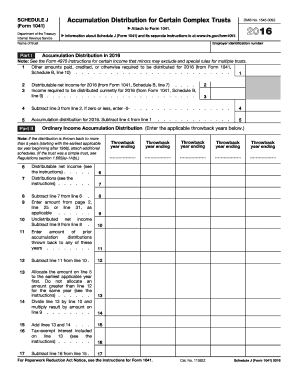

Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts Irs 2016

Understanding Form 1041 Schedule J for Complex Trusts

Form 1041 Schedule J is specifically designed for certain complex trusts that accumulate income rather than distribute it. This form allows trustees to report the accumulated income and determine the distribution deduction. It is essential for ensuring that the trust complies with IRS regulations regarding income taxation. Understanding the purpose of this form is crucial for trustees managing complex trusts, as it directly impacts tax liabilities and the overall financial strategy of the trust.

Steps to Complete Form 1041 Schedule J

Completing Form 1041 Schedule J involves several key steps:

- Gather all relevant financial information regarding the trust's income and distributions.

- Fill out the basic information section, including the trust's name, address, and Employer Identification Number (EIN).

- Report the total income that has been accumulated during the tax year.

- Calculate the distribution deduction based on the income that is required to be distributed to beneficiaries.

- Ensure all calculations are accurate and cross-verify with the trust's financial statements.

- Sign and date the form before submission.

Obtaining Form 1041 Schedule J

Form 1041 Schedule J can be obtained directly from the IRS website or through various tax preparation software. It is important to ensure that you are using the most current version of the form to comply with any recent tax law changes. Additionally, tax professionals can provide assistance in acquiring the form and ensuring it is filled out correctly.

Key Elements of Form 1041 Schedule J

Form 1041 Schedule J includes several key elements that trustees must understand:

- Accumulated Income: This section reports the total income that has not been distributed to beneficiaries.

- Distribution Deduction: This is the amount that can be deducted from the trust's taxable income based on distributions made to beneficiaries.

- Beneficiary Information: Details about beneficiaries receiving distributions must be accurately reported to ensure compliance.

IRS Guidelines for Form 1041 Schedule J

The IRS provides specific guidelines for completing Form 1041 Schedule J. These guidelines include instructions on how to calculate accumulated income and distribution deductions, as well as the necessary documentation required for filing. It is advisable for trustees to review these guidelines carefully to avoid errors that could result in penalties or audits.

Filing Deadlines for Form 1041 Schedule J

The filing deadline for Form 1041 Schedule J typically aligns with the due date for Form 1041, which is the 15th day of the fourth month following the end of the trust's tax year. Trustees should be aware of these deadlines to ensure timely filing and avoid late fees. Extensions may be available, but it is important to follow the proper procedures to request them.

Create this form in 5 minutes or less

Find and fill out the correct form 1041 schedule j accumulation distribution for certain complex trusts irs

Create this form in 5 minutes!

How to create an eSignature for the form 1041 schedule j accumulation distribution for certain complex trusts irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs?

Form 1041 Schedule J is used by certain complex trusts to report the accumulation and distribution of income. This form helps ensure that trusts comply with IRS regulations regarding income distribution. Understanding this form is crucial for trustees managing complex trusts.

-

How can airSlate SignNow assist with Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to Form 1041 Schedule J. Our solution simplifies the process of preparing and submitting necessary forms, ensuring compliance with IRS requirements. This streamlines the workflow for trustees handling complex trusts.

-

What features does airSlate SignNow offer for managing trust documents?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage. These tools are designed to facilitate the management of trust-related documents, including Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. Our platform enhances efficiency and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for managing Form 1041 Schedule J?

Yes, airSlate SignNow is a cost-effective solution for managing Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. Our pricing plans are designed to accommodate various business sizes, ensuring that you get the best value for your investment. This affordability makes it accessible for trustees and accountants alike.

-

Can I integrate airSlate SignNow with other software for trust management?

Absolutely! airSlate SignNow offers integrations with various software applications commonly used in trust management. This includes accounting software and document management systems, allowing for seamless handling of Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. Integration enhances overall efficiency and data accuracy.

-

What are the benefits of using airSlate SignNow for trust documentation?

Using airSlate SignNow for trust documentation provides numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that all documents, including Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs, are securely stored and easily accessible. This allows trustees to focus on managing their trusts rather than paperwork.

-

How does airSlate SignNow ensure compliance with IRS regulations?

airSlate SignNow is designed with compliance in mind, particularly for forms like Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs. Our platform adheres to industry standards and best practices, ensuring that all documents are prepared and signed in accordance with IRS regulations. This reduces the risk of penalties and audits.

Get more for Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs

Find out other Form 1041 Schedule J Accumulation Distribution For Certain Complex Trusts Irs

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast