Certificate of Discharge of Estate Tax Lien 2018-2026

What is the Certificate Of Discharge Of Estate Tax Lien

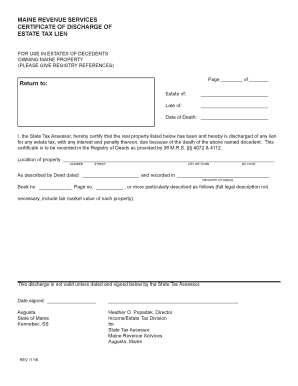

The Certificate Of Discharge Of Estate Tax Lien is a legal document that releases a property from a federal estate tax lien. This lien typically arises when a deceased person's estate owes taxes to the Internal Revenue Service (IRS). The certificate confirms that the estate has settled its tax obligations, thereby allowing the heirs or beneficiaries to transfer or sell the property without the encumbrance of the lien. This document is crucial for ensuring clear title to the property and facilitating smooth transactions in estate management.

How to obtain the Certificate Of Discharge Of Estate Tax Lien

To obtain the Certificate Of Discharge Of Estate Tax Lien, the executor or administrator of the estate must file Form 4422 with the IRS. This form requests the discharge of the lien and must include specific details about the estate and its tax obligations. The IRS requires information such as the estate's value, the tax amounts owed, and any payments made. After reviewing the application, the IRS will issue the certificate if all requirements are met.

Steps to complete the Certificate Of Discharge Of Estate Tax Lien

Completing the Certificate Of Discharge Of Estate Tax Lien involves several steps:

- Gather necessary documentation, including the estate's tax returns and payment records.

- Complete Form 4422 accurately, providing all required information about the estate.

- Submit the form to the appropriate IRS office, ensuring it is sent to the correct address for processing.

- Wait for the IRS to review the application, which may take several weeks.

- Receive the Certificate Of Discharge if the application is approved, allowing for the transfer or sale of the property.

Key elements of the Certificate Of Discharge Of Estate Tax Lien

The Certificate Of Discharge Of Estate Tax Lien includes several key elements that are essential for its validity:

- The name and address of the deceased individual.

- The estate's tax identification number.

- The specific property or properties affected by the lien.

- The amount of tax owed and any payments made towards it.

- The date of the lien and the date of discharge.

Legal use of the Certificate Of Discharge Of Estate Tax Lien

Legally, the Certificate Of Discharge Of Estate Tax Lien serves to clear the title of the property from any federal tax claims. This document is often required when selling or transferring property, as it assures buyers and financial institutions that there are no outstanding tax liens. It is advisable to keep this certificate with the estate's records, as it may be needed for future transactions or legal matters related to the estate.

Filing Deadlines / Important Dates

Filing deadlines for the Certificate Of Discharge Of Estate Tax Lien can vary based on the estate's tax situation. Generally, it is best to apply for the discharge as soon as the estate tax return has been filed and any taxes owed have been paid. The IRS typically processes Form 4422 within a few weeks, but it is essential to account for any potential delays. Executors should monitor deadlines closely to avoid complications in the estate settlement process.

Create this form in 5 minutes or less

Find and fill out the correct certificate of discharge of estate tax lien

Create this form in 5 minutes!

How to create an eSignature for the certificate of discharge of estate tax lien

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Certificate Of Discharge Of Estate Tax Lien?

A Certificate Of Discharge Of Estate Tax Lien is a legal document that releases a property from a lien imposed by the IRS for unpaid estate taxes. This certificate is essential for property owners looking to sell or refinance their property without the burden of tax liens. Obtaining this certificate can streamline the process of transferring ownership.

-

How can airSlate SignNow help me obtain a Certificate Of Discharge Of Estate Tax Lien?

airSlate SignNow simplifies the process of obtaining a Certificate Of Discharge Of Estate Tax Lien by allowing you to eSign and send necessary documents quickly. Our platform ensures that all your paperwork is organized and easily accessible, making it easier to submit your request to the IRS. This efficiency can save you time and reduce stress during the process.

-

What are the costs associated with obtaining a Certificate Of Discharge Of Estate Tax Lien?

The costs for obtaining a Certificate Of Discharge Of Estate Tax Lien can vary based on the estate's tax situation and any associated fees from the IRS. While airSlate SignNow offers a cost-effective solution for document management and eSigning, you should also consider potential IRS fees. It's advisable to consult with a tax professional for a comprehensive understanding of all costs involved.

-

What features does airSlate SignNow offer for managing estate tax documents?

airSlate SignNow provides a range of features for managing estate tax documents, including secure eSigning, document templates, and cloud storage. These features ensure that your Certificate Of Discharge Of Estate Tax Lien and other important documents are easily accessible and securely stored. Additionally, our user-friendly interface makes it simple to navigate through your documents.

-

How long does it take to receive a Certificate Of Discharge Of Estate Tax Lien?

The time it takes to receive a Certificate Of Discharge Of Estate Tax Lien can vary depending on the IRS processing times and the completeness of your application. Typically, it may take several weeks to receive the certificate after submission. Using airSlate SignNow can help expedite the process by ensuring that all documents are correctly prepared and submitted.

-

Can I integrate airSlate SignNow with other software for managing estate documents?

Yes, airSlate SignNow offers integrations with various software applications to enhance your document management process. This includes popular tools for accounting, project management, and customer relationship management. Integrating these tools can streamline your workflow when dealing with a Certificate Of Discharge Of Estate Tax Lien and other estate-related documents.

-

What are the benefits of using airSlate SignNow for estate tax lien documents?

Using airSlate SignNow for estate tax lien documents, including the Certificate Of Discharge Of Estate Tax Lien, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and easy document sharing, which can signNowly speed up the process. Additionally, our secure storage ensures that your sensitive information is protected.

Get more for Certificate Of Discharge Of Estate Tax Lien

Find out other Certificate Of Discharge Of Estate Tax Lien

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe