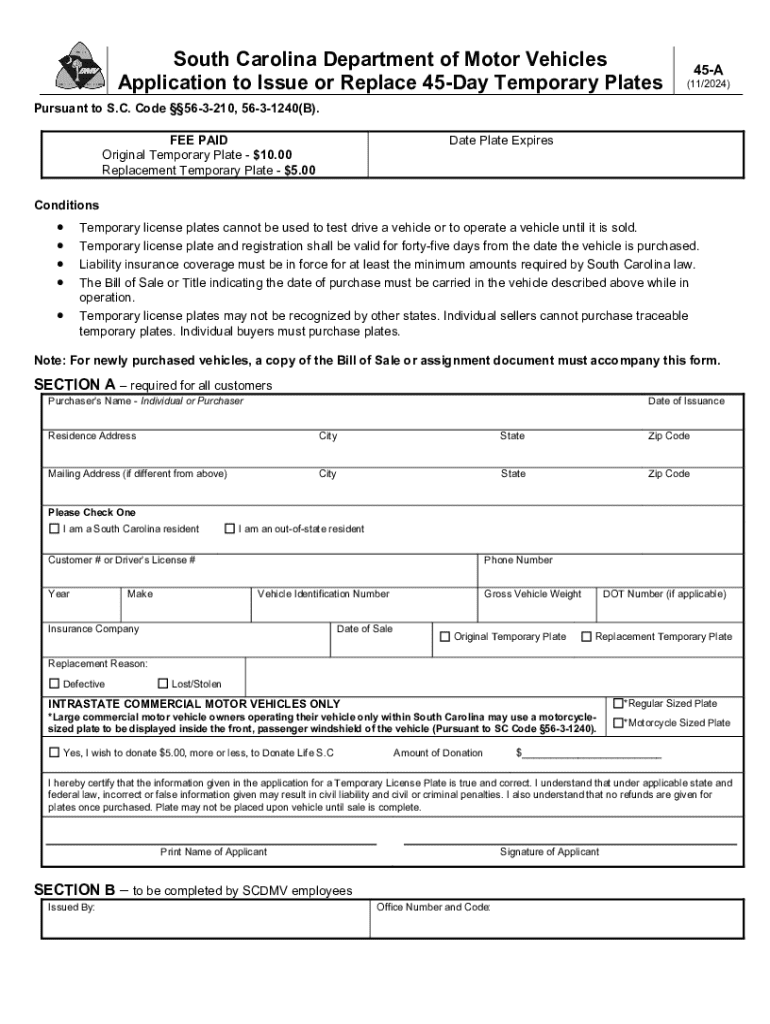

45 a Form

What is the 45 A

The 45 A form is a tax document used primarily for reporting certain types of income and deductions related to specific tax credits. It is essential for taxpayers who are eligible for these credits, as it helps ensure compliance with IRS regulations. The form captures detailed financial information that allows the IRS to assess the taxpayer's eligibility for the credits claimed.

How to use the 45 A

Using the 45 A form involves several steps to ensure accurate reporting of income and deductions. Taxpayers must gather all necessary financial documents, including income statements and previous tax returns. Once all information is compiled, the form should be filled out carefully, ensuring that all entries are accurate and complete. After completing the form, it should be submitted according to IRS guidelines, either electronically or via mail.

Steps to complete the 45 A

Completing the 45 A form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including W-2s and 1099s.

- Review the eligibility criteria for the tax credits associated with the form.

- Fill out the form, ensuring all income and deduction entries are accurate.

- Double-check the completed form for any errors or omissions.

- Submit the form electronically or by mail, following the IRS submission guidelines.

Legal use of the 45 A

The 45 A form must be used in accordance with IRS regulations. Taxpayers are legally obligated to report their income accurately and claim only the credits for which they are eligible. Misuse of the form, such as falsifying information or claiming ineligible credits, can result in penalties or legal repercussions. It is crucial to understand the legal implications of using the form correctly.

Filing Deadlines / Important Dates

Filing deadlines for the 45 A form are critical for compliance. Typically, the form must be submitted by the tax return due date, which is usually April 15 for individual taxpayers. However, if that date falls on a weekend or holiday, the deadline may be extended. It is important for taxpayers to keep track of these dates to avoid late penalties.

Required Documents

To complete the 45 A form accurately, several documents are necessary. These may include:

- Income statements such as W-2s or 1099s.

- Previous tax returns for reference.

- Documentation supporting any deductions claimed.

- Records of any tax credits previously received.

Eligibility Criteria

Eligibility for using the 45 A form is based on specific criteria outlined by the IRS. Taxpayers must meet certain income thresholds and have qualifying expenses to claim the associated credits. Understanding these criteria is essential to ensure that the form is used correctly and to maximize potential tax benefits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 45 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow's 45 A plan?

The 45 A plan offers a competitive pricing structure designed to meet the needs of businesses of all sizes. With flexible monthly and annual subscription options, you can choose a plan that fits your budget while enjoying the full range of features. Additionally, airSlate SignNow provides discounts for annual commitments, making it a cost-effective solution.

-

What features are included in the 45 A plan?

The 45 A plan includes a comprehensive set of features such as document templates, advanced eSignature capabilities, and real-time tracking. Users can also benefit from integrations with popular applications, ensuring a seamless workflow. This plan is designed to enhance productivity and streamline document management.

-

How does airSlate SignNow's 45 A plan benefit businesses?

The 45 A plan empowers businesses by simplifying the document signing process, reducing turnaround times, and improving overall efficiency. With user-friendly tools and automation features, teams can focus on their core tasks rather than getting bogged down by paperwork. This leads to increased productivity and better customer satisfaction.

-

Can I integrate airSlate SignNow's 45 A plan with other software?

Yes, the 45 A plan supports integrations with a variety of popular software applications, including CRM systems, cloud storage services, and project management tools. This allows businesses to create a cohesive workflow and enhance their operational efficiency. Integrating with existing tools ensures that you can maximize the benefits of airSlate SignNow.

-

Is there a mobile app for the 45 A plan?

Absolutely! The 45 A plan includes access to a mobile app that allows users to send and sign documents on the go. This feature is particularly beneficial for businesses with remote teams or those that require flexibility in document management. The mobile app ensures that you can stay productive, no matter where you are.

-

What security measures are in place for the 45 A plan?

The 45 A plan prioritizes security with robust measures such as encryption, secure data storage, and compliance with industry standards. airSlate SignNow ensures that your documents are protected throughout the signing process, giving you peace of mind. This commitment to security helps businesses maintain trust with their clients and partners.

-

How can I get support for the 45 A plan?

Support for the 45 A plan is readily available through multiple channels, including live chat, email, and a comprehensive knowledge base. Our dedicated support team is equipped to assist you with any questions or issues you may encounter. We strive to ensure that your experience with airSlate SignNow is smooth and efficient.

Get more for 45 A

- Buyers home inspection checklist new hampshire form

- Sellers information for appraiser provided to buyer new hampshire

- Subcontractors agreement new hampshire form

- Option to purchase addendum to residential lease lease or rent to own new hampshire form

- New hampshire prenuptial premarital agreement with financial statements new hampshire form

- New hampshire prenuptial form

- Amendment to prenuptial or premarital agreement new hampshire form

- Girl scout gold award project proposal form

Find out other 45 A

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later