CHILD TAX CREDIT and CREDIT for OTHER DEPENDE 2020-2026

What is the Child Tax Credit and Credit for Other Dependents

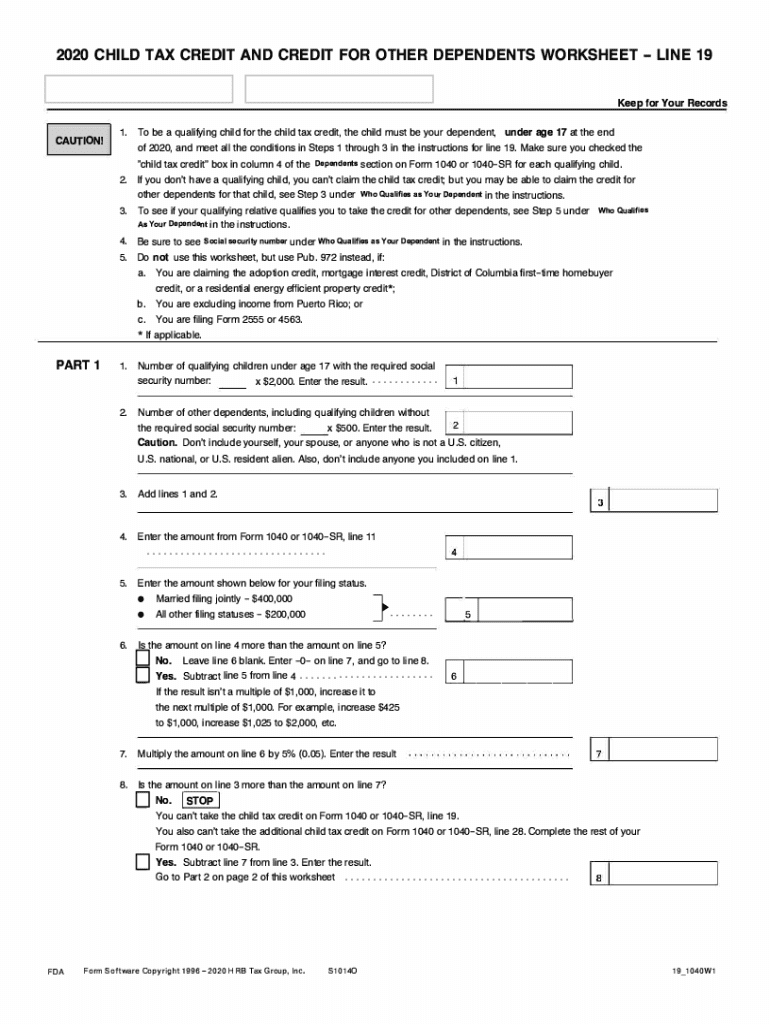

The Child Tax Credit (CTC) is a tax benefit designed to help families with qualifying children by reducing their overall tax burden. For the tax year 2023, eligible taxpayers may receive a credit of up to two thousand dollars per qualifying child under the age of seventeen. Additionally, the Credit for Other Dependents (ODC) allows taxpayers to claim a credit of five hundred dollars for dependents who do not qualify for the CTC, such as older children or other relatives. Both credits aim to provide financial relief to families and encourage the well-being of children and dependents in the United States.

Eligibility Criteria

To qualify for the Child Tax Credit, taxpayers must meet specific criteria. The child must be under the age of seventeen at the end of the tax year, be a U.S. citizen, national, or resident alien, and must have lived with the taxpayer for more than half of the year. Additionally, the taxpayer's income must fall below certain thresholds, which vary based on filing status. For the Credit for Other Dependents, the dependent must be a U.S. citizen, national, or resident alien and must not qualify for the Child Tax Credit. Understanding these criteria is essential for maximizing potential tax benefits.

Steps to Complete the Child Tax Credit and Credit for Other Dependents

Completing the Child Tax Credit and Credit for Other Dependents involves several steps. First, gather necessary documentation, including Social Security numbers for each qualifying child or dependent. Next, determine eligibility based on income and the specific criteria outlined by the IRS. When filing your tax return, complete the relevant sections on Form 1040 or 1040-SR, ensuring to include the Child Tax Credit Worksheet to calculate the credit amount. Finally, review your return for accuracy before submission to avoid any potential issues.

Required Documents

To successfully claim the Child Tax Credit and Credit for Other Dependents, certain documents are essential. These include:

- Social Security cards or ITINs for each qualifying child or dependent.

- Proof of residency, such as school records or medical documents.

- Income statements, including W-2 forms or 1099s, to verify eligibility based on income thresholds.

- Any previous tax returns that may help in determining eligibility.

Having these documents readily available can streamline the filing process and ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the Child Tax Credit and Credit for Other Dependents. Taxpayers should refer to IRS Publication 972 for detailed information on eligibility, calculation methods, and filing procedures. This publication outlines the specific requirements for each credit, including income limits and the definition of qualifying children and dependents. Staying informed about these guidelines helps taxpayers maximize their credits and avoid potential pitfalls during tax season.

Filing Deadlines / Important Dates

Filing deadlines for tax returns are crucial for taxpayers claiming the Child Tax Credit and Credit for Other Dependents. Typically, the deadline to file individual tax returns is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in legislation that may affect deadlines or credits. Filing on time ensures that taxpayers can benefit from available credits without incurring penalties.

Create this form in 5 minutes or less

Find and fill out the correct child tax credit and credit for other depende

Create this form in 5 minutes!

How to create an eSignature for the child tax credit and credit for other depende

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE?

The CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE are tax benefits designed to help families with dependent children. These credits can signNowly reduce your tax liability, providing financial relief to eligible taxpayers. Understanding these credits is essential for maximizing your tax return.

-

How can airSlate SignNow help with the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE?

airSlate SignNow simplifies the process of signing and sending documents related to the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE. Our platform allows you to easily manage tax forms and submissions, ensuring you meet all necessary deadlines. This efficiency can help you focus on maximizing your credits.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, all of which are beneficial for managing documents related to the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE. These tools streamline the process, making it easier to handle tax-related paperwork. Additionally, our user-friendly interface ensures a smooth experience.

-

Is airSlate SignNow cost-effective for small businesses handling tax credits?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE. Our pricing plans are designed to fit various budgets, allowing you to choose a plan that meets your needs without breaking the bank. This affordability makes it easier for businesses to access essential tax document management tools.

-

Can I integrate airSlate SignNow with other accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE. This integration allows for efficient data transfer and document management, ensuring that all your tax-related information is organized and easily accessible.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including increased efficiency, enhanced security, and improved collaboration. By streamlining the process of managing the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE, you can save time and reduce the risk of errors. Our platform ensures that your documents are securely stored and easily retrievable.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including those related to the CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure your data remains safe and confidential.

Get more for CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE

- North dakota agreement 497317435 form

- Quitclaim deed from husband and wife to an individual north dakota form

- Warranty deed from husband and wife to an individual north dakota form

- North dakota quitclaim deed form

- Mineral deed individual to individual north dakota form

- Limited liability company 497317440 form

- North dakota disclaimer form

- Verified notice of intention to claim mechanics lien individual 497317443 form

Find out other CHILD TAX CREDIT AND CREDIT FOR OTHER DEPENDE

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself