MAINE REVENUE SERVICES CERTIFICATE of Maine Gov Maine 2015

What is the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

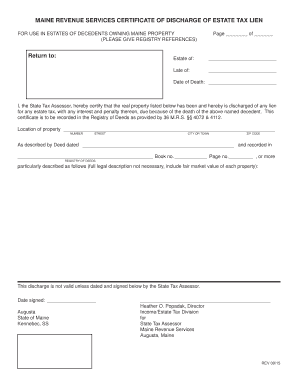

The MAINE REVENUE SERVICES CERTIFICATE is an official document issued by the state of Maine, primarily used for tax-related purposes. This certificate serves as proof of a taxpayer's compliance with state tax obligations and may be required for various transactions, including business registrations, loan applications, or other financial dealings. The certificate confirms that the taxpayer is in good standing with the Maine Revenue Services, indicating that all tax filings and payments are current.

How to obtain the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

To obtain the MAINE REVENUE SERVICES CERTIFICATE, individuals or businesses must first ensure that all tax obligations are fulfilled. The process typically involves the following steps:

- Verify that all tax returns have been filed and any outstanding taxes have been paid.

- Visit the Maine Revenue Services website or contact their office directly for specific application instructions.

- Complete any required forms, providing necessary identification and business information.

- Submit the application either online or by mail, depending on the instructions provided.

Steps to complete the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

Completing the MAINE REVENUE SERVICES CERTIFICATE involves several key steps:

- Gather all relevant tax documents, including previous tax returns and payment records.

- Fill out the application form accurately, ensuring all information is current and correct.

- Review the application for completeness and accuracy before submission.

- Submit the form according to the guidelines provided by the Maine Revenue Services.

Legal use of the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

The MAINE REVENUE SERVICES CERTIFICATE is legally recognized in various contexts. It is often required when:

- Engaging in business transactions that require proof of tax compliance.

- Applying for loans or financial assistance that necessitate verification of tax status.

- Participating in government contracts or grants where tax standing is a prerequisite.

Key elements of the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

Several key elements are essential to the MAINE REVENUE SERVICES CERTIFICATE:

- The certificate number, which uniquely identifies the document.

- The name and address of the taxpayer or business entity.

- The date of issuance, which indicates the certificate's validity period.

- A statement confirming the taxpayer's compliance with state tax laws.

Required Documents

When applying for the MAINE REVENUE SERVICES CERTIFICATE, several documents may be required:

- Completed application form.

- Proof of identity, such as a driver's license or state ID.

- Tax returns for the previous years, if applicable.

- Payment receipts for any outstanding taxes.

Create this form in 5 minutes or less

Find and fill out the correct maine revenue services certificate of maine gov maine

Create this form in 5 minutes!

How to create an eSignature for the maine revenue services certificate of maine gov maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine?

The MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine is an official document that verifies a business's compliance with state tax regulations. It is essential for businesses operating in Maine to ensure they meet all necessary tax obligations and maintain good standing with the state.

-

How can airSlate SignNow help with the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine?

airSlate SignNow provides an efficient platform for businesses to electronically sign and send documents, including the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine. This streamlines the process, making it easier to manage and submit necessary paperwork to the state.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that support the management of documents like the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing important documents like the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine, ensuring a smooth workflow.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with various applications, enhancing its functionality. This allows users to seamlessly manage documents related to the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine alongside other business tools.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning offers numerous benefits, including increased efficiency and reduced turnaround times. This is especially important for documents like the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine, where timely submission is crucial.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that documents such as the MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine are handled safely and securely.

Get more for MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

Find out other MAINE REVENUE SERVICES CERTIFICATE OF Maine gov Maine

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement