document issued by the Internal Revenue Service (IRS) used primarily for reporting the completion of certain tax-related activities. This form is essential for businesses that need to report specific information related to their tax obligations. Understanding the purpose and requirements of the Form 8725 is crucial for compliance with U.S. tax laws.

How to use the Form 8725

To effectively use the Form 8725, first ensure you have the latest version of the form, as updates may occur. Fill out the form accurately, providing all required information about your business activities. Once completed, you can submit the form according to IRS guidelines, which include options for online submission, mail, or in-person delivery. It is important to retain a copy for your records.

Steps to complete the Form 8725

Completing the Form 8725 involves several key steps:

- Download the form from the IRS website or obtain a physical copy.

- Read the instructions carefully to understand the information required.

- Fill in your business details, including name, address, and tax identification number.

- Provide specific information related to the activities being reported.

- Review the completed form for accuracy before submission.

Legal use of the Form 8725

The legal use of the Form 8725 is defined by IRS regulations. It is essential for businesses to utilize this form to report their activities accurately and comply with federal tax laws. Failure to use the form correctly can result in penalties or fines, making it vital for businesses to understand their obligations under U.S. tax law.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8725 can vary based on the specific tax year and the nature of the business activities being reported. Generally, it is advisable to submit the form by the end of the tax year to avoid any late penalties. Keeping track of these important dates ensures compliance and helps maintain good standing with the IRS.

Examples of using the Form 8725

Examples of situations where the Form 8725 may be used include reporting the completion of certain transactions or activities that affect tax liabilities. For instance, businesses involved in property transactions may need to report these activities to ensure proper tax treatment. Understanding these examples can help clarify when and why to use the form.

Create this form in 5 minutes or less

Find and fill out the correct form 8725 rev december internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8725 rev december internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8725 pdf and how can it be used with airSlate SignNow?

The 8725 pdf is a specific document format that can be easily managed using airSlate SignNow. With our platform, you can upload, edit, and eSign the 8725 pdf, streamlining your document workflow. This ensures that your important documents are handled efficiently and securely.

-

How does airSlate SignNow ensure the security of my 8725 pdf?

airSlate SignNow prioritizes the security of your documents, including the 8725 pdf. We utilize advanced encryption methods and secure cloud storage to protect your data. Additionally, our platform complies with industry standards to ensure that your information remains confidential.

-

What are the pricing options for using airSlate SignNow with the 8725 pdf?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently work with the 8725 pdf. Our plans are designed to be cost-effective, allowing you to choose the one that best fits your budget and usage requirements. You can start with a free trial to explore our features before committing.

-

Can I integrate airSlate SignNow with other applications when working with the 8725 pdf?

Yes, airSlate SignNow supports integrations with various applications, making it easy to manage your 8725 pdf alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our platform can seamlessly connect to enhance your workflow. This integration capability helps streamline your document processes.

-

What features does airSlate SignNow offer for editing the 8725 pdf?

airSlate SignNow provides a range of features for editing the 8725 pdf, including text editing, form filling, and adding signatures. Our user-friendly interface allows you to make changes quickly and efficiently. You can also annotate and highlight important sections of the document to ensure clarity.

-

How can airSlate SignNow improve my business's efficiency with the 8725 pdf?

By using airSlate SignNow for your 8725 pdf, you can signNowly enhance your business's efficiency. Our platform automates the document signing process, reducing the time spent on manual tasks. This allows your team to focus on more strategic activities, ultimately improving productivity.

-

Is it easy to get started with airSlate SignNow for the 8725 pdf?

Absolutely! Getting started with airSlate SignNow for the 8725 pdf is straightforward. Simply sign up for an account, upload your document, and you can begin eSigning and sharing it in minutes. Our intuitive interface ensures that users of all skill levels can navigate the platform with ease.

Get more for Form 8725 Rev December Internal Revenue Service

Find out other Form 8725 Rev December Internal Revenue Service

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement