Ttb Excise Tax 2016-2026

What is the TTB Excise Tax?

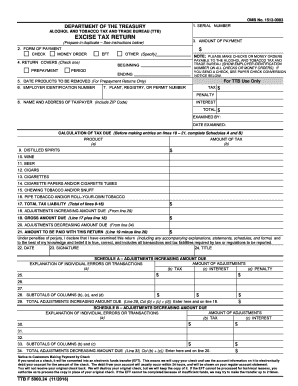

The Alcohol and Tobacco Tax and Trade Bureau (TTB) imposes an excise tax on specific goods, including alcohol and tobacco products. This tax is a federal levy, and businesses involved in the production, distribution, or importation of these products must comply with TTB regulations. The excise tax is calculated based on the volume of the product and varies depending on the type and alcohol content. Understanding the TTB excise tax is crucial for businesses to ensure compliance and avoid penalties.

Steps to Complete the TTB Excise Tax

Completing the TTB excise tax form involves several key steps to ensure accuracy and compliance. Start by gathering necessary information, including your business details, product types, and production volumes. Next, accurately fill out the excise tax return form, ensuring all calculations reflect the current tax rates. Double-check your entries for any errors. Once completed, submit the form either electronically or via mail, depending on your preference and the TTB guidelines. Keeping detailed records of your submissions is essential for future reference and audits.

Filing Deadlines / Important Dates

Filing deadlines for the TTB excise tax vary based on the type of business and the frequency of tax payments. Generally, businesses must file monthly or quarterly, depending on their production levels. It is essential to stay informed about these deadlines to avoid late fees and penalties. The TTB provides a calendar of important dates, including submission deadlines and payment due dates, which can help businesses plan their tax obligations effectively.

Required Documents

To file the TTB excise tax form, certain documents are necessary. These typically include proof of production, sales records, and any relevant importation documents. Businesses may also need to provide additional information based on their specific operations, such as labels or formulas for alcohol products. Ensuring that all required documents are prepared and submitted with the excise tax form can streamline the filing process and reduce the likelihood of delays or rejections.

Penalties for Non-Compliance

Failure to comply with TTB excise tax regulations can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action against the business. Non-compliance can also damage a business's reputation and lead to increased scrutiny from regulatory bodies. It is crucial for businesses to understand their obligations and maintain compliance to avoid these consequences.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the TTB excise tax form. The most efficient method is electronic submission through the TTB's online portal, which allows for quicker processing and confirmation of receipt. Alternatively, businesses can mail their forms to the appropriate TTB office or submit them in person. Each method has its advantages, and businesses should choose the one that best suits their operational needs and compliance requirements.

Quick guide on how to complete ttb excise tax

Complete Ttb Excise Tax seamlessly on any device

Managing documents online has gained traction among both businesses and individuals. It offers a sustainable alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Ttb Excise Tax on any platform using the airSlate SignNow Android or iOS apps and simplify any document-related process today.

How to modify and eSign Ttb Excise Tax effortlessly

- Find Ttb Excise Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important parts of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced papers, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign Ttb Excise Tax and guarantee effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ttb excise tax

Create this form in 5 minutes!

How to create an eSignature for the ttb excise tax

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is an excise tax return form?

An excise tax return form is a document that businesses use to report and pay excise taxes to the government. This form covers various excise taxes related to specific goods and services, ensuring compliance with tax regulations. Utilizing airSlate SignNow can streamline the process of completing and submitting your excise tax return form with ease.

-

How can airSlate SignNow help me with my excise tax return form?

airSlate SignNow provides a simple and effective way to create, fill out, and eSign your excise tax return form. With user-friendly templates and electronic signature capabilities, you can ensure your forms are accurate and submitted on time. This efficiency saves time and reduces the risk of errors in your tax documentation.

-

Is there a cost associated with using airSlate SignNow for my excise tax return form?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet different business needs. You can choose a plan that suits your budget and frequency of use, allowing you to file your excise tax return form without breaking the bank. Plus, the cost-effectiveness of our solution adds considerable value to your operations.

-

What features does airSlate SignNow offer for handling excise tax return forms?

airSlate SignNow comes equipped with various features ideal for managing your excise tax return forms, including customizable templates, secure electronic signatures, and cloud storage. These features ensure that your documents are not only compliant but also easily accessible and organized. Additionally, tracking capabilities help you monitor the status of your submissions.

-

Can I integrate airSlate SignNow with other applications for my excise tax return form?

Absolutely! airSlate SignNow offers integrations with various applications, including accounting and tax software, which makes handling your excise tax return form more efficient. By connecting these tools, you can streamline data transfer and enhance your workflow, saving time and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for excise tax return forms?

Using airSlate SignNow for your excise tax return forms provides numerous benefits, including increased efficiency, accuracy, and convenience. The ability to eSign documents saves time and enhances collaboration among team members. Moreover, our secure platform ensures that your sensitive information is protected throughout the signing process.

-

Is airSlate SignNow compliant with tax regulations for excise tax return forms?

Yes, airSlate SignNow is designed to uphold industry standards and compliance requirements for electronic signatures on tax documents, including excise tax return forms. Our platform follows best practices to ensure that your submissions are legally valid and recognized by regulatory agencies. You can confidently use our service for your tax documentation needs.

Get more for Ttb Excise Tax

- Oswestry disability index 100389639 form

- Cancellation notice contract template form

- Quick fire plan for use of this from see fm 620 form

- 21 3 5 taxpayer inquiry referrals form 4442 irm

- Index of wp contentuploads04 solano county superior court form

- Sh 032 declaration regarding notice and service of ex parte application for order shortening time for hearing on motion to form

- Electrical permit application 765984917 form

- About continuum of care prince william county government form

Find out other Ttb Excise Tax

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation