Maine Certificate of Discharge of Estate Tax Lien 2011

What is the Maine Certificate of Discharge of Estate Tax Lien

The Maine Certificate of Discharge of Estate Tax Lien is an official document that confirms the release of a tax lien placed on an estate due to unpaid estate taxes. This certificate serves as proof that the estate has settled its tax obligations with the state of Maine. Once issued, it allows the estate to clear any encumbrances related to estate taxes, facilitating the transfer of assets to beneficiaries without the burden of tax-related claims. This document is crucial for the smooth administration of an estate and for ensuring compliance with state tax laws.

How to Obtain the Maine Certificate of Discharge of Estate Tax Lien

To obtain the Maine Certificate of Discharge of Estate Tax Lien, the estate representative must first ensure that all estate taxes have been paid in full. This includes filing the necessary tax returns and settling any outstanding tax liabilities. Once these requirements are met, the representative can request the certificate from the Maine Revenue Services. This process may involve submitting specific forms and providing documentation that verifies the payment of estate taxes. It is advisable to check the Maine Revenue Services website for the most current procedures and requirements.

Steps to Complete the Maine Certificate of Discharge of Estate Tax Lien

Completing the Maine Certificate of Discharge of Estate Tax Lien involves several key steps:

- Verify that all estate taxes have been paid and that there are no outstanding debts.

- Gather necessary documentation, including proof of tax payments and relevant estate documents.

- Fill out the application form for the discharge of the estate tax lien, available from the Maine Revenue Services.

- Submit the completed form along with any required documentation to the appropriate state office.

- Await confirmation and issuance of the certificate, which will be sent to the estate representative.

Legal Use of the Maine Certificate of Discharge of Estate Tax Lien

The Maine Certificate of Discharge of Estate Tax Lien is legally significant as it provides evidence that the estate has fulfilled its tax obligations. This document is essential for the legal transfer of assets to beneficiaries, ensuring that there are no lingering tax claims against the estate. It is often required by financial institutions, real estate agencies, and other entities involved in the distribution of the estate's assets. Proper use of this certificate helps protect the interests of both the estate representatives and the beneficiaries.

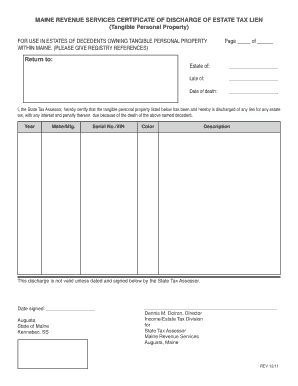

Key Elements of the Maine Certificate of Discharge of Estate Tax Lien

The Maine Certificate of Discharge of Estate Tax Lien includes several key elements that are important for its validity:

- The name of the estate and the estate representative.

- The date of issuance of the certificate.

- A statement confirming that all estate taxes have been paid.

- The signature of the authorized state official.

- A unique identification number for tracking purposes.

Required Documents for the Maine Certificate of Discharge of Estate Tax Lien

When applying for the Maine Certificate of Discharge of Estate Tax Lien, specific documents are typically required to support the application. These may include:

- Proof of payment of all estate taxes.

- Completed application form for the discharge.

- Documentation of the estate's assets and liabilities.

- Any prior correspondence with the Maine Revenue Services regarding the estate tax.

Create this form in 5 minutes or less

Find and fill out the correct maine certificate of discharge of estate tax lien

Create this form in 5 minutes!

How to create an eSignature for the maine certificate of discharge of estate tax lien

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Maine certificate of discharge of estate tax lien?

A Maine certificate of discharge of estate tax lien is a legal document that releases a property from a lien placed due to unpaid estate taxes. This certificate is essential for clearing the title of the property, allowing for its sale or transfer. Obtaining this certificate ensures compliance with state tax regulations.

-

How can airSlate SignNow help with obtaining a Maine certificate of discharge of estate tax lien?

airSlate SignNow streamlines the process of obtaining a Maine certificate of discharge of estate tax lien by allowing users to easily eSign and send necessary documents. Our platform simplifies document management, ensuring that all required forms are completed accurately and submitted promptly. This efficiency can save time and reduce the stress associated with legal paperwork.

-

What are the costs associated with obtaining a Maine certificate of discharge of estate tax lien?

The costs for obtaining a Maine certificate of discharge of estate tax lien can vary based on the specific circumstances and any associated legal fees. While airSlate SignNow offers a cost-effective solution for document management, users should also consider state fees for processing the discharge. It's advisable to check with local authorities for the most accurate pricing.

-

What features does airSlate SignNow offer for managing estate tax documents?

airSlate SignNow provides a range of features for managing estate tax documents, including customizable templates, secure eSigning, and real-time tracking of document status. These features ensure that users can efficiently handle the paperwork required for a Maine certificate of discharge of estate tax lien. Additionally, our platform offers cloud storage for easy access to important documents.

-

Can I integrate airSlate SignNow with other software for managing estate tax liens?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your ability to manage estate tax liens effectively. Whether you use accounting software or document management systems, our platform can seamlessly connect to streamline your workflow. This integration capability is particularly beneficial for handling a Maine certificate of discharge of estate tax lien.

-

What are the benefits of using airSlate SignNow for estate tax lien documentation?

Using airSlate SignNow for estate tax lien documentation offers numerous benefits, including increased efficiency, reduced paperwork errors, and enhanced security. Our platform allows for quick eSigning and document sharing, which can expedite the process of obtaining a Maine certificate of discharge of estate tax lien. Additionally, the user-friendly interface makes it accessible for everyone.

-

Is airSlate SignNow secure for handling sensitive estate tax documents?

Absolutely, airSlate SignNow prioritizes the security of your sensitive estate tax documents. We utilize advanced encryption and security protocols to protect your data during transmission and storage. This ensures that your Maine certificate of discharge of estate tax lien and other important documents remain confidential and secure.

Get more for Maine Certificate Of Discharge Of Estate Tax Lien

- Oklahoma installments fixed rate promissory note secured by personal property oklahoma form

- Oklahoma note form

- Notice of option for recording oklahoma form

- Oklahoma documents form

- General durable power of attorney for property and finances or financial effective upon disability oklahoma form

- Essential legal life documents for baby boomers oklahoma form

- Oklahoma general form

- Revocation of general durable power of attorney oklahoma form

Find out other Maine Certificate Of Discharge Of Estate Tax Lien

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed